Gold was historically considered the symbol of wealth, stability, and security. Investors have long relied on the precious metal to cushion against inflation, currency devaluation, and market volatility. However, in the current dynamic economic environment, where economic times are shifting swiftly, many are discovering that gold stocks with dividends can provide a contemporary version of this age-old investment: the stability of gold and the regular payment of dividends from shareholding companies.

This is why gold dividend stocks are emerging as a smart investment for investors seeking steady returns with long-term potential.

Gold has earned a good reputation as a hedge against inflation. As the cost of living increases, fiat currencies are losing their purchasing power; however, gold tends to retain its value or even increase in value over time. The gold mining companies with a strong balance sheet are able to remain profitable even during inflationary periods and pay dividends.

This renders them an important instrument of saving capital, as well as earnings during economic unpredictability.

Not every gold company is able to pay dividends to its investors; only a few financially sound companies can do so. Companies with a high cash flow, controlled debt, and efficient operations usually pay dividends to their shareholders. These companies typically:

To investors, it will be more stable and have a lower risk profile compared to speculative mining operations.

Dividend-paying gold stocks are a very good diversification tool. Their correlation with traditional equities and bonds is low, indicating that they do not necessarily move in tandem with them. You can also minimize some of the overall risk by adding dividend-paying gold assets to your portfolio, but this will enhance your chances of relatively steady returns, particularly in such cases as a market fall, when defensive assets perform better than other investments.

The strength of dividend reinvestment is one of the advantages that should not be overlooked. The investors are able to compound their returns over time through reinvesting dividends in more shares (this will increase their wealth in the long term by a large margin). This strategic move converts a fixed source of income into a growth engine, especially when the dividends in certain industries, such as gold mining, are typically linked to rising commodity prices.

Environmental, Social, and Governance (ESG) standards are becoming increasingly important to modern investors. It has become a common practice among many major gold producers to adopt eco-friendly production and management practices, community development initiatives, and open governance policies. Such companies, with sustainability as part of their business models, are likely to have better reputations, long-term profitability, and less regulatory risk, all of which help maintain steady dividends and investor trust.

Physical gold possession can lead to increased taxation when sold, including in most jurisdictions where it is treated as a collectible. By contrast, dividend-paying stocks of gold can be taxed more favorably. Dividends can be taxed at a lower rate, and investors can postpone capital gains until the sale of the stock. The benefit increases the net returns in the long term, particularly among investors in higher tax brackets.

Physical gold is also awkward to sell - you need to find someone willing to buy the gold, check its purity, and incur storage expenses. By contrast, gold dividend stocks are easily liquidated on large exchange platforms immediately. This flexibility enables investors to quickly rebalance their portfolios or respond to market trends without the hassle of owning physical gold.

Investing in gold companies, you are not just gambling on the gold price, but on the management team of professionals who are knowledgeable of the mining industry. These units focus on exploration, extraction, hedging, and production efficiency, all of which have the potential to enhance profitability and sustain dividends even in challenging markets.

When the world encounters a recession or a worldwide crisis, investors tend to rush to safe-haven commodities such as gold. When demand for gold increases, mining companies directly benefit, and their earnings and dividend prospects are strengthened. Gold stocks that pay dividends may provide defense and serve as a buffer in your portfolio against wider economic declines. This is their protective nature, and hence, a great addition to any risk-averse investment strategy.

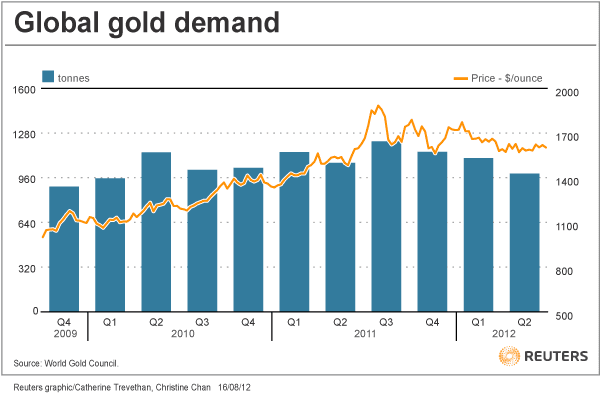

A growing global demand for gold, combined with a short and expensive supply, is one of the best reasons to invest in gold dividend stocks. Gold remains a crucial asset among central banks, jewelry markets, and emerging economies, particularly in countries such as India and China, where it is deeply ingrained in culture and drives significant economic demand.

Meanwhile, new gold finds are becoming increasingly rare, and mining activity costs are rising, accompanied by stricter regulations and environmental concerns. Such a mismatch between supply and demand typically leads to a long-term increase in the price of gold.

Gold stocks with dividends provide a balanced and intelligent approach to investing in precious metals. They blend the perennial and inflation protection capabilities of gold with the stability of earnings and growth prospects of well-managed corporations. Gold dividend stocks are a smart investment, particularly during uncertain economic periods, for investors seeking consistent returns and long-term wealth preservation.

You can be a conservative investor and seek stability, or you could be the diversifier in your portfolio for the future. Regardless, these are the golden opportunities that will enable you to find the right mix between security and profitability.