During an uncertain economic period, investment is usually in assets that offer a mix of stability and growth. Gold, which has long been a symbol of wealth preservation, is again popular, not in its corporeal manifestation, but as dividend-paying gold stocks. The benefit of such stocks is their ability to deliver both capital growth and consistent income, making them an attractive investment for the current generation of investors looking to build balanced portfolios. Let’s explore why savvy investors are shifting their focus to gold stocks with dividends.

Gold was always considered an insurer against inflation. As paper money loses value due to rising prices, gold tends to retain or even increase its value. Gold dividend-paying stocks provide investors with hedge protection and an annual income. This renders them particularly attractive during periods of economic instability or when central banks use lax monetary policy.

In contrast to physical gold, which does not generate income, gold mining companies that pay dividends provide investors with stable income even during market downturns. Such regular dividends provide a buffer against the temporary price changes. This stream of income will enable long-term investors to balance portfolio risk, as they receive dividends and price appreciation.

The problem with holding physical gold lies in storage, insurance, and liquidity. Gold stocks remove these fears and provide exposure to gold's price fluctuations. Gold companies that pay dividends provide an alternative way for an investor to engage in the gold market without the logistical and security hassles of holding the asset. This convenience makes them appealing to investors who cherish simplicity.

When the economy is in a recession, gold stocks are likely to outperform the rest. In a turbulent stock market, investors will resort to safe-haven investments such as gold. This increased demand is beneficial to dividend-paying gold companies. Their returns increase as gold prices rise, enabling them to sustain, or even increase, dividend payouts, which give shareholders certainty during turbulent economic periods.

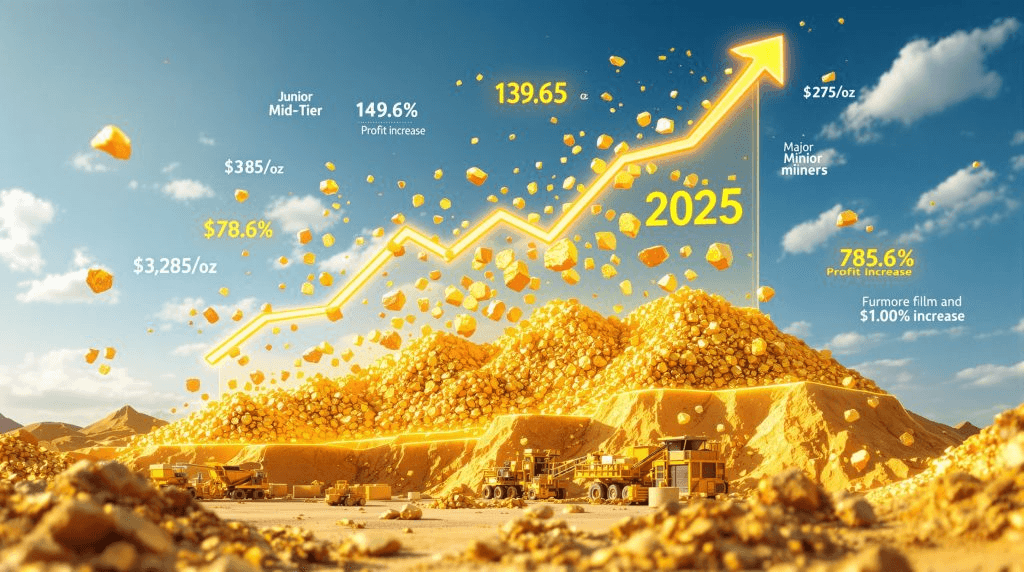

It is not only dividend income that gold mining companies can offer, but also capital growth prospects. When the price of gold increases, the gains of productive miners may explode, and the stocks begin to rise. This is a special combination of capital returns and dividends to the investors. This is the twofold advantage of gold dividend stocks: they are very attractive to investors who want both growth and yield.

Gold stock dividend-paying stocks are generally less volatile than non-dividend-paying stocks. Dividend income is steady, providing a cushion during market corrections. Those companies that can maintain steady dividend payments typically have strong balance sheets, well-run operations, and disciplined management—qualities that minimize risk and appeal to long-term investors seeking stability.

The global demand for gold remains strong, driven by the jewelry market, central bank purchases, and industrial applications. Gold prices tend to rise with demand, which in turn increases profits for mining companies. These profits can be distributed to shareholders as dividends by gold-mining firms. Such stocks appeal to investors seeking steady long-term growth, as they combine exposure to global demand with a consistent income stream.

Dividends on gold stocks can increase over time, unlike bonds, where the fixed interest payment becomes worthless during periods of inflation. Companies will be able to raise payouts as gold prices rise due to inflation. This feature is inflation-resistant, providing investors with a rising stream of income that helps maintain purchasing power even if the cost of living rises.

A majority of dividend-paying gold stocks are those of well-established companies with a track record. Such companies usually possess consistent cash flows, effective business, and diversified mining resources. By investing in them, the risks of adopting smaller and speculative miners are mitigated. This means reduced volatility, better governance, and more predictable dividend returns for investors.

A good number of contemporary gold firms are embracing environmental, social, and governance (ESG) practices to support responsible gold mining. Investors can invest in ethical practices and still enjoy dividend payouts. Sustainability can lead to higher valuations and steady profitability for long-term shareholders because sustainable companies tend to attract institutional investors more easily and have a stronger reputation.

Traditional fixed-income investments yield little in an era of historically low interest rates. Gold stocks that pay dividends offer a more appealing yield but also have growth potential. This is what makes them the best choice for an income-oriented investor seeking a substitute for bonds or savings accounts with returns, while remaining relatively low-risk.

In some countries, dividends may be taxed more favorably than capital gains. This makes gold dividend-paying stocks more tax-efficient investments. Investors can receive income and appreciation, maximize after-tax returns, and benefit from this as a good investment option for long-term wealth management.

Smart investors realise that you cannot conserve wealth and earn continuous income. Gold stocks with dividends offer both—protecting against inflation, exposure to gold’s growth potential, and regular cash flow. These investments offer stability but are outweighed by the opportunities in a volatile world. Gold dividend stocks keep glowing as part of robust, proactive investment approaches, as more investors seek sustainable returns without recoiling from risk.

Gold is regarded as the classic safe-haven investment in unstable markets, and gold stocks provide an additional investment layer. Gold stocks, complemented by dividend-paying opportunities, are not only a balancing act in the market but also a form of regular income. Gold stocks with dividends offer investors a moderate balance between growth and stability. The important benefits are explained below.

Gold shares tend to appreciate with a rise in gold prices, resulting in capital gains. Adding dividends makes these types of stocks even more attractive to investors, as they create a solid income stream and also offer the opportunity for capital appreciation. It is a combination that makes them more attractive than physical gold, which never pays or earns an income. The dividend effect of reinvestment over time also amplifies the compounding effect of gold dividend stocks, thereby contributing to a potent investment in diversified portfolio solutions.

Gold has consistently proven to be an effective hedge against inflation. An increase in the cost of living causes the prices of gold to rise, thereby protecting purchasing power. Dividend-paying gold stocks serve as an additional measure, providing investors with a means to counteract inflation through their income. Gold dividend stocks tend to retain their value in an inflationary environment, unlike fixed-income instruments. This double shield helps protect against economic risks and enables the achievement of long-term financial goals.

Well established mining companies often issue dividend paying gold stocks, backed by stable operations and consistent returns. These firms usually maintain strong cash flow and operational efficiency, which helps reduce the risks associated with stock price volatility. Because of their reliable dividend payouts, investors face less speculation compared to non dividend gold stocks. For conservative investors, this steady income and lower risk make dividend paying gold stocks a valuable addition to a diversified portfolio.

Consistency in cash flow is one of the key advantages of investing in dividend-paying Brazilian stocks, particularly those in the gold sector. Unlike physical gold, which does not generate passive income, dividends are paid on a regular basis and can be used as living expenses or reinvested. This is what makes them quite attractive to retirees and income-oriented investors. Structurally sound mining companies are also able to pay dividends even in the circumstances of market instability, which provides their shareholders with financial stability.

The payment of dividends on gold stocks can be used to buy more stocks, which helps compound the growth over time. The strategy can significantly improve total returns, and it does not require additional capital investment from investors. One key aspect of reinvestment that works especially well during gold price rallies is that it reinforces the wealth accumulation benefit. For long-term investors seeking exponential growth, reinvesting dividends from gold stocks is a valuable wealth-generating tool, as it offers passive income while also providing capital investment opportunities.

With dividend stocks, you have the possibility of short-term income gain, as well as the potential of long-term growth. Mining companies usually acquire new mines, find new resources, or are hit by an increase in demand for gold across the world. These factors bring about a steady increase in share prices. In the meantime, dividends are paid regularly as a reward to long-term holders. For those interested in long-term wealth growth, the combination of dividend reinvestment and rising asset value prospects offers good long-term investment potential, outperforming many traditional investment forms over time.

Physical gold would also be valuable, but lacks liquidity and creates the costs of storage and insurance. Compared to these, gold dividend stocks are easy to trade in stock markets and have higher flexibility for investors. This liquidity enables fast access to funds without them being sold at a discount or with delays. Moreover, the payouts of the dividends also provide continuous income without the need to sell the assets. Accordingly, the dividend-paying gold stocks are both convenient and profitable.

The dividends of stocks may receive preferential treatment in regard to other sources of income in most jurisdictions. Gold-paying dividend stocks enable investors to gain both tax advantages and exposure to gold simultaneously. As opposed to sales of physical gold that can attract high taxes, there are usually fewer taxes to pay on dividends. That is why dividend-paying gold stocks are a wise and more effective option for those seeking the highest returns, regardless of the tax implications.

Dividend-paying gold stocks are normally offered by well-established mining companies of good repute with good balance sheets and operational efficiency. The focus of these companies is on shareholder returns in the form of regular dividends. Their physical size and strength enable them to withstand market conditions, providing greater assurance to investors of the security of their investments. Furthermore, successful businesses tend to allocate funds to new technologies and green operations, which makes them more sustainable in the long term. Investing in these companies enables shareholders to reap the benefits of industry leadership and sustained financial returns.

Gold dividend stocks give the optimal combination of growth and stability. On the one hand, they give access to the appreciation of such-like gold prices, which increases capital gains. With conventional dividend payments, the income and reliability are more stable, and one is less dependent on the stock market levels. This combination qualifies them as securities that are attractive to investors seeking to satisfy their need for security and growth. Consequently, gold dividend stocks are attractive to a wide range of investors.

Investing in gold stocks with dividends combines the enduring strength of gold with the wealth-building power of consistent income. The investments offer diversification, stability, and liquidity, with the ability to act as an excellent hedge against inflation and economic decline. Dividend-paying gold stocks are an attractive option to those concerned about both income and long-term wealth generation, as well as investors needing to protect their investments against volatility. Combining capital growth and dividend yields, they can form a very clever part of a portfolio.