Gold is also considered a safe-haven asset, particularly in uncertain economic times. Although many investors own physical gold, another increasingly popular alternative is gold stocks that can yield dividends. Such stocks offer the security of gold along with the potential for dividend income, making them easy to hold for growth and income-oriented investors. The following are the largest benefits of holding gold stock with dividend.

The opportunity to receive a constant income is one of the greatest benefits of having dividend-paying gold stocks. Another key difference between the two types of gold is that, unlike the former, which is physical, gold does not generate funds; dividend-paying gold stocks are periodic. This revenue can also help balance out market fluctuations and provide uniform returns even when gold prices do not rise, making it attractive to long-term investors who require a steady stream of cash.

Gold stocks enable the investor to enjoy the gains from rising gold prices without owning the gold in physical form. The rise in gold prices tends to increase the revenues and profits of mining firms, which may in turn raise stock prices. Shareholders will benefit from the potential rise in gold, in addition to dividend payments, giving them a two-fold payoff that cannot be achieved with physical ownership of gold.

Gold has a proven track record as a hedge against inflation, and gold stocks amplify the same advantage. The rise in inflation tends to raise gold prices, helping mining companies remain profitable. Gold stocks that pay dividends may also safeguard buying power by providing capital growth and income, making them a great option in times of rising costs and currency devaluation.

Gold stocks that pay dividends help diversify an investment portfolio. Gold tends to perform differently from equities and bonds, and this lowers the total portfolio risk. Gold stocks are useful for offsetting losses during a recession because the dividends are dependable. This risk-adjusted diversification and higher portfolio resilience in case of economic or geopolitical turbulence.

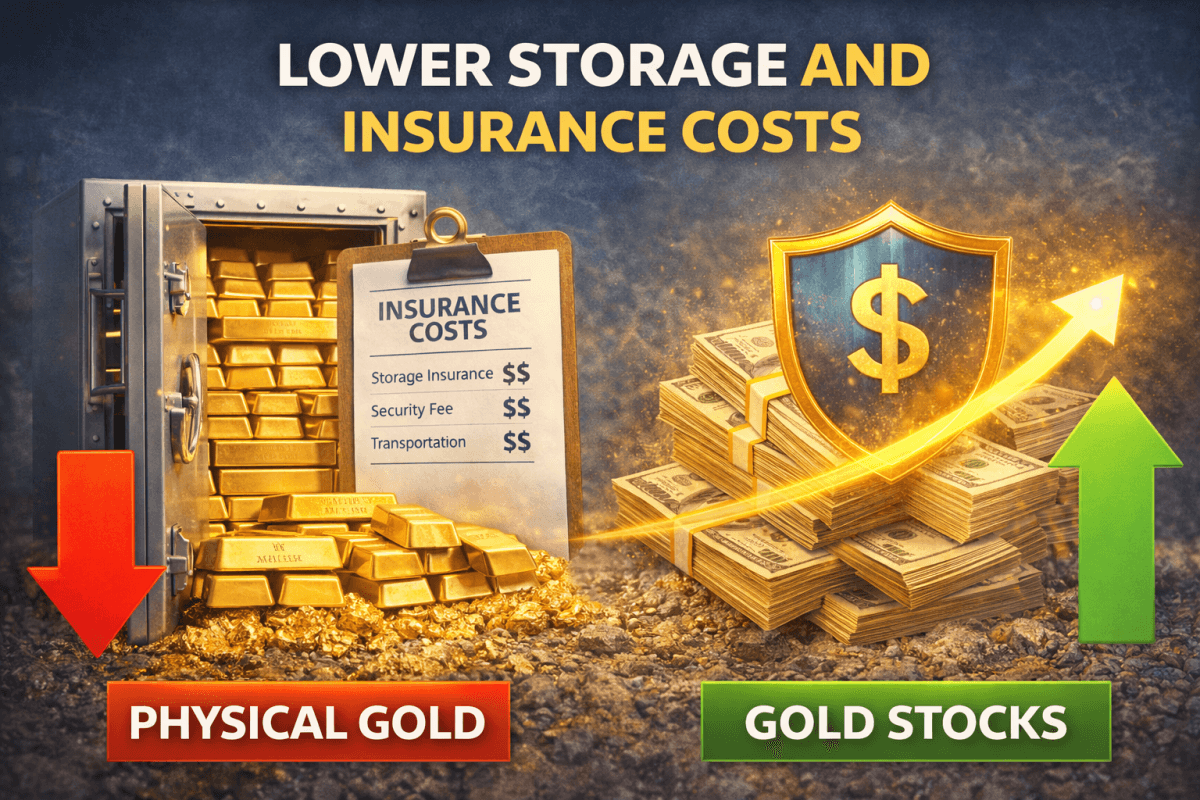

Gold stocks do not require storage or security and do not incur insurance costs, unlike physical gold. Through gold stocks, investors would not incur the costs of protecting bullion, making the stocks a cheaper way to invest in gold. It enables investors to keep more of their returns while still enjoying the value of gold and dividend payments from publicly traded companies.

Gold stocks are liquid and very easy to trade in major stock exchanges. The investor can buy or sell shares in real time in the market, unlike gold, which may require appraisal fees and dealer charges. This liquidity offers flexibility, allowing the investor to react quickly to market changes and still receive dividends over time.

Most established gold mining companies increase dividends as profits rise. This gives investors dividend growth, enabling income to keep pace with inflation. With positive changes in operational efficiencies or increases in gold prices, companies can pay shareholders more dividends, and overall returns and wealth creation will be generated over the long run.

The mining companies involved in gold mining are run by professionals who streamline operations, cut costs, and manage risks. Investors can enjoy professional management without the complications of gold mining or warehousing. Properly managed companies can pay regular dividends even in difficult market conditions, providing shareholders with dependability and assurance.

In most areas, other stocks can be taxed as dividends and long-term capital gains rather than physical gold. Such efficiency can be used to great effect to boost net returns. The dividend-paying gold stocks can also enjoy preferential tax treatment, making them an even wiser choice for investors seeking after-tax income and growth.

Gold stock dividends can be used to buy more, and their returns grow over time. Dividend reinvestment policies enable investors to accumulate wealth gradually, particularly during market declines when share prices are low. This will maximize long-term growth while still exposing it to gold's defensive features.

Gold stocks that pay dividends tend to be less volatile than gold itself. Dividend earnings help cushion price declines, making total returns stable. This predisposes them to conservative investors seeking exposure to gold, not subject to large price fluctuations, while still enjoying regular income.

Dividend-paying stocks of gold stocks are likely to do well during economic downturns, recessions, and geopolitical crises. With the demand increasing, investors tend to rush to gold-related assets in search of safety. Dividend income also increases returns, making these stocks a safe bet in uncertain times when other investments falter.

Owning a gold stock with dividend offers a powerful combination of income, growth, and stability. The investments offer exposure to the long-term value of gold, regular cash flow, diversification, and protection against inflation. Dividend-paying gold stocks are more liquid, less expensive, and tax-exempt as compared to physical gold. Dividend-paying gold stocks may be a good addition to an existing diversified portfolio for investors seeking a balance of returns and financial stability.

Dividend-paying gold stocks represent an effective way to earn both dividends and exposure to precious metals. These stocks are a combination of defensive assets, including gold and income investments of equities. But not every company that deals with gold is the same. The selection of the right one depends on the evaluation of a number of factors. The present article is aimed at discussing how it is wise to analyze gold stock with dividend and build a strong portfolio.

When choosing a gold stock, its dividend record is the first thing to consider. Companies that have consistently paid dividends are generally reliable and financially disciplined. Verifying that the dividends are steady or increasing demonstrates that the company is stable and that it is concerned about its shareholders. Look into the performance of the company in times of previously witnessed downturns. It is better to avoid those stocks that have irregular or suspended dividends; it may be a sign of operational or financial fragility.

The capacity of the firm to sustain dividends is much influenced by its financial strength. Check the measures such as net income, net cash flow, net balance sheet, and cash flow strength. Firms with low debt-to-equity ratios and good free cash flows have a higher chance of maintaining dividends, even in low-gold-price environments. Avoid the firms that depend on borrowing or asset sales to finance dividends, since such a firm may be risky in the long term and will not perform well.

Gold mining is capital-intensive, so understanding production costs is essential. The All-In Sustaining Cost (AISC) metric shows how much it really costs to produce one ounce of gold. Companies with low AISC have higher profit margins and more capacity to pay dividends. These businesses can remain profitable even if gold prices fall. Choose gold stock with dividend companies that are efficient, well-managed, and operate in cost-effective regions or mining environments.

The performance of gold stock with dividend is tied closely to the price of gold. Some companies are highly sensitive to gold price fluctuations, while others hedge their production to reduce risk. Look for miners that balance exposure and protection so that you can benefit from rising gold prices without too much downside. Assess the company's flexibility—firms that can scale operations or adjust costs are better equipped to weather volatility.

The mining companies are regularly organized in several countries, and they are all regulated differently. Avoid companies domiciled in mining-unfriendly jurisdictions, such as South Africa. These geographical areas are less prone to any operational interruptions, labour strikes, or nationalization. The risk of political exposure of a company influences its safety and long-term profitability. They would be wise to avoid those who are too dependent on high-risk nations, where changes to law or government may adversely affect revenues and payout of dividends.

Good management is very important in the mining industry. A competent and seasoned management team guarantees good operation, strategic planning, and sustainable dividend policies. Find out the past performance of the executives, have they ever piloted successful projects? Are they value creators to shareholders? There should also be open communication and a sense of capital discipline. Do not take firms that have been unstable in terms of missing targets, bad acquisitions, or shareholder dilution.

If you're unsure about choosing specific stocks, consider buying gold mining ETFs, which offer lower risk and diversified investment opportunities. Comprising a basket of gold miners, with several of them being dividend-paying, this is what these funds invest in. ETFs such as the VanEck Gold Miners ETF (GDX) or the iShares MSCI Global Gold Miners ETF (RING) diversify risks to a number of businesses and locations. Exchange-traded funds are particularly useful to unskilled investors who need to get a wide market exposure or who are conservative income spectrum players.

Prices of gold run in cycles and depend heavily on world interest rates, inflation, and geopolitical turmoil. A strong gold stock sustains dividends at a time when the price of gold plummets. Examine how the company performed in previous recessions. Did the company reduce its dividends or hold firm on them? Sustainability will yield greater benefits than a high payout. Firms that have low debt as well as high cash levels, along with diversified production, are in better positions to retain dividends in rough market periods.

Incorporation of modern technology and automation in mining operations usually makes them cost-effective and resourceful. Businesses that invest in innovation tend to sustain healthier profit margins, either through AI-powered exploration, drone surveys, or environmentally friendly extraction procedures. These efficiencies have enabled them to continuously capitalize on more free cash flows, which justify the payments of dividends in the long term. The technological advantage also lowers the risks of environmental and regulatory compliance, which otherwise may jeopardise the financial performance and dividend stability.

The use of Environmental, Social, and Governance (ESG) criteria is becoming essential in the determination of long-term investment health. Corporations that adhere to responsible mining, good labor relations, and compliance with the environment have fewer chances of being interrupted or incurring legal expenses. The popularity of ESG-compliant companies among institutional investors has been rising, which may aid in increasing the share prices of these companies. An ESG-dedicated gold company, according to the rule of thumb, demonstrates long-term strategic thinking, which is a good prognosis for dividend stability and financial health.

Selecting a gold stock with dividend is a tactical scenario where one has to look at the financial capability of a company, the effectiveness of its operations, as well as its stability in the long run. It is easy to be tempted by the yield, but it is important to explore cost structures, how sensitive the company is to the price of gold, geopolitical risk, and the quality of the management. Regardless of whether you invest in individual stocks or ETFs, you would want to, as far as possible, balance between generating yields and preserving and growing your capital. Gold stock with a dividend can help you make your portfolio stronger and more valuable when done right.

Investing in gold stocks is a popular strategy for those seeking stability, diversification, and income. However, finding a high-yield gold stock with dividend requires more than simply looking at gold prices. It involves analyzing key financial metrics, company operations, and market trends. Here’s a step-by-step strategy to help identify lucrative dividend-paying gold stocks.

It’s important to understand how the gold market operates before investing in gold stocks. Gold’s value is influenced by global economic trends, inflation rates, interest rates, and geopolitical uncertainties. During times of instability, investors often move their money into gold as a safe haven. Meanwhile, the performance of gold stocks depends on factors such as production costs, operational efficiency, and hedging strategies. By keeping track of key developments in the gold market, investors can identify the most opportune time and place to make their investments.

To earn high-yield dividends, consider investing in established, large scale gold mining companies. These firms typically generate consistent earnings, maintain substantial reserves, and sustain steady production levels. Notable examples include Barrick Gold, Newmont Corporation, and Franco Nevada. Their ability to remain profitable even when gold prices decline allows them to offer regular dividend payouts. It’s advisable to invest only in reputable, globally recognized companies.

The dividend yield is calculated by dividing a company’s annual payout by its share price. When evaluating gold stocks, focus on those offering yields above the industry average rather than unusually high yields, which may signal risk. A consistent dividend record over the years indicates that the company is financially strong and committed to rewarding shareholders, reflecting its potential to provide long term income.

The payout ratio shows the proportion of a company’s earnings allocated to dividends. A ratio between 30% and 60% is generally considered healthy. Ratios that are too high may be unsustainable during economic downturns, while very low ratios could indicate potential for future dividend growth. Investors should focus on companies with balanced, sustainable payout ratios that are supported by actual earnings.

Dividend payments are made from free cash flow (FCF), not just reported earnings. FCF represents the cash remaining after capital expenditures and operating expenses. A strong FCF ensures that a company can sustain dividend payments while also reinvesting in growth. Gold mining companies with consistent FCF, even during challenging periods, typically offer more stable dividends. Investors should look for rising or stable FCF trends over the past few years.

Gold mining is a capital-intensive industry. The All-In Sustaining Cost (AISC) measures how much it costs a company to produce one ounce of gold. A lower AISC indicates higher profit margins, even when gold prices decline. By comparing a company’s AISC to the current gold price, investors can better assess profitability. Companies with consistently low production costs are better positioned to provide high and stable dividends to shareholders.

The profitability of a gold mining company depends on the size and longevity of its reserves. Investors should focus on companies with substantial reserves that are expected to sustain long-term production and a proven track record of discovering new resources. Such companies are more likely to maintain reliable cash flow, ensuring consistent dividend payments. Conversely, smaller or depleting reserves may signal potential challenges. Long-term corporate growth and ongoing dividends rely on a dependable pipeline of replacement reserves, whether through exploration or strategic acquisitions.

Experienced mining and finance management teams play a crucial role in guiding a company through market downturns. Transparency, adherence to ethical standards, and a focus on shareholder interests are essential. Investors should review management’s statements in earnings reports and monitor how funds are allocated. Companies with strong corporate governance avoid overextending dividend payments in ways that could compromise long-term financial stability or core operations.

Many gold mining companies operate globally, including in regions with challenging political environments. Political instability can disrupt operations, increase costs, and reduce profit margins, ultimately affecting dividend payments. Investors should focus on companies operating in politically stable countries with clear, enforceable laws. Review how these companies manage geopolitical risks, and consider diversification across multiple regions. Firms with minimal exposure to political uncertainty are better positioned to maintain consistent operations and reliable dividend payments.

A good approach is to invest in companies that collect royalties or hold streaming rights in precious metals. Examples include Wheaton Precious Metals and Royal Gold. Mining companies get funds for operations by receiving a share of the earnings or what is produced. Because they don’t have mining costs, they are usually more financially secure. You may see that gold explorers tend to reward investors with more consistent and higher dividends than more conventional mining companies.

Don’t let the dividend yield be the only thing you look at. An excellent high-yield gold stock should rise in value gradually as time goes by. Look at the total return figure, which is the dividends earned plus the rising stock price, for a number of years. For greater security and better returns, an equal balance of income and growth helps your portfolio.

Diversifying your gold stock with dividend helps reduce risk. Mix various types of companies, including hashing producers, royalty firms, and exploration and mining businesses of all sizes. This helps because even if one company doesn’t do as well or reduce its dividend, others can help. Spreading your gold across different holdings helps you manage risks because there is no major threat from only one country or asset.

Identifying a high-yield gold stock with dividend involves more than yield chasing. Its main points are exploring gold markets, studying company performance, checking that dividends will continue, and scrutinizing risks. It is important to choose companies in good shape financially, with steady free cash, low borrowing, and sufficient extra money to mitigate risk. Using several strategies at the same time makes sure both profits and income are dependable through all kinds of market situations.