Hecla Mining Company has gradually ascended to the limelight as one of the closely monitored precious-metals stocks in recent years. Amid growing global economic uncertainty, inflation, and the industry's need for silver, more investors are focusing on businesses with high production capacity and sound operations. Hecla is the largest producer of silver in America, with a long history of operations, and its assets are located in favorable mining jurisdictions. Market interest has been compounded by the stock's recent performance, growing reserves, and rising financial strength. All these aspects justify the reason why institutional and retail investors are keeping a close eye on Hecla Mining Company.

All of these factors have contributed to Hecla becoming an increasingly promising business opportunity in the precious metals industry.

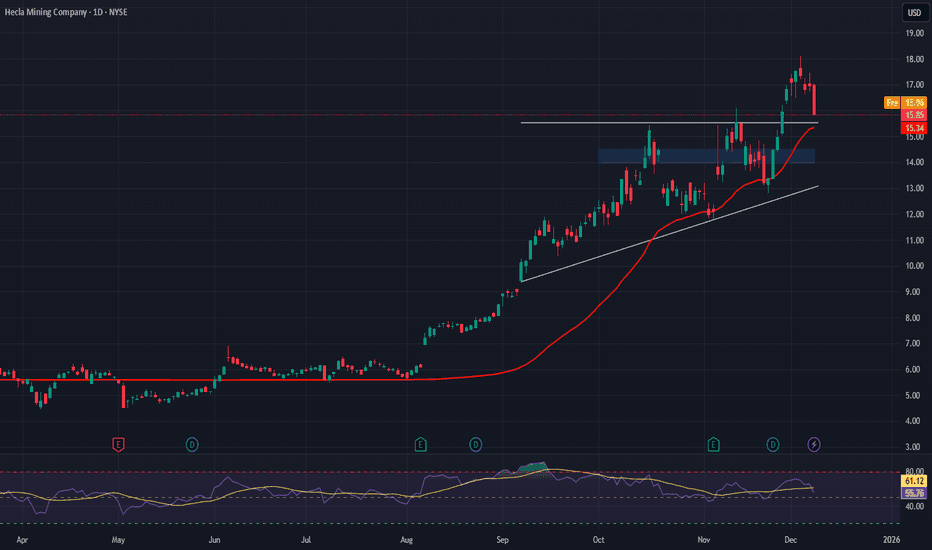

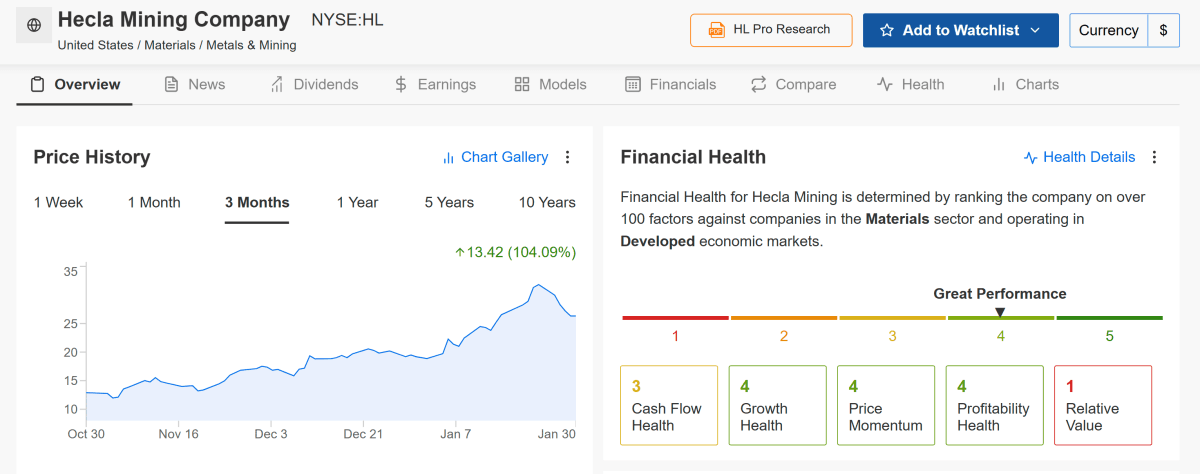

Hecla Mining is under intense investor scrutiny as its share price has been surging, hitting new 52-week highs in 2025 and 2026. With its humble start to trading at the beginning of the year, HL has soared more than 400 percent year over year, indicating strong market momentum and investor confidence in its operations and financial performance. This kind of drastic price increase is, of course, attracting retail and institutional attention.

The lack of Hecla is closely connected with the boom in precious metals, such as gold and silver. Strong price records across these commodities have increased revenue potential for miners and made companies such as Hecla particularly appealing to investors seeking exposure to safe-haven products amid economic uncertainties and inflationary pressures. This macroeconomic environment has increased investor interest worldwide.

Hecla Mining is the largest silver producer in the United States and one of the leading companies in the North American industry, with millions of ounces of silver in reserves and an annual output. Its pure-silver revenue mix also gives it an edge over others that are more mixed with gold or industrial metals, providing a clear value proposition for specialty investors.

One of the biggest drivers of investor interest was the upcoming inclusion of Hecla in the S&P MidCap 400 and its prior inclusion in the S&P SmallCap 600, which brings more publicity to institutional funds and index-tracking portfolios. Inclusion generally leads to increased liquidity and diversification of ownership, particularly among mutual funds and ETFs, which makes HL a more mainstream investment choice.

Operational performance has shown significant growth in production, with record output at some of Hecla's major assets. In addition to growth in output, the company has increased proven and probable reserves, which have extended mine life and ensured a stable future revenue stream. These basics appeal to investors interested in long-term value creation.

Hecla's exploration activities, such as the Libby Project in Montana and the discovery of high-grade in Midas, Nevada, highlight future growth potential. Investors tend to re-rate a stock when a mining company discovers new deposits or extends existing ones, depending on projected future cash flows and output.

Beyond price performance, its financials have improved, supported by rising revenues, expanding margins, and stronger cash flow. According to the data, the company's overall financial stability is very good, and its shares are more attractive than those of junior miners, which may be riskier and show less stability.

Although silver is the main source of Hecla's core revenues, the company also produces gold, lead, and zinc. This is a heterogeneous approach that would help avert fluctuations in a specific commodity by exposing investors to a wider range of metals crucial to industry and technology.

Most of Hecla's operations are focused on politically stable North American jurisdictions, which is another significant risk-management consideration of major interest to investors. The safe regulatory mining environment also minimizes geopolitical risk compared to companies with assets in more unstable geographic locations, making Hecla more appealing to risk-averse capital.

The long-run structural demand for silver, including industrial uses in electronics, solar panels, and EVs, as well as periodic supply limitations, puts silver miners such as Hecla in an important position in the portfolios of investors seeking to play the secular-trends game. The lack of this supply on demand is still a basis for bullish opinions about producers.

Lastly, the high valuation multiples and volatility of mining stocks imply that Hecla is a popular choice for both short-term and long-term strategic placements for tactical investors. Even the most conservative observers admit that HL has an operational advantage in both commodity prices and capital project risks, making the company an interesting, though subtle, investment target.

Hecla Mining Company is now the focus for investors seeking exposure to silver and other precious metals with strong fundamentals. The company provides a compelling investment story, driven by robust growth in production and reserves, positive commodity price returns, and strong financial management. Its business is in stable areas, with an emphasis on sustainability, and its potential upside from rising silver demand makes it even more attractive. Although other threats, such as price volatility and operational issues, remain, Hecla's strategic positioning and market momentum continue to attract. Hecla Mining is a stock worth keeping an eye on for investors tracking the precious metals sector.