Dividend-paying gold stocks represent an effective way to earn both dividends and exposure to precious metals. These stocks are a combination of defensive assets, including gold and income investments of equities. But not every company that deals with gold is the same. The selection of the right one depends on the evaluation of a number of factors. The present article is aimed at discussing how it is wise to analyze gold stock with dividend and build a strong portfolio.

When choosing a gold stock, its dividend record is the first thing to consider. Companies that have consistently paid dividends are generally reliable and financially disciplined. Verifying that the dividends are steady or increasing demonstrates that the company is stable and that it is concerned about its shareholders. Look into the performance of the company in times of previously witnessed downturns. It is better to avoid those stocks that have irregular or suspended dividends; it may be a sign of operational or financial fragility.

The capacity of the firm to sustain dividends is much influenced by its financial strength. Check the measures such as net income, net cash flow, net balance sheet, and cash flow strength. Firms with low debt-to-equity ratios and good free cash flows have a higher chance of maintaining dividends, even in low-gold-price environments. Avoid the firms that depend on borrowing or asset sales to finance dividends, since such a firm may be risky in the long term and will not perform well.

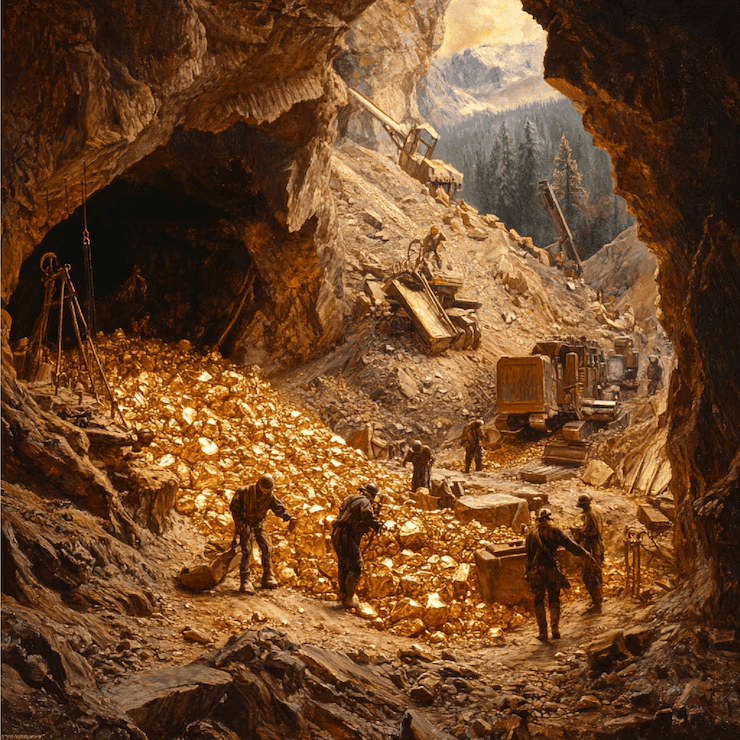

Gold mining is capital-intensive, so understanding production costs is essential. The All-In Sustaining Cost (AISC) metric shows how much it really costs to produce one ounce of gold. Companies with low AISC have higher profit margins and more capacity to pay dividends. These businesses can remain profitable even if gold prices fall. Choose gold stock with dividend companies that are efficient, well-managed, and operate in cost-effective regions or mining environments.

The performance of gold stock with dividend is tied closely to the price of gold. Some companies are highly sensitive to gold price fluctuations, while others hedge their production to reduce risk. Look for miners that balance exposure and protection so that you can benefit from rising gold prices without too much downside. Assess the company's flexibility—firms that can scale operations or adjust costs are better equipped to weather volatility.

The mining companies are regularly organized in several countries, and they are all regulated differently. Avoid companies domiciled in mining-unfriendly jurisdictions, such as South Africa. These geographical areas are less prone to any operational interruptions, labour strikes, or nationalization. The risk of political exposure of a company influences its safety and long-term profitability. They would be wise to avoid those who are too dependent on high-risk nations, where changes to law or government may adversely affect revenues and payout of dividends.

Good management is very important in the mining industry. A competent and seasoned management team guarantees good operation, strategic planning, and sustainable dividend policies. Find out the past performance of the executives, have they ever piloted successful projects? Are they value creators to shareholders? There should also be open communication and a sense of capital discipline. Do not take firms that have been unstable in terms of missing targets, bad acquisitions, or shareholder dilution.

If you're unsure about choosing specific stocks, consider buying gold mining ETFs, which offer lower risk and diversified investment opportunities. Comprising a basket of gold miners, with several of them being dividend-paying, this is what these funds invest in. ETFs such as the VanEck Gold Miners ETF (GDX) or the iShares MSCI Global Gold Miners ETF (RING) diversify risks to a number of businesses and locations. Exchange-traded funds are particularly useful to unskilled investors who need to get a wide market exposure or who are conservative income spectrum players.

Prices of gold run in cycles and depend heavily on world interest rates, inflation, and geopolitical turmoil. A strong gold stock sustains dividends at a time when the price of gold plummets. Examine how the company performed in previous recessions. Did the company reduce its dividends or hold firm on them? Sustainability will yield greater benefits than a high payout. Firms that have low debt as well as high cash levels, along with diversified production, are in better positions to retain dividends in rough market periods.

Incorporation of modern technology and automation in mining operations usually makes them cost-effective and resourceful. Businesses that invest in innovation tend to sustain healthier profit margins, either through AI-powered exploration, drone surveys, or environmentally friendly extraction procedures. These efficiencies have enabled them to continuously capitalize on more free cash flows, which justify the payments of dividends in the long term. The technological advantage also lowers the risks of environmental and regulatory compliance, which otherwise may jeopardise the financial performance and dividend stability.

The use of Environmental, Social, and Governance (ESG) criteria is becoming essential in the determination of long-term investment health. Corporations that adhere to responsible mining, good labor relations, and compliance with the environment have fewer chances of being interrupted or incurring legal expenses. The popularity of ESG-compliant companies among institutional investors has been rising, which may aid in increasing the share prices of these companies. An ESG-dedicated gold company, according to the rule of thumb, demonstrates long-term strategic thinking, which is a good prognosis for dividend stability and financial health.

Selecting a gold stock with dividend is a tactical scenario where one has to look at the financial capability of a company, the effectiveness of its operations, as well as its stability in the long run. It is easy to be tempted by the yield, but it is important to explore cost structures, how sensitive the company is to the price of gold, geopolitical risk, and the quality of the management. Regardless of whether you invest in individual stocks or ETFs, you would want to, as far as possible, balance between generating yields and preserving and growing your capital. Gold stock with a dividend can help you make your portfolio stronger and more valuable when done right.