It would be an exciting and potentially lucrative venture to invest in a gold mine in Colorado. The state boasts an extensive mining history, mountainous terrain rich in minerals, and an active prospecting community, making it a target for claim buyers. Two things, however: most investors jump into such deals without adequate research and end up making costly mistakes. To make a smart, safe investment, avoid these mistakes when purchasing gold mines for sale in Colorado.

It is one of the greatest errors buyers can make because they have to rely on the seller's information about gold deposits without conducting their own geological investigations. The terrain in Colorado is varied, and mineral concentrations may vary significantly within the same mining district. The steps in recruiting a certified geologist, reviewing historical production data, and analyzing geological maps are important. Without this, investors may risk buying land with low-grade ore or none at all, which cannot be economically recovered.

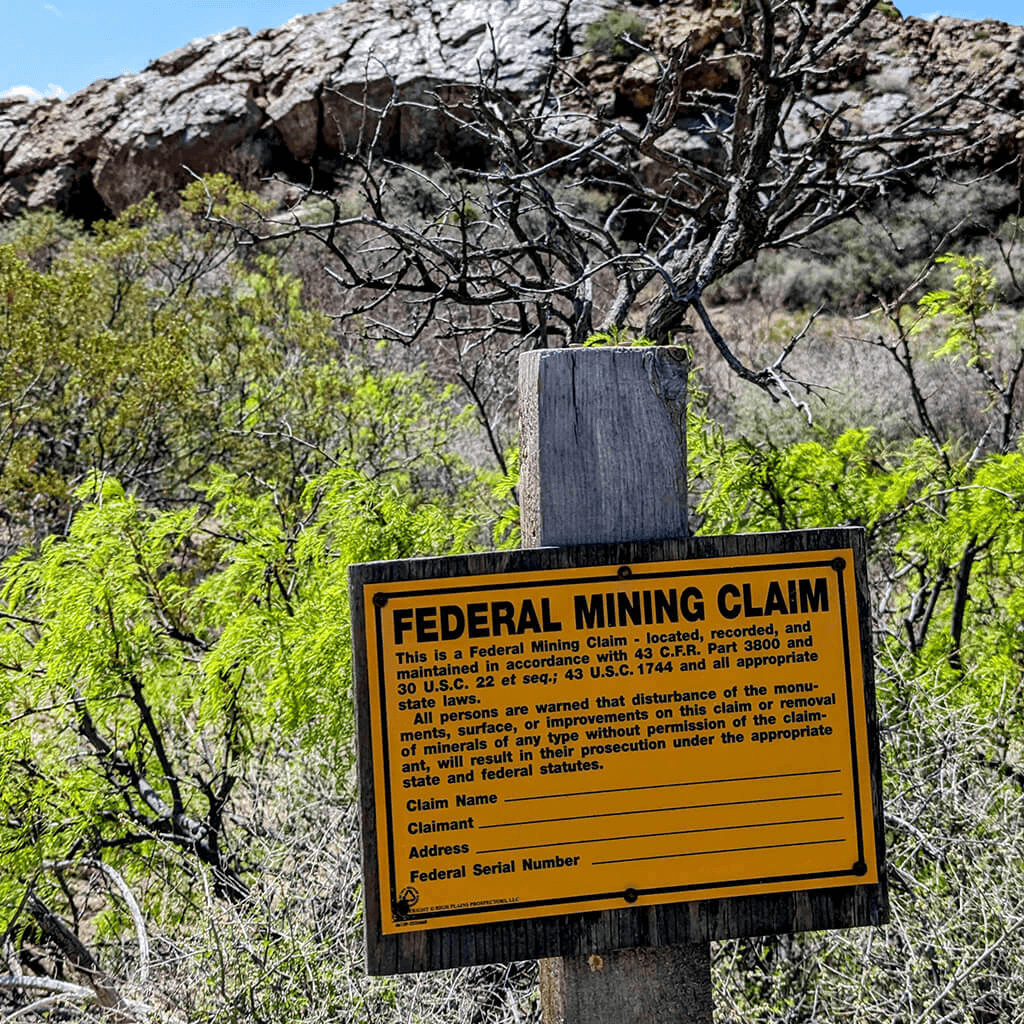

Most new customers believe the mining claim or property is legally owned by the seller, which can lead to future conflicts. It is important to ensure that you confirm the validity of claims with the Bureau of Land Management (BLM) and county records before you pay. There are cases when some claims can be abandoned, filed improperly, or continue to belong to another person. Legal verification is conducted to ensure that the mine is transferable in good faith, free of encumbrances. Failure to do this may result in the loss of your investment and mining rights.

Colorado gold mines are usually located in remote, mountainous areas that are difficult to access. Most purchasers will not consider the availability of roads, water, and power sources, or the cost of transporting equipment to the location. Low accessibility will greatly increase operating costs or even render the mine unviable. Infrastructure considerations allow checking whether the property is viable for mining. Investors can purchase claims without giving them serious consideration and later end up carrying out costly upgrades to make them operational.

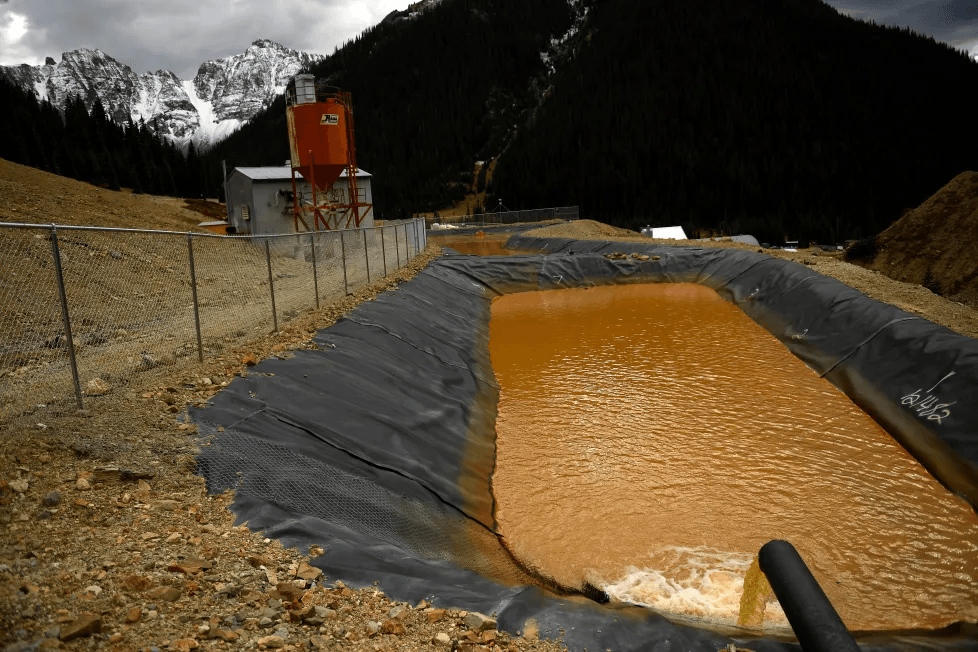

Colorado's mining operations can be severely affected by environmental restrictions. Purchasers do not pay much attention to the need for environmental evaluations to define preserved areas, establish waterway standards, and identify potential pollution issues. The mines placed close to streams or other wildlife zones might require special permission or face stringent restrictions. When neglected, they may cause operations to stall or result in huge fines. A thorough environmental review is conducted to ensure the mine complies with state and federal regulations before it is purchased.

Most investors aim to purchase the claim but fail to appreciate the current extraction costs. Mining is capital-intensive, whether in the form of equipment and fuel, permits, or even transportation. Rough conditions in Colorado may also reduce machinery efficiency and increase operational costs. A lack of a budget will make buyers spend their money before they can dig up enough gold to be lucrative. Understanding all the project's financial needs will make the investment sustainable and profitable in the long run.

Sellers usually promote claims by stating they have high yields or rich deposits, yet most of those claims are distorted. Trusting fabricated production is a widespread and expensive error. Buyers are supposed to demand assay reports, a sample of the mineral, and documented past production information. If the seller is unable to provide sound evidence, it is a warning. It is necessary to take time to cross-examine production options to avoid becoming entangled in empty pledges and ensure that real mining value is achieved.

It is risky to buy a gold mine without going to the location. Photos and descriptions do not highlight key features, such as unstable ground, flood-prone areas, abandoned shafts, or low-grade ore. An on-site inspection is an opportunity for a buyer to assess the land's actual condition and confirm that it has visible mineralization. The visit can be supplemented by bringing a geologist or a seasoned miner with her. Failure to follow this procedure may result in the acquisition of an inappropriate or unsafe mining land.

Colorado has specific mining regulations governing land use, water, environmental protection, and the upkeep of claims. Most buyers fail to educate themselves on such rules, and those who do not comply forfeit their claims. Laws mandate the yearly filing, charge, and running of reports. This is because the legal structure can be used to avoid punishment and to retain long-term ownership. Talking to a mining lawyer or specialist before buying is insightful and gives the purchaser an opportunity to remain in compliance with state and federal regulations.

Purchasing a gold mines in Colorado for sale may be a rewarding investment as long as it is done with due diligence and research. Eschewing such pitfalls as missing geological research, overlooking legal scrutiny, or underestimating the cost of operations, you can come up with a safer and more profitable decision. The mining prospects in Colorado are rich, and these people who succeed in buying the mines are those who research, screen, and strategize before making a purchase.