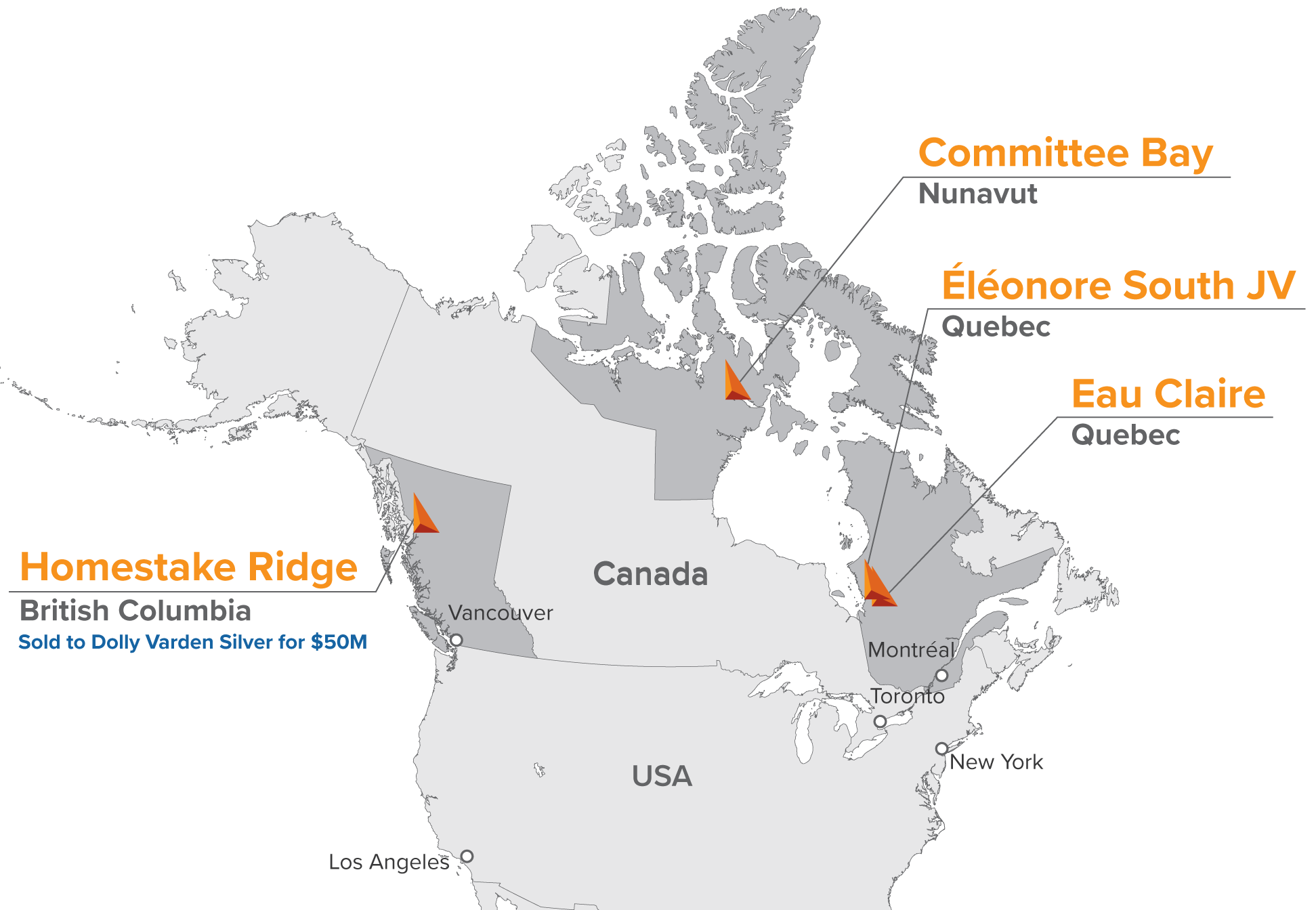

Fury Gold Mines Ltd is a Canadian exploration and development company that focuses on the acquisition, exploration, and development of gold properties in Canada. The company's competitive edge lies in its experienced management team, strong financial position, and high-quality gold assets.

One of the key differentiators of Fury Gold Mines is its focus on high-grade gold deposits. The company's flagship project, the Eau Claire project in Quebec, has an estimated resource of 1.1 million ounces of gold at an average grade of 6.18 grams per tonne. This high-grade deposit is expected to provide significant value to the company and its shareholders.

Fury Gold Mines also has a strong financial position, with a cash balance of approximately $20 million as of June 30, 2021. This financial strength allows the company to pursue its exploration and development activities without the need for additional financing.

Finally, Fury Gold Mines has a highly experienced management team with a proven track record of success in the mining industry. The team has extensive experience in exploration, development, and production, and is well-positioned to execute on the company's growth strategy.

Overall, Fury Gold Mines' focus on high-grade gold deposits, strong financial position, and experienced management team provide the company with a competitive edge in the gold mining industry.