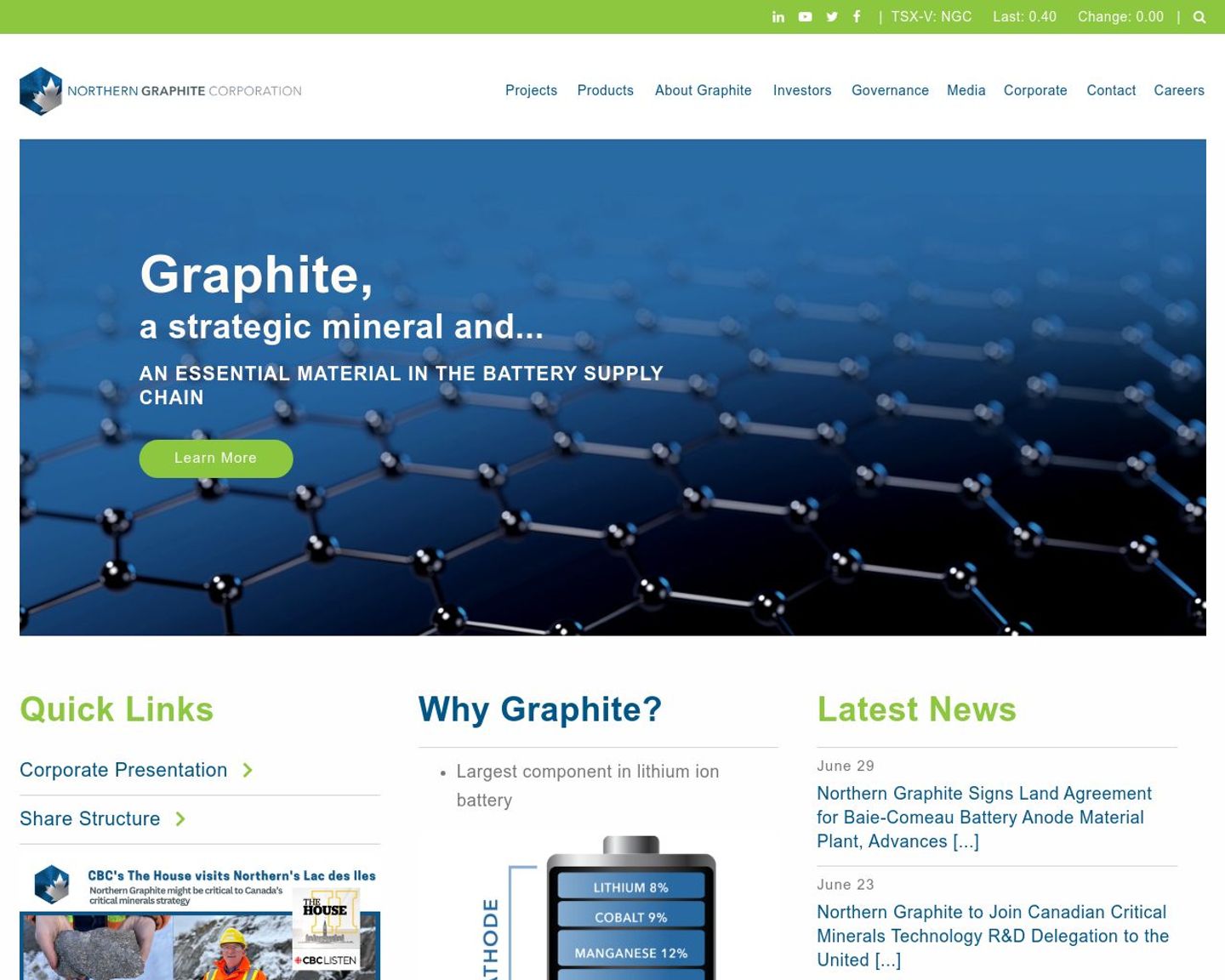

Northern Graphite Corporation is a Canadian company that is focused on the exploration and development of graphite deposits in Canada. The company's flagship project is the Bissett Creek Graphite Project, located in eastern Ontario. The project is a large-scale, open-pit mine that is expected to produce high-quality, large-flake graphite concentrate. Northern Graphite Corporation is committed to developing the project in an environmentally responsible manner, and has received all necessary permits and approvals to proceed with construction. The company is also exploring other graphite properties in Canada, including the Mousseau East Graphite Property in Quebec. Northern Graphite Corporation is listed on the Toronto Stock Exchange under the symbol NGC.