When the economy is uncertain, investors are always in search of physical assets that will preserve wealth and generate value over time. Placer gold claims have emerged as one such venture that has drawn both old and new miners. These assertions provide access to land containing gold, which is a combination of resource ownership and financial gain. These are the main justifications for investors' interest in "placer gold claims for sale".

Placer gold claims give the investors direct ownership of a tangible commodity associated with natural resources. Gold-bearing land is liquid gold that cannot be lost in a stock crash or technological breakdown, unlike other digital investments like stocks. During inflation, investors prefer the security of owning a piece of land already recorded as having good potential for mineral deposits. This physical possession provides a sense of safety and permanence that paper assets do not.

Gold has been a valid hedge against inflation and a depreciating currency. Fiat money tends to lose its purchasing power, and the value of gold tends to remain or, more often, grow in value. Investing in placer gold claims exposes investors to the gold market without confining their interests to bullion or ETFs. This type of investment is also suitable for diversification strategies that seek to safeguard wealth in unstable economic periods.

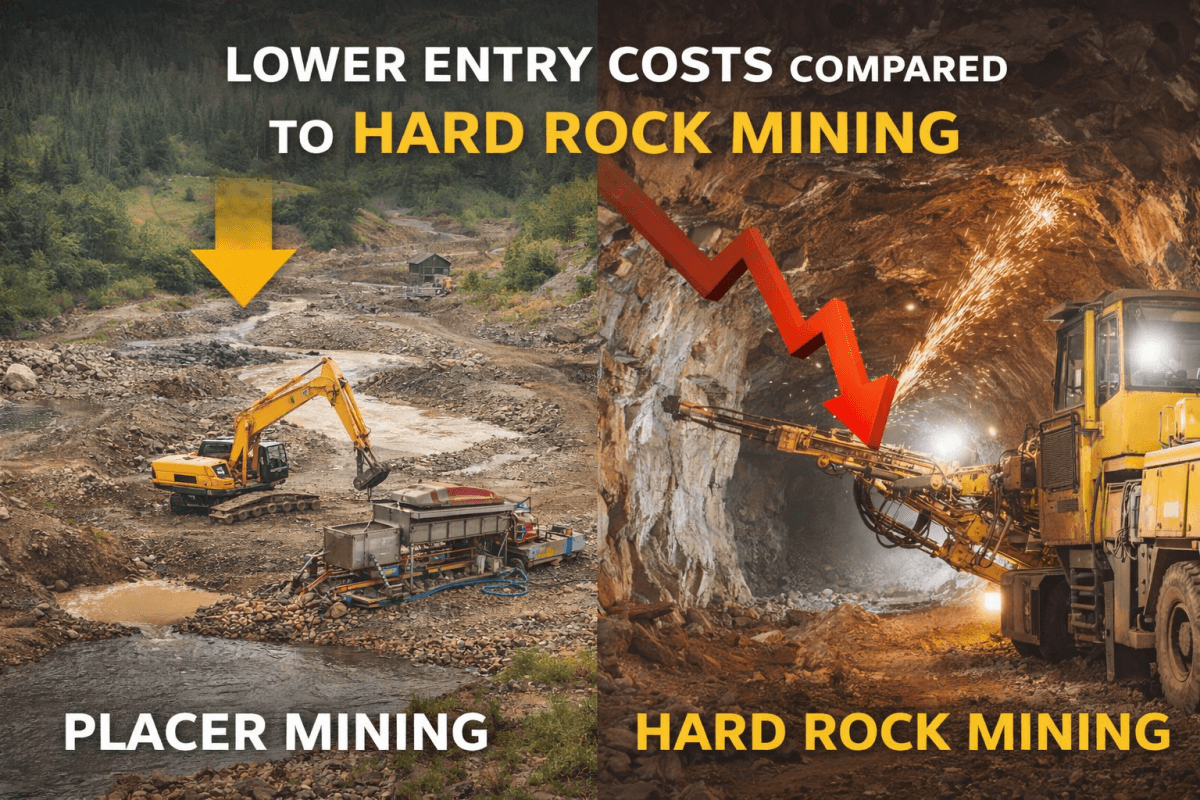

Placer gold mining operations tend to be cheaper than hard rock mining. They do not need excessive capital, infrastructure, or special equipment. The reduced entry barrier of placer claims would appeal to individual investors and small-scale operations. The deposits of many of the claims are already available, minimising exploration risk so that investors can start operations or leasing sooner.

Flexibility in income generation is one of the key benefits of placer gold claims. The investors have the option of actively mining the claim or renting it out to professional miners on a royalty basis. This twofold possibility enables investors to align their level of engagement with their financial objectives. Passive income opportunities with no day-to-day operational concerns are provided by leasing arrangements, in particular.

With the traditional investment markets getting more volatile, investors are shifting to other assets. This is the same category as the placer gold claims, which attracts individuals who want to diversify their investments beyond stocks, bonds, and real estate. These assertions provide both land ownership and the potential to extract resources, making them a good substitute for other asset classes in terms of risk reduction.

Numerous placer gold claims on sale are in previously productive mining areas. Gold deposits have been recorded in these regions, which has reduced geological uncertainty. Investors would be attracted to claims with existing data, previous production records, or those in the vicinity of active mines. This history makes the claim's potential more confident and allows investors to make more informed decisions than speculative exploration efforts.

The demand for gold worldwide remains strong due to its use in jewelry, technology, and as a financial reserve. Meanwhile, the finding of new gold is getting scarcer. This demand-supply imbalance is in favor of the long-term gold prices. When investors buy placer gold claims, they position themselves to profit when gold prices rise in the future, and they may be in possession of a limited, obviously valuable resource.

Other than monetary gains, placer gold claims have attracted other investors who are more interested in recreational mining and outdoor lifestyles. Other consumers appreciate prospecting, being in the wild, and the process of hands-on gold recovery. This aspect of placer mining provides individuals with personal gratification from the investment, and it makes the process interesting to retirees, hobbyists, and families seeking to make a profit and enjoy the process of gold mining.

Placer gold claims in good locations have the potential to increase in value over time, particularly when gold prices rise or mining activity increases. Shareholders can always opt to retain the claims in the long term and sell them later for a profit. Any improvement, such as an access road, equipment installation, or recorded production, can also increase resale value, and such claims are appealing not only to mining but also to future investors.

In contrast to the gold stocks or exchange-traded funds, placer gold claims enable investors to have direct control over their asset. The owner has the ultimate control over decisions on mining, leasing, or even selling. Investors who prefer hands-on management and transparency are drawn to this autonomy. By owning a claim, there is no dependence on corporate performance or fund management, making this investment strategy more independent.

The increased interest in placer gold claims for sale is indicative of a broader trend towards tangible and alternative investments. These claims offer an attractive opportunity for various investors, with perks including inflation protection, income potential, lifestyle enjoyment, and asset control. With a strong demand for gold and economic uncertainty here to stay, placer gold claims appear to remain a viable option to add to the modern investment portfolio.