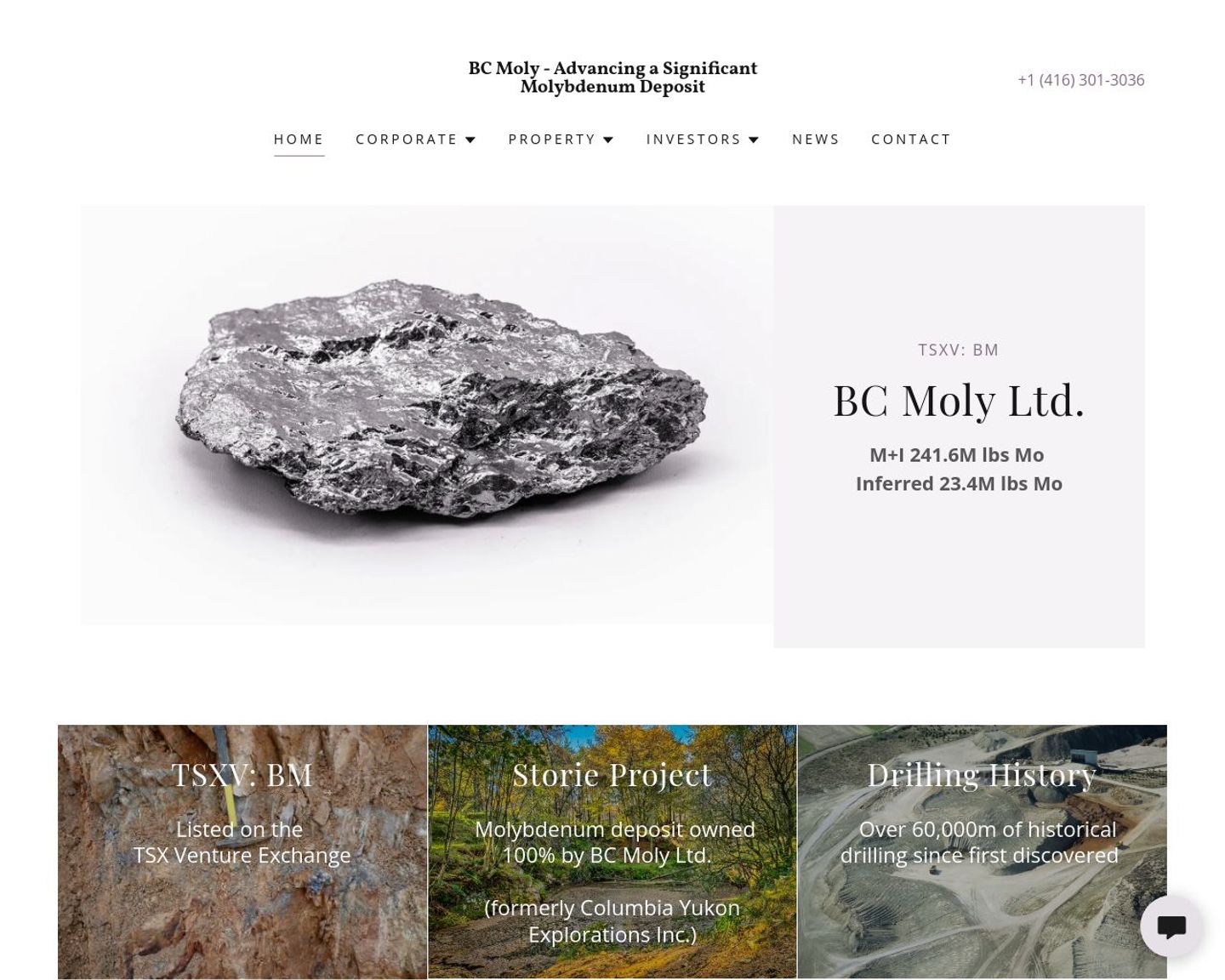

BC Moly Ltd. However, based on publicly available information, BC Moly Ltd is a mining company that focuses on exploring and developing molybdenum deposits in British Columbia, Canada.

The competitive edge of BC Moly Ltd may include:

1. High-quality molybdenum deposits: BC Moly Ltd may have access to high-quality molybdenum deposits that are rich in grade and size, which can give the company a competitive advantage over its peers.

2. Experienced management team: BC Moly Ltd may have an experienced management team with a strong track record in the mining industry, which can help the company make strategic decisions and navigate challenges.

3. Strong partnerships: BC Moly Ltd may have strong partnerships with other mining companies, suppliers, and stakeholders, which can help the company access resources, expertise, and funding.

4. Sustainable practices: BC Moly Ltd may prioritize sustainable mining practices, such as minimizing environmental impact and promoting social responsibility, which can enhance the company's reputation and attract investors and customers who value sustainability.

Overall, BC Moly Ltd's competitive edge may depend on a combination of factors, including the quality of its deposits, the expertise of its management team, the strength of its partnerships, and its commitment to sustainability.