If you are like me and getting really fed up western lithium and disgruntled about the junior mining sector, your not alone. It seems almost every junior is either running out of money, their stock prices are in the toilet, investors just don't want to hear the word junior anymore and you've lost a whack of money in the market. Well that's what happening over in the metals side of things. Uranium stocks and diamond stocks are doing quite well and there seems to be some interest in them. Another sector that is getting some eyes is the the rare earths that are used in technology. One of those rare earths is lithium and today we are going to take a quick look at a company that is into the lithium scene.

Economic concentrations of lithium are found in brines, minerals and clays in various parts of the world. Brines and high-grade lithium ores are the present source for all commercial lithium production. The largest known deposits of lithium are in Bolivia and Chile. Lithium brines are found in saline desert basins sometimes known as salt lakes or salt flats. It is also found in hard rock minerals, such as spodumene in pegmatites. The lithium company we are going to look at is finding their lithium in significant concentrations in the mineral hectorite, a trioctahedral smectite. The company that is working on this deposit is Western Lithium WLC and their deposit is in the Humbolt County Nevada and their project is called the Kings Valley. Because of the large-scale mining in the Winnemucca area, local resources offer much of the infrastructure and support required by mining. The area is about 30 km north of the now depleted Sleeper gold mine and 100 km northwest of Twin Creeks, Turquoise Ridge, and Getchell gold mines. Several other gold and copper mines operate in the regional area providing an experienced work force and adequate support for mining operations.

Kings Valley has about 11 million tonnes lithium carbonate equivalent (1) (historical estimate based on exploration work by Chevron Resources during the 1970s and 1980s). The project is spread over five mineralized lenses (Stages I to V) that extend approximately 30 kilometers from the southern to the northern edges. As far as a develpoment plan the company would see their stage I reserve base supports annual production of 26,000 tonnes lithium carbonate, 90,000 tonnes of potassium sulfate and 100,000 tones of sodium sulfate. Once full lithium carbonate production of 26,000 tonnes per year is achieved, average annual cash flow is projected to be $124 million per year. Nominal production of by-product potassium sulfate and sodium sulfate of 90,000 and 100,000 tonnes per year, respectivelyA 20 year mine life, processing 25.5 million tonnes of ore at an average grade of 0.40% lithium using a 0.320% cut-off grade.

The company has a NI 43-101 that was completed on May 09, 2014. This report is an update to the Western Lithium Kings Valley property. It addresses the Stage I and Stage II deposits as well as provides additional updates to the Project. The report on the Stage I deposit includes a Preliminary Feasibility Study (PFS) identifying the progression of WLC's exploration of the property along with advancements in the metallurgical process. The report on the Stage II deposit includes a mineral resource estimates for lithium (Li), along with potassium (K), fluorine (f), and sodium (Na).

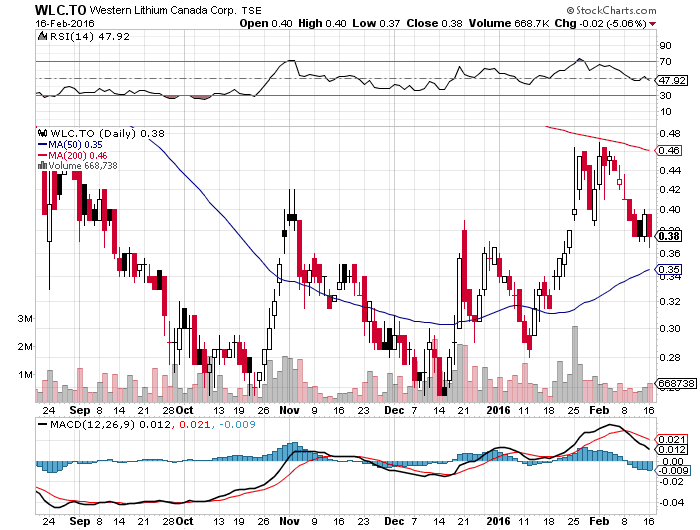

The company has 120 million shares out and by looking at the chart is one of the few mining stocks that is seeing some postive action. There has also been a lot of new releases lately so the stock is seeing some good action. If your tired of the base and precious metals, lithium just might be something to look at.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.