March 1, 2016

Who says gold prices haven't done much in the past few years. Living in North America a person can get a sometimes skewed perception of what is really happening in the world. We are constantly being bombarded by what seems to be American news and American everything else. So when it comes to things like the price of gold, we are always accustom to a US dollar amount. And when commentators say that the price of gold hasn't performed as well as some stocks or other equities or even the US dollar we tend to agree or acknowledge that.

Who says gold prices haven't done much in the past few years. Living in North America a person can get a sometimes skewed perception of what is really happening in the world. We are constantly being bombarded by what seems to be American news and American everything else. So when it comes to things like the price of gold, we are always accustom to a US dollar amount. And when commentators say that the price of gold hasn't performed as well as some stocks or other equities or even the US dollar we tend to agree or acknowledge that.

However if you were to take the price of gold and look at the price in some other currency outside of US dollars you would be surprised to see just how well it has performed year over year. Being as I am in Canada I will post a chart taken today of a US gold price, a Canadian gold price a South African gold price and a Brazilian gold price. The reason I use a South Africa currency is because South Africa is country built on gold. Australia also is a heavy resource country and gold mining plays a very important role in that country. I also decided to use 15 year charts to show the actual upside growth in the price of gold. The first chart is the price in US dollars followed by Canada, Australia, South Africa and finally Brazil.

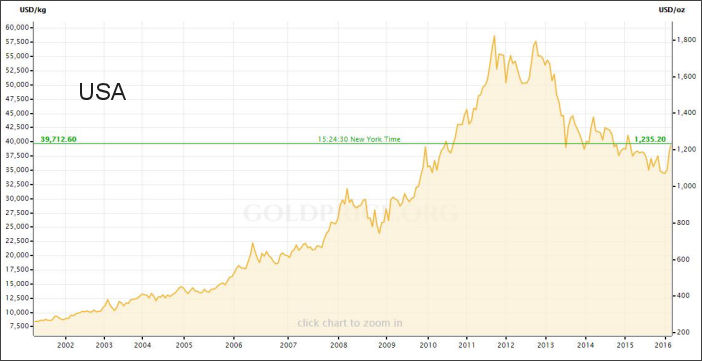

So first up is a chart showing the price of gold in US dollars as of today, March 1 2016. Remember the high was in September 2011 and the top gold price was $1911.

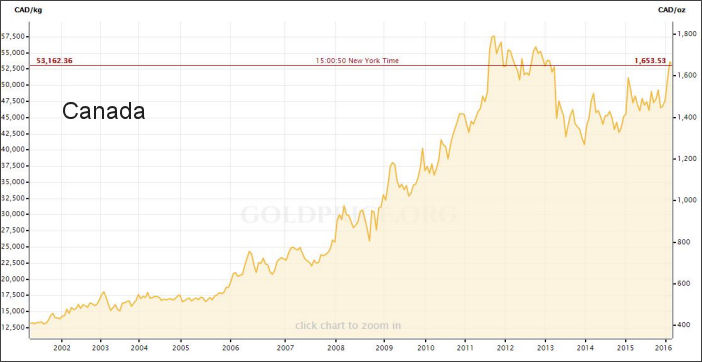

Next chart here is showing the performance of price of gold in Canadian dollars. Notice that we are only couple hundred bucks from our all time high back in 2011.

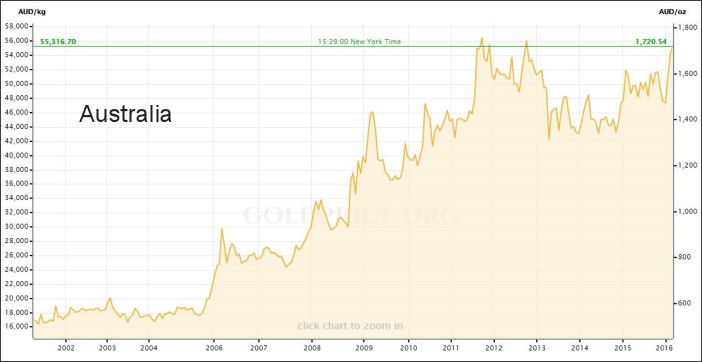

Now we have a chart showing what an ounce of is worth in Australian dollars. Notice it is right back up so it is almost kissing those old highs back in 2011.

And finally here is a chart of what an ounce of gold is worth if you were living in South Africa right now today. Let's say you bought a few ounces 10 years ago as a rainy day investment. I'll just bet you would be one happy smiling happy person today.

So there is a couple lessons to learn here. One is that gold always holds it's value. It always has and will most likely always will. Gold is not only an investment but it is also an insurance for when things go bad. Things like your currency gets devalued and the economy is a mess. Just ask anyone who lives in Brazil today if they wished they would have bought some gold a few years back. And no, Brazil is not some third world country. Brazil is a huge country that is part of the BRIC's nations. Well educated people, big factories, offshore oil, agriculture that is second to none.

Gold is a great invesment and everyone should have a portion of their investment portfolio in gold or even silver. You can buy gold almost anywhere online and if you are American you can even have real gold in your IRA. If buying physical gold is not your thing, there are other great ways to invest such as gold mining stocks or even gold mining properties.

If you enjoyed this article, please feel free to share. When seeking out mining stocks alsways use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.