Brooklyn Mineral PropertyContact Gold Rush Expeditions

Use code JRM1003 for a 10% discount.

Terms and Conditions apply.

www.goldrushexpeditions.com

Ph: 385-218-2138

Email: goldrush@goldrushexpeditions.com

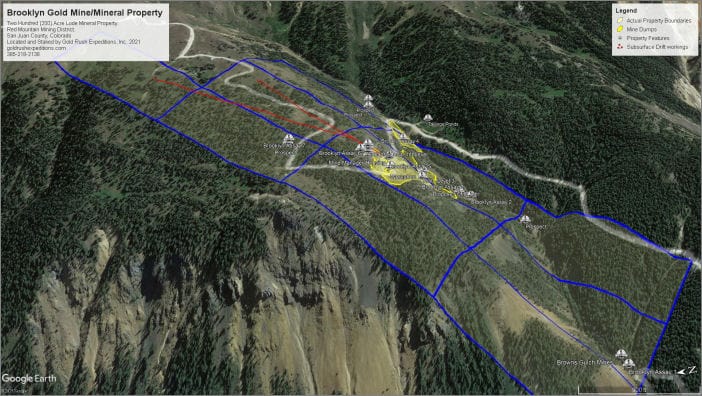

The Brooklyn Mineral property is a primarily gold producing property. It consists of 200 acres of lode mining claims located in the Red Mountain Mining District of San Juan County in Colorado. The Brooklyn property is a significant producing property with a well documented history of production ranging over more than 100 years. The property was last active in 2014 under contract with Colorado Goldfields Corporation. Colorado Goldfields executed diamond drilling the property and defined native gold deposits with ancillary silver and copper. The Colorado Goldfields corporation took control of the property in 2010. The agreed upon price was $4 (four) million dollars. Colorado Goldfields Corporation owned several other properties in the area including the infamous Gold King mine. As a result of the Gold King disaster and other poor planning, the company was bankrupt and dissolved in 2018.

Gold Rush Expeditions, Inc. acquired the property in 2019 and completed surveys and assay work in 2020. The property is well developed with an excellent, well maintained road that breaks off from the main highway. The road is steep but flat and wide enough for heavy equipment transportation.

The primary commodity of the site is native gold, which has been well documented by USGS and private mining engineer reports. The gold at the Brooklyn occurs as free-milling gold in fissure veins. Widths of the veins vary from a few inches to several feet based on observations. Gold assay values at the property range from 0.012 to 7.35 oz per ton. The highest value ores are those running with iron, sphalerite and quartz. Samples were taken from the dump material at the various portals as shown in Figure 2.

The primary commodity of the site is native gold, which has been well documented by USGS and private mining engineer reports. The gold at the Brooklyn occurs as free-milling gold in fissure veins. Widths of the veins vary from a few inches to several feet based on observations. Gold assay values at the property range from 0.012 to 7.35 oz per ton. The highest value ores are those running with iron, sphalerite and quartz. Samples were taken from the dump material at the various portals as shown in Figure 2.

The property contains existing blocked and measured reserves of 21,065 tons averaging 0.69 oz. AU per ton, a total of 14,535 ounces defined. Silver and copper measurements were not a part of this report, but worthy of noting that the silver deposits occur in areas separate from the native gold veins. This is defined by drill data that shows where gold is prevalent, the silver values are lower. Conversely, in areas where high silver is noted, there is a lower concentration of gold. Copper is an intermittent value as shown by drill data and the copper deposits have not been mapped or defined despite some assays that show copper at 2% or higher (per ton).

Chessher, in a 1981 report, estimated inferred gold reserves at 4x the blocked reserves based on drill data taken by Bakers Park Mining Company.

Chessher, in a 1981 report, estimated inferred gold reserves at 4x the blocked reserves based on drill data taken by Bakers Park Mining Company.

Surveyors in 2020 reported there was no open access to the subsurface workings. A gated and locked adit (Brooklyn Level 2) located near the workshop would need light rehabilitation to be safely usable. Conversely, the upper portal (Brooklyn Level 1) was collapsed, but could be cleared with a Mini-Excavator or similar. The 3rd level of the workings were reported as collapsed and in need of clearing as well. There is a proposed 4th level. The 4th level was a part of the OME proposal from 1963-1971. It is unclear if the 4th level portal was ever cut.

The current Brooklyn property has some overlap on two patent properties. These properties do not have any impact or bearing on the development of the Brooklyn mine in its current or proposed development. The patent properties do not bear any discovery as related to the Brooklyn Mine and the apexes of the veins are not on patent property. Right of ways have been established on both private parcels and there is no mining of any sort being conducted on the private parcels.

The current Brooklyn property has some overlap on two patent properties. These properties do not have any impact or bearing on the development of the Brooklyn mine in its current or proposed development. The patent properties do not bear any discovery as related to the Brooklyn Mine and the apexes of the veins are not on patent property. Right of ways have been established on both private parcels and there is no mining of any sort being conducted on the private parcels.

Contact: Gold Rush Expeditions

Use code JRM1003 for a 10% discount.

Terms and Conditions apply.

www.goldrushexpeditions.com

Ph: 385-218-2138

Email: goldrush@goldrushexpeditions.com