Colorado has long been associated with gold mining, offering great opportunities for investors, prospectors, and entrepreneurs. Buying a gold mine in Colorado to sell it is an exciting and complex task that requires careful analysis of legal, environmental, geological, and financial factors. This resource offers a buyer important information to facilitate the acquisition process with confidence, reduce risk, and make sound decisions when investing in the gold mine for sale Colorado, which is abundant in resources and a rich historic gold mining industry.

The mining history of Colorado dates back to the 1850s, with settlement and economic growth following. The first gold was found in the areas of Denver, Central City, and Cripple Creek, making Colorado a major gold producer. There are old gold mines that are in operation or non-operational today, which provide opportunities and challenges. To understand the true potential and liabilities of legacy mining claims, buyers should research past mining records and procedures, as well as the associated risks, before investing.

In Colorado, there are a variety of gold mines for sale. There are placer claims (gold washed down into stream beds), lode claims (hard rock veins), and complete mine infrastructure. The extraction methods, costs, and potential values differ by type. Placer claims might require only a few pieces of equipment, whereas lode mines might require heavy equipment and permits. The type of mine will determine your investment plan and returns.

ld mine is a business operates with the approval of local, state, and federal authorities. Water discharge, land disturbance, air quality, and reclamation bonding environmental permits are usually obligatory. Without proper permits, mining processes may result in fines or closures. Colorado Buyers will need to seek advice from the Division of Reclamation, Mining & Safety, and federal agencies regarding the schedule, costs, and permit requirements to avoid delays and costly compliance requirements.

Evaluation of the geological potential of a mine is important. Drilling logs, rock samples, and previous production reports can be used by a qualified geologist to estimate gold reserves. Buyers risk paying premiums for low-yield properties unless they conduct a thorough analysis of the resources. Independent analysis assists in establishing economic feasibility, the approaches to extracting mineral resources, and the anticipated recovery rates. When a comprehensive technical analysis is conducted, risk is minimized, and a strong bargaining position is gained in negotiations with sellers.

Infrastructure availability, or lack thereof, has a significant impact on a mine's value. Roads, power, water, access to processing plants, and general worker housing can significantly reduce startup costs. On the other hand, unreachable properties and those that are not easily reachable require more investment. Buyers would have to determine short- and long-term operating costs, including labor, equipment, operations, and transportation. Good financial planning will help ensure the sustainability of mining activities and prevent unforeseen budget overruns.

Gold mines are one of the capital-intensive investments. They can be privately financed, borrowed, partnered with an investor, or funded with available capital. Conservative banks can be risk-averse, and miners are typically innovative in funding or specialized lending. To obtain funding, the buyers are advised to prepare detailed business plans and projected cash flows. To secure your financial future and support my development, it is important to understand the financial terms, interest rates, and repayments.

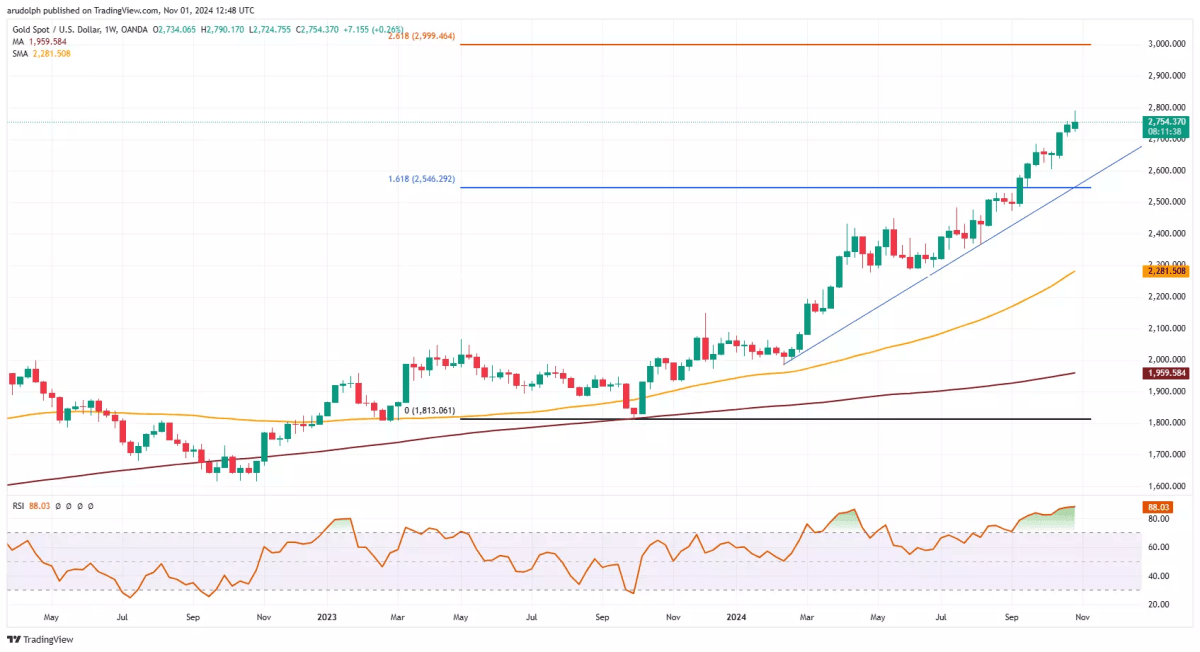

The prices of gold determine the profitability of a mine. Buyers are expected to keep an eye on global gold markets, supply/demand, and economic factors that influence prices. When prices are high, it is worth developing lower-grade ore; when markets turn down, margins are tight. Cost controls and hedging tactics address price volatility. Knowing the market conditions will mean you venture into the mining business at a time that is financially viable and make operational changes as the market changes.

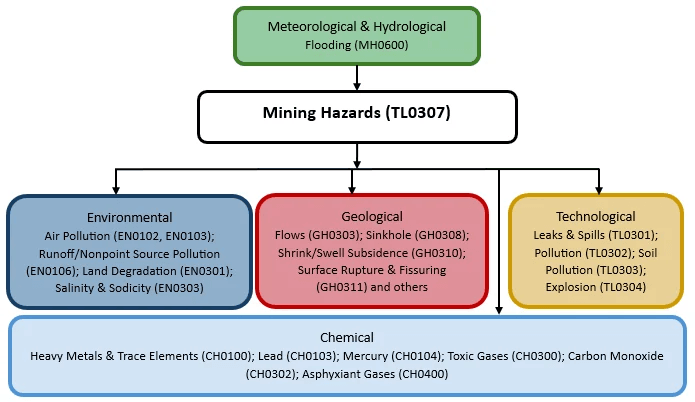

Mining is a dangerous occupation, and hazards include rockfalls, water influx, equipment accidents, and underground fires. Strict safety measures will protect workers and reduce liability. Buyers are supposed to develop comprehensive risk management strategies, obtain sufficient insurance coverage, and comply with OSHA and MSHA regulations. An intensive safety culture can minimize accidents, improve productivity, and ensure legal compliance. Responsible mine ownership involves budgeting for emergency response and safety training.

The use of a mine impacts local communities through employment, noise, traffic, and environmental issues. By establishing good relationships with county officials, residents, and indigenous groups, co-operation is fostered, and conflicts are minimized. First-mover advantage, openness, and social good, like employment and infrastructure development, reinforce your social license to operate. Considering the community's interests makes operations easier and, in the long run, increases the likelihood that your mining project will be accepted by the community.

Purchasing a gold mine for sale Colorado is a serious undertaking that requires proper research and professional advice as well as long-term planning. Between knowledge of the legal demands and environmental concerns to evaluation of geological prospects and market dynamics, each will count. Buyers can unlock lucrative opportunities without being irresponsible through due diligence and professional support. An informed strategy would guarantee not only financial prosperity but also sustainable, lawful mining in Colorado.