The sale of a placer gold claim to invest in may be an exciting and lucrative prospect, whether you are a long-time prospector or a first-time purchaser. Placer Gold Claim for Sale opportunities usually involve claims that allow gold to be mined from riverbeds, streams, and alluvial deposits using comparatively simple methods. However, not every placer claim is equal. For smart buyers considering a placer gold claim for sale, it is important to evaluate each option carefully before making any purchase.

A placer gold claim gives the owner the legal right to mine gold that occurs in loose materials such as sand, gravel, and silt. In contrast to hard-rock mining, placer mining targets exposed or shallow deposits and, therefore, is less intricate and expensive. Prior to the purchase of any placer gold claim on sale, the initial step towards a good investment is having an idea of how these claims operate and what they entail.

One of the most essential considerations to make is location. An excellent placer gold claim would be located in a region with a known history of gold production. An investigation is conducted into the surrounding mining records, historical yields, and geological surveys to assess the availability of gold. Claims in active or ancient river channels have greater potential because gold is found in such areas.

Smart purchasers never fail to ensure that a placer gold claim is legal before sale. Make sure that you have duly registered your claim with the appropriate mining authority and paid the company your yearly maintenance fees. Make sure that boundaries are clearly defined and that there are no duplicate claims or rights issues. A legally sound claim will help you avoid future complications and financial loss.

The accessibility of the mine may have a considerable effect on the mining efficiency and costs. Assess access to roads, utility access, and access to the town or supply center. The ones that are more readily accessible require less transport expenditure and enable smoother operations. In addition, verify the land's availability on a year-round basis, or limit it to weather or environmental laws.

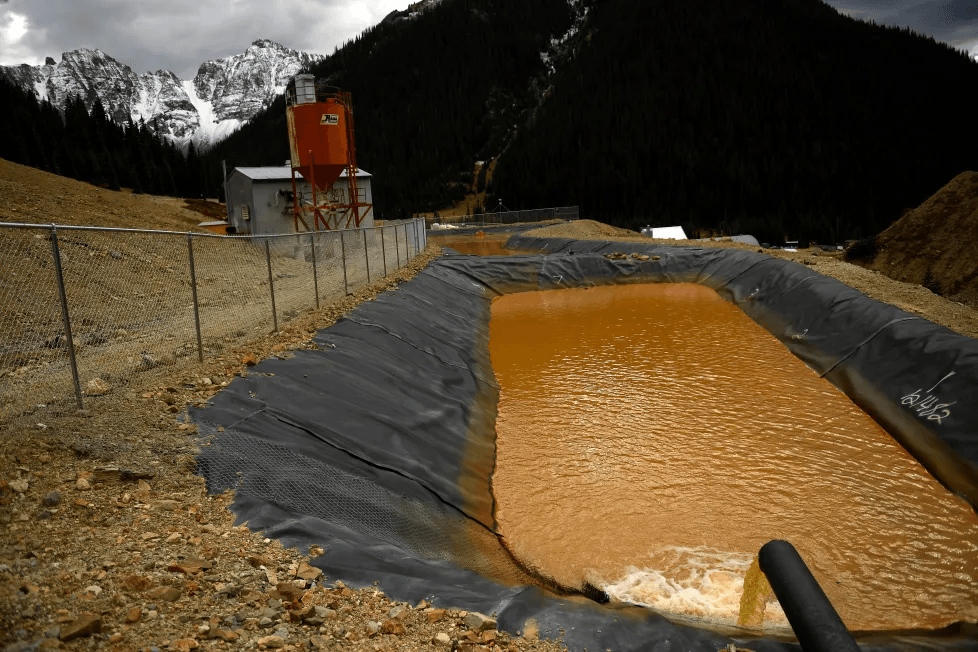

Placer mining typically involves using water to process materials. Ensure the statement includes genuine water rights or permits where necessary. Moreover, be familiar with local environmental and reclamation requirements, as well as any limitations on equipment use. Legal compliance is not only a way to avoid legal trouble but also a way to ensure that mining practices are sustainable.

A credible placer gold claim to purchase is likely to be accompanied by sampling or previous production information. Test samples review, recovery reports, and any geological assessment by the seller. Do your own sampling in order to ascertain the gold content. Finds of fine gold or nuggets of occasional gold may be good signs of a prospective claim.

The various claims involve different mining techniques, i.e., panning, sluicing, or dredging. Assess the cost-effectiveness of recovery using the equipment you intend to use. Knowing the cost of the operation, including fuel, labor, permits, and maintenance, can help you estimate profitability and avoid unpleasant surprises.

It is as important to purchase from a reliable seller as it is to assess property. An open seller should be ready to provide documents and clarifications and to allow unannounced inspections. Watch out for false claims or promises of guaranteed returns, as gold mining is not always a gamble.

Make sure that before a placer gold claim is sold, a full set of mineral rights is included in the deal. The claims only give mining rights and leave the surface rights to a different party. Knowing what prevents any access conflicts and makes sure that you will be able to extract the gold without any limitations imposed on you by the owners of the particular piece of land or government officials.

Placer gold mining size has a significant influence on long-term profitability. The bigger the claims, the more ground there is to investigate, minimizing the risk of exhausting resources. The intelligent buyers also verify whether neighboring claims can be used in the future to expand their operations, which may be very important for a massive increase in scale and eventual recovery of gold.

Seasonal processes that can influence the area of placer mining include snowmelt, precipitation, and freezing. Review the number of months per year during which the assertion can be actively mined. A longer operational season with a placer gold claim for sale ensures superior planning, increased productivity, and returns on the investment.

Mining is directly influenced by terrain. Steep or rocky terrain is usually more difficult and expensive to work on than flat or gently sloping ground. Determine the depth of the gravel, the overburden, and the type of bedrock because the gold is frequently found around the cracks of the bedrock. When ground conditions are favorable, gold recovery can increase significantly.

Most jurisdictions require miners to restore land after operations conclude. Review reclamation obligations, bonding requirements, and restoration costs tied to the placer gold claim for sale. Understanding these responsibilities upfront prevents unexpected financial burdens and ensures compliance with environmental standards.

Purchasing a placer gold claim for sale can be a rewarding investment when approached with diligence and informed decision-making. Smart consumers consider the place, legal assurance, availability, green processes, and authenticated gold prospects before making a commitment. With the considerations of all these factors well examined, you stand more chances of having a productive claim which is not only financially fulfilling but also adventurous and drier of gold.