On the 2nd of July, mercury retrograde ends. Now I know that not everyone out there is into astrology and that sort of thing, but there are those who are. In fact a lot of traders will sit on the side lines during this time due to the fact that in a lot of cases, things have been known to go wonky. Myself I always keep it mind and I have noticed that in a lot of cases some of my best call trades during retrograde tuned out to be some of my worst call trades, so I guess there is some truth in the matter around retrograde. Hopefully my one trade that I am down 25% on, will rebound after July 2nd.

I get an email from a cycle theory guy named Bo Polny. He is calling for the gold top in June we just had on the 27th to be the top. Gold should now sink thoughout the summer to maybe close to it's old low last year of around $1150 or so. The guys has been quite acurate in the past so I will give him the benefit of the doubt here. However with the selling off in gold thoughout the summer months, he is calling for a $2000 prise per oz by year end 2014.

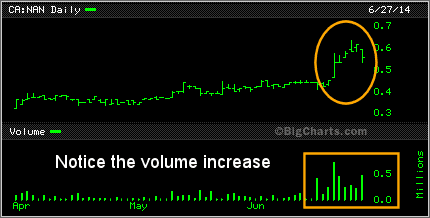

So with the gold price possibly heading down this summer and silver most likely doing the same, one has to wonder if there are some bright spots still on the market? Well one of those brighter spots is nickel. Not only the price of nickel but some of the nickel junior stocks. Of course for anyone who has been reading this column for any length of time you will see that I an avid follower of North American Nickel NAN who has drills running at this moment over in Greenland. The first drill started up about 10 days ago and the second drill should be running in about a weeks time. Since the drilling began there has been a lot of excitement and it sure shows in the stock price. The stock has risen about 30% in the past week alone on way above average volumes. Since the December lows the stock is now up 200%. After hitting a new 52 week high of 63 cents on Thursday, the stock took a breather and fell back to 55 cents on Friday.

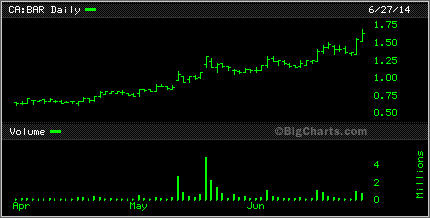

Another nickel player getting noticed and hitting new highs is Balmoral Resources BAR. The company is working in Quebec right beside the Ontario border. On June 20th they put out news stating: discovery of high-grade nickel-copper-PGE mineralization associated with the previously highlighted (see NR14-09, April 30, 2014) net textured sulphide zone in hole GR-14-25. The net textured zone, one of four mineralized intervals in the hole, returned a near surface intercept of 1.79% nickel, 0.19% copper, 0.42 g/t platinum and 1.04 g/t palladium over 45.28 metres. This high-grade interval is capped by, and includes, 1.11 metres of massive to semi-massive sulphide which returned 10.60% Ni, 0.45% Cu, 2.04 g/t Pt and 5.23 g/t Pd, confirming the potential for very high grade nickel and PGE values within the system.

This news of course has propelled the stock price higher so that it too hit a new 52 week high this week of $1.68. The 52 week low was just 27 cents. So far this year Balmoral has been a 6 bagger stock play riding mostly on this nickel play.

Other nickel explorers would include Noront NOT and it's McFaulds Lake Project located in the highly prospective Ring of Fire, and Royal Nickel RNX which is working on it's Dumont Nickel Project. This project is a mammoth deposit near the town of Amos in the established Abitibi mining camp in Quebec. When in production, it is expected to rank as the fifth-largest nickel sulphide operation in the world by annual production only the mining operations at Norilsk (Russia), Jinchuan (China), Sudbury (Ontario, Canada), Voisey's Bay (Newfoundland and Labrador, Canada) will be larger.

Tuesday is Canada day and then retrograde ends so hopefully everyone will be back into the plus side of the market and with nickel stocks shining, this might very well be the season for nickel. The last time nickle shone was back in the 90's with Voisey's Bay and Diamond Fields who found the deposit saw it's stock run from under $2 bucks to around $120 with in a year and a half. Something to keep in mind.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.