Gold has fascinated investors, miners, and entrepreneurs over the years. Recently, gold claims for sale have gained immense popularity as people seek tangible assets or other investment opportunities in small mining operations. But it definitely is not a good idea to go for a gold claim without being adequately informed about it. With accurate information on key considerations before you purchase a gold claims sale, you can avoid making costly blunders when you make your investment.

A gold claim is a right to mine or search for precious ores on a particular piece of property, most likely on government lands leased under mining legislation. Having a claim will not necessarily make you a proprietor over a piece of land, but will see you acquire rights to the minerals under specific circumstances. A claim can either be a placer claim, which is over loose ore such as in a stream, or a claim over ore embedded in a rock structure.

One of the most critical factors in selling a gold claims sale is verifying that the claim is legally valid and in good standing. Buyers should verify that the claim has been properly filed with the appropriate government authority, such as the Bureau of Land Management (BLM) in the United States, and that all annual maintenance fees or assessment work requirements have been met. Failure to do so can lead to an invalid or expired claim-one that will render your investment null. Consulting official records and, where possible, a mining attorney can help confirm the legitimacy of the claim.

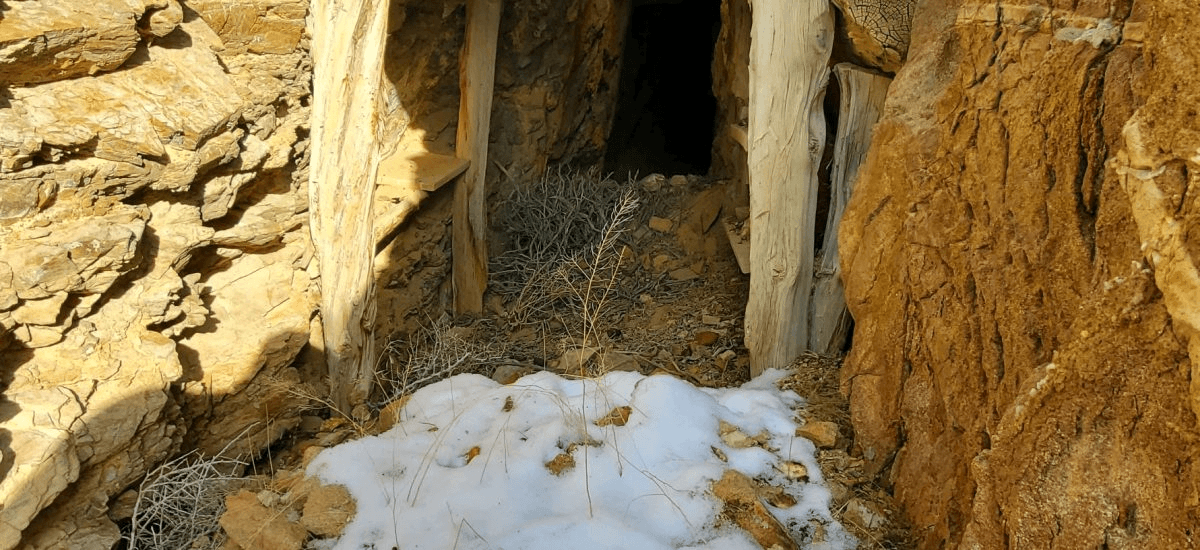

The value of gold claims sale lies very much in their geographical location. Claims found in historically productive mining areas will garner more interest, but accessibility is just as crucial. Consider factors such as proximity to roads, terrain difficulty, and seasonal access limitations. Remote claims may contain promising mineral deposits but could require significant investment in transportation, equipment, and infrastructure. Assessing accessibility helps you balance potential reward against operational challenges.

The geology of a claim is its very basis. A buyer would be smart to review historical production records, geologic surveys, and sample results from the area to understand areas with gold-bearing potential better. Claims with documented gold production or favorable geology typically carry lower risk. No claim can be guaranteed to succeed, but evidence of geological strength reduces the risk of any viable return on investment. If you are not a knowledgeable person in this field, it may be wise to hire a geologist or mining consultant.

Not all gold is recovered the same. Placer gold claims sale is often extracted using relatively low-tech methods such as panning, sluicing, or dredging, which makes it attractive to small-scale miners. Typically, the extraction of lode gold requires advanced technological processes, including drilling, blasting, and crushing ore. Understanding the type of gold present and the required mining method helps determine whether the claim aligns with your experience, budget, and operational goals.

Mining is heavily regulated due to environmental impact concerns on land, water, and wildlife. However, it would be wise to learn about the permits required for exploration and mining operations before buying a gold claim. Some areas may have restrictions on water usage, equipment types, or land disturbance. Non-compliance can bring in fines, shutdowns, or even court battles. Considering the regulatory requirements of your decision ensures smoother operations and long-term sustainability.

While the cost of a gold claim purchase is not all-encompassing when it comes to expenses, other expenditures may include annual fees for a claim, taxes for a claim on a piece of property (depending on where it is located), additional purchases such as mining equipment, fuel, and other forms of labor, among others. Such expenditures cost both new and veteran gold claim buyers.

Seller reputation and transparency play a very important role in handling gold claims sale. A reputable gold claim seller will provide transparent information that highlights not only the pros but also the cons of a gold claim. Do not fall prey to false claims and directions to achieve higher returns because, by all means, gold mining is never devoid of risks.

Your aims will inform your investment in a gold claim. Some people will invest in a gold claim simply for investment purposes. They will hope the value of the land will increase over time, or because they can resell it to others. Other people will invest in a gold claim simply because they will mine gold from it. Based on your aims, you will be better positioned to choose a gold claim that aligns with your expectations.

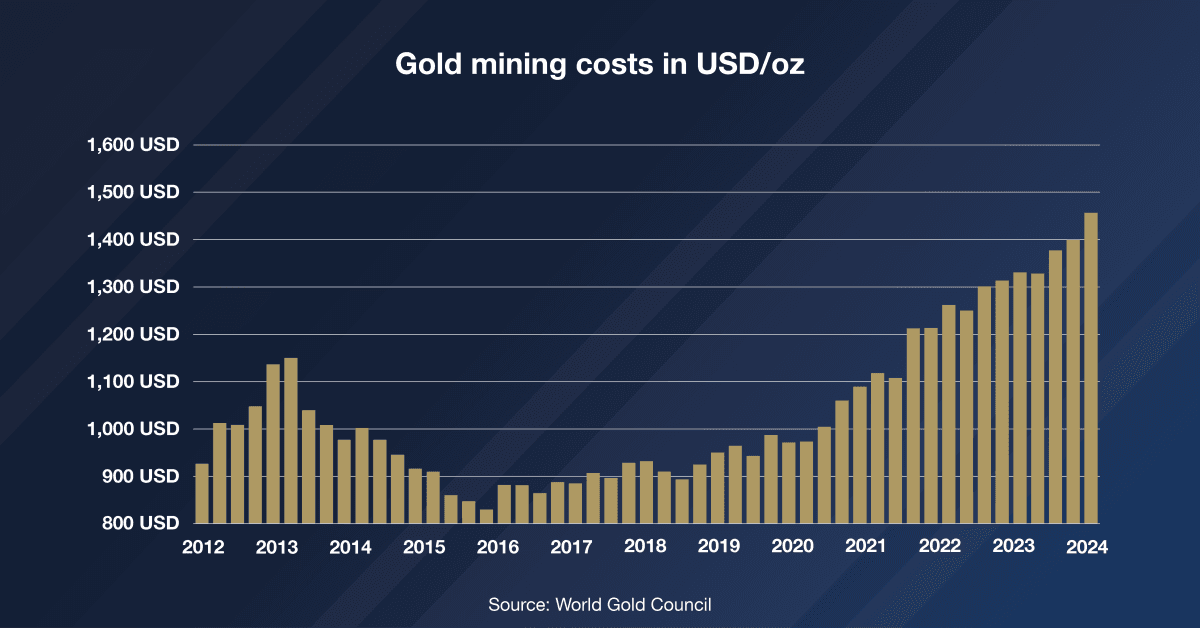

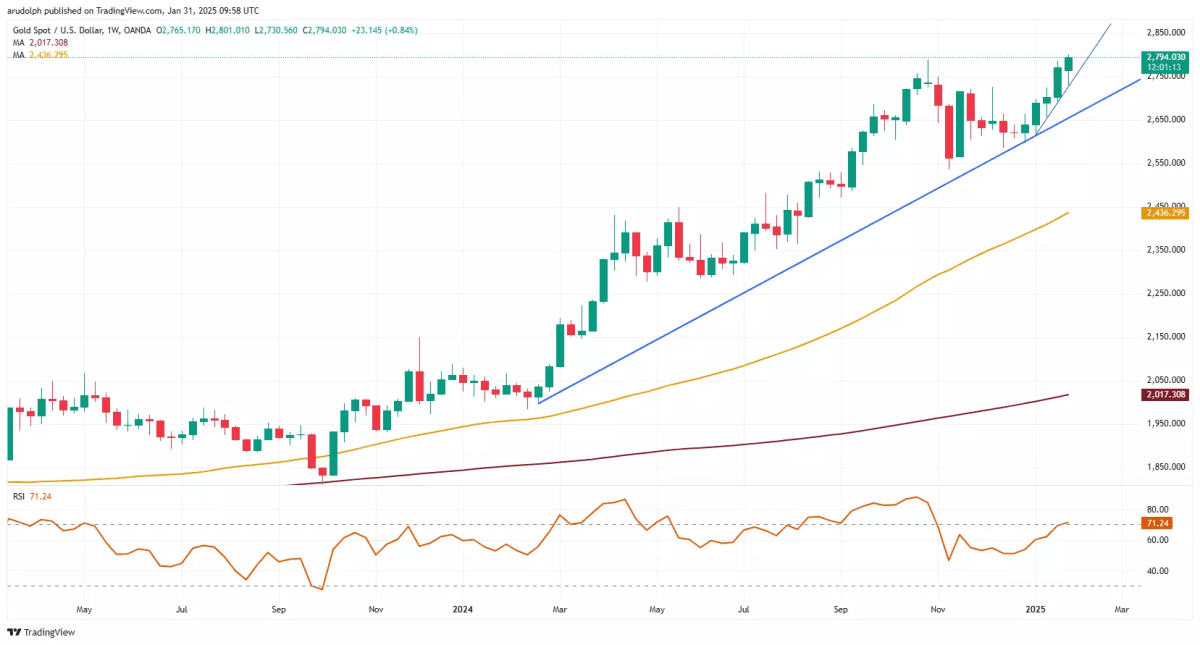

Although gold is perceived as a stable commodity, its price fluctuates in response to global economic and geopolitical events. While researching gold claims available for purchase, market and future gold pricing are important factors to consider, since they affect gold claim pricing. Higher gold pricing can support higher operational costs, but lower gold pricing can render marginal claims uneconomic. Market trends can provide a vital financial dimension to your research decisions.

Having a good exit strategy in place is sometimes overlooked. Whether you plan to resell your claim after mining, lease it to another prospector, or hold onto it, being knowledgeable about resale value can be an important consideration. It will be easier to resell a claim that is in a good location with gold potential.

Exploring a gold claims sale can be an exciting opportunity, but it requires careful evaluation and informed decision-making. Every consideration, be it legal confirmation and geologic potential, cost and regulation, or market elements, holds equal significance in establishing the viability of your investment. Through meticulous investigation and aligning your purchase with a set of specific aims, you can undertake gold claims with optimism and pragmatism. The most precious asset you can possess in a gold mining project is prudent preparation.