When the environment is not very clean, investors usually resort to gold as a haven; however, one significant alternative to the gold industry that investors may not know about is the gold dividend stock. These stocks provide a combination of gold exposure and the steady nature of dividends. Gold dividend stocks are very strategic, whether you are a conservative investor or even want to diversify your portfolio. Here are the specs for building a stronger investment portfolio.

Gold dividend stocks offer the compound advantage of both capital gains and regular dividends. Although conventional gold investments as bullion or ETFs, do not produce cash flow, gold mining firms usually pay dividends to shareholders. Such dividends offer a stable source of income even when markets are slow, making them attractive to long-term investors. Regular dividends also save you in case of a fluctuated market, so that your portfolio will be secure no matter what the economic climate is like.

Gold has, in the past, remained one of the surest hedges against inflation. An increase in the cost of living will cause commodity prices to drop, while the price of gold will tend to rise. The additional benefit of dividend income from gold dividend stocks enhances this inflation protection. This is a two-fold advantage for investors: they can maintain their purchasing power in the long term and receive regular returns. These stocks can help protect your wealth as inflation intensifies.

A balanced portfolio incorporates assets that behave differently in diverse market conditions. Gold dividend stocks are great diversification instruments as they do not react in the same way as conventional stock and bond investments. Gold prices generally rise when markets decline or the economy is uncertain. Such an inverse relationship lessens the total portfolio risk. Including gold dividend stocks, the investor is able to develop a more stable and resilient financial plan that is less susceptible to market shocks.

Stock markets are unpredictable, but gold-based investments tend to serve as safe havens. Gold dividend stocks are more likely to retain or increase their value during market turmoil, providing a cushion against losses. Gold stocks are advantageous for investors seeking stability in times of crisis, such as recessions, geopolitical crises, or financial crises. The dividends paid provide additional confidence and help ensure returns are even in times when the broader markets decline sharply, which benefits the entire portfolio.

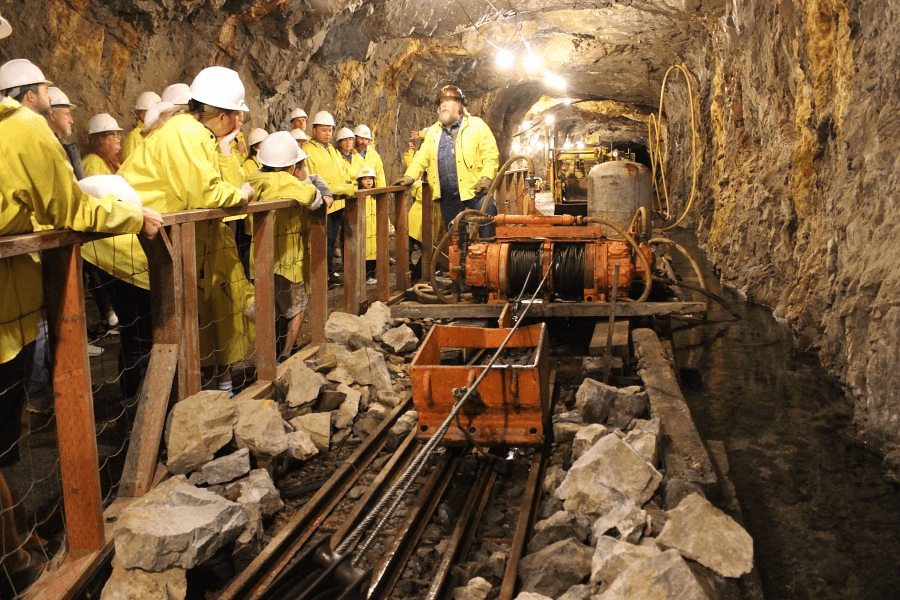

The gold mining companies can also take advantage of rising gold prices, which can lead to higher revenues and stronger profits. These companies can increase their dividends or invest in growth as gold prices rise. Gold dividend stock investors enjoy the benefits of higher share prices and higher dividends. This is the exposure you can take advantage of commodity cycles, and hence gold dividend stocks are a good way to profit from the long-term upward trend in the gold market.

Gold stocks are not all equal. Those companies that pay dividends are generally better financially, more disciplined, and more stable in terms of cash flows. These characteristics make dividend-paying gold stocks less risky than speculative mining companies still in the exploration phase. The advantages of low volatility, enhanced long-term opportunities, and steady revenue apply to the investors. Purchasing well-established dividend-paying miners reduces risk and, at the same time, has great potential to jump if the market goes positive.

Gold dividend stocks are strong in the development of long-term wealth. The compounding effect of the increase in dividend income and the possibility of capital appreciation are achieved over time. Reinvestment through dividends increases your investment rate, and the returns in the long run are increased. Traditionally, the dividend-paying stocks perform better than the non-dividend stocks, and the stability of the gold industry adds an extra performance to them. This renders them perfect for investors who are in search of long-term financial growth that is sustainable.

When there is a recession or financial crisis, traditional equities may fall significantly, but the assets related to gold are more likely to do well. Gold dividend stocks offer an added security level since they also give income even in times of a downturn in economic activity. They are defensive and useful for protecting portfolio value in difficult times. As other investments experience earnings declines or layoffs, the growth of gold companies is driven by rising demand for safe-haven assets.

Aside from dividends, gold stocks offer strong capital appreciation prospects. When gold prices rise, mining companies' profits increase, and their stock prices rise as well. Investors benefit from dividends and market-driven price increases. Shares can increase significantly in value when companies expand operations, reduce debt, or discover new reserves. This income and appreciation combination makes gold dividend stocks a strong economic addition to every growth-oriented portfolio.

Gold dividend stocks provide a very strong mix of stability, income, and long-term growth, and as such, they are very good to have in any investment portfolio. They offer consistent dividends, protect against inflation, and assist in lowering the aggregate market risks. Capital appreciation and high performance in times of uncertainty provide an added advantage to these stocks, which increase financial resilience. Be it a conservative or growth investor, gold dividend stocks provide an all-around, safe, and future-oriented investment base.