Nickel has emerged as a major industrial metal with growing prominence in global markets. Once regarded as a critical metal for stainless steel production, it has now gained attention as a vital component in electric vehicle (EV) batteries. As the world increasingly shifts toward sustainable energy, demand for nickel continues to rise. For investors, nickel stocks present a compelling opportunity to capitalize on the transition to green energy while benefiting from a metal essential to industrial growth.

Nickel has been used for decades and remains indispensable across industries. About 70 percent of global nickel is utilized in stainless steel, valued for its strength and corrosion resistance. This steady demand has stabilized the nickel market, making it a reliable metal for infrastructure and construction. Historically, nickel prices were cyclical, closely tied to industrial development. Today, nickel’s growing role in the energy transition adds a new dimension to its appeal as a long-term investment.

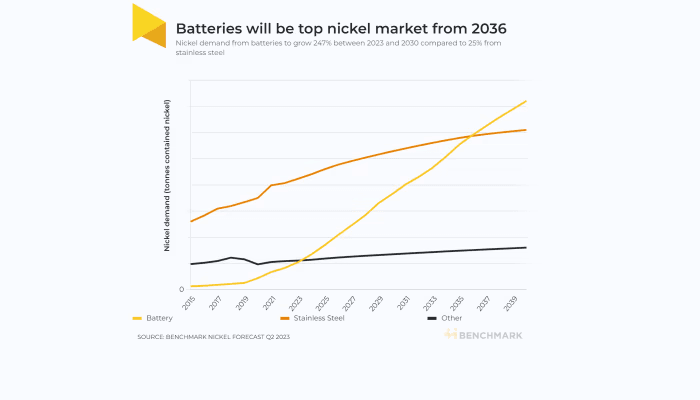

Nickel is a cornerstone metal in the global transition to renewable energy. Nickel-based lithium-ion batteries are essential for electric vehicles and energy storage systems, as they enhance energy density and extend battery life. As governments worldwide accelerate the adoption of EVs and renewable energy initiatives, demand for nickel is expected to rise sharply. This growing demand for green technologies presents significant opportunities for investors in nickel stocks.

The supply-demand balance strongly influences nickel’s market potential. Demand is rising rapidly, especially among electric vehicle battery manufacturers, while supply is increasing slowly. Many nickel deposits are located in politically unstable regions, creating risks of shortages and price volatility. `This imbalance attracts investor attention, as high demand coupled with limited supply often supports long-term price growth. Understanding global supply chains is essential for investors considering nickel stocks as part of their portfolios.

Production of nickel is geographically concentrated, with its major exporters such as Indonesia, the Philippines, Russia, Canada, and Australia being the major suppliers of nickel. Indonesia is a leader in terms of large reserves of laterites and has invested large volumes of capabilities in the processing of battery-grade nickel. But global availability is affected by geopolitical issues in Russia and environmental problems in the Philippines. The production policies, environmental regulations, and trade agreements in such countries are the factors that investors should follow in nickel stocks because they influence the prices of nickel and the value of the stock directly.

Nickel is an important part of the future of electric mobility. EV batteries with high-nickel cathodes offer a better energy density, which results in more driving range and a faster charge. This renders nickel-rich batteries the option of choice among the major automakers such as Tesla. With the increasing use of EVs, analysts anticipate a skyrocketing increase in the use of nickel. Therefore, the long-term rise in stocks of nickel, which is associated with battery manufacturers or mining corporations, can be expected.

Nickel is also made attractive by new technology in battery making. There are other sophisticated chemistries under development by scientists and manufacturers, such as NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) types of batteries, which also demand high levels of nickel. Such technologies emphasize efficiency, safety, and longevity- the major EV adoption requirements. In addition to batteries, nickel is critical in aerospace alloys, electronics, and renewable energy systems. These varied applications guarantee strong growth in demand, which qualifies nickel in terms of its strategic value to investors who are considering its market potential.

While nickel stocks are promising, they carry inherent risks. Prices are highly volatile due to fluctuating demand, geopolitical conflicts, and supply chain disruptions. For example, unexpected shutdowns at key mining regions or trade restrictions can cause sharp price spikes, leaving investors uncertain. Additionally, environmental concerns related to nickel mining add further complexity and regulatory considerations. Investors should account for these risks and implement diversification and risk management strategies when including nickel stocks in their portfolios.

Nickel extraction and refinement can pose significant environmental concerns, particularly in tropical regions, where it may lead to deforestation and pollution. Sustainability initiatives and ethical sourcing are now central to the industry. Companies adopting greener technologies and responsible mining practices are gaining investor confidence. For investors, supporting environmentally responsible companies ensures ESG compliance while mitigating regulatory risks. Thus, choosing nickel stocks committed to sustainable practices can be a strategic advantage.

Nickel stocks have a good long-term future. By the time of the EVs' adoption and the development of infrastructure, analysts project that nickel will experience high and sustained demand. Although the price changes in the short term are unavoidable, the overall trend is towards growth. Compounding gains can help investors who are prepared to take a patient approach as the world becomes electrified and goes green. The changing position of nickel makes it remain relevant as a potential high-income investment area.

Nickel stocks provide an interesting case for long-term investors. Since nickel has been used traditionally in stainless steel, it continues to take center stage in the transformation of industries and energy through its growing application in batteries and green technologies. Although supply threats and environmental problems are important factors that warrant caution, the rise in global demand supports investment. Investors can unleash the potential of the nickel stocks in the contemporary economy by focusing on responsible producers and long-term trends.