Gold is often sought by investors seeking to balance growth, income, and stability. Although gold is physically secure, it is not productive. That is where dividend stocks made of gold shine through. These businesses will offer potential gains and consistent dividends by combining the stability of gold with regular payouts. Gold dividend stocks can be a potent asset for any long-term investor's portfolio, helping diversify and build resilience.

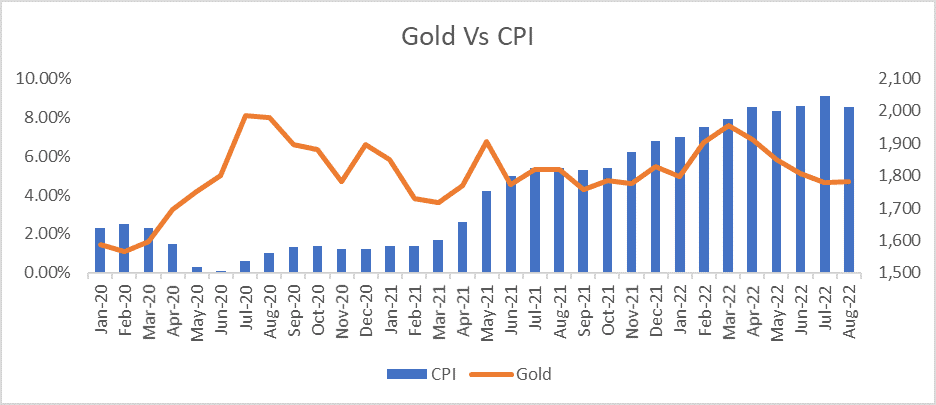

Gold has been viewed as a safe-havens to inflation. Gold prices tend to rise when inflation rises and a currency's purchasing power declines. Gold dividend stocks will offer this inflation-resistant asset exposure along with a dividend stream. Firms such as Newmont Corporation and Barrick Gold benefit from high gold prices, which may boost the value of their stock and the dividends paid to shareholders during periods of inflation.

Physical gold, as compared to gold mining companies, makes profits and distributes them in the form of dividends. Passive income can help investors in unpredictable markets who want a steady cash flow from dividends. Incumbent miners tend to keep lean pay policies, which are reliable. This income feature makes gold dividend stocks desirable to retirees and other investors who prioritize income over gold exposure, without compromising regular cash flow.

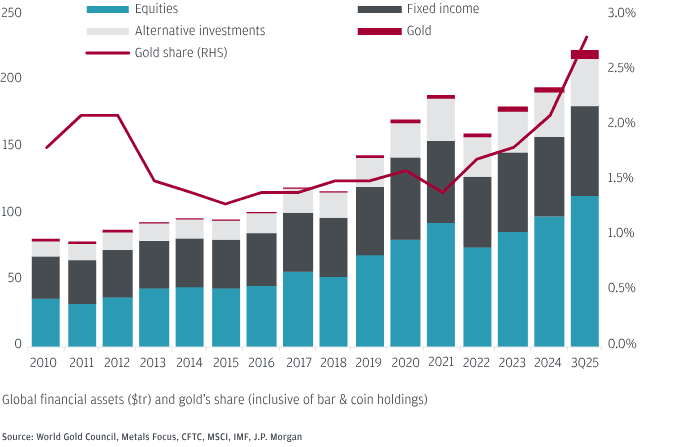

Diversification generally helps minimize portfolio risk, and gold dividend stocks provide exposure to a distinct asset class. Gold prices tend to move independently of conventional equities and bonds. By incorporating gold dividend stocks, investors introduce a layer of protection against market downturns. The diversification strategy will help smooth portfolio volatility and increase long-term risk-adjusted returns.

Gold is generally a strong performer during economic uncertainty, geopolitical tensions, or stock market declines. During these periods, gold dividend stocks tend to track the gold price. Although no investment is risk-free, compared with other investments, companies that deal in gold can be considered to offer some degree of certainty. Their defensive nature makes them attractive when larger markets are volatile.

Gold dividend stocks are not only profitable, but they can also grow. Mining company revenues and profits tend to rise when the price of gold rises, and in turn boost the stock prices. Shareholder value can further be improved through operational improvements, exploration successes, and cost management. Investors can receive capital gains over the long term, as well as dividend income, to form a balanced portfolio of returns.

Large mining firms with large-scale operations have high gold cash flow. Other companies, such as Franco-Nevada, work on a royalty and streaming basis, having exposure to gold revenues without the risks of mining. Good cash flow helps sustain dividends and occasionally even increase them, thereby giving investors confidence that they can receive income over the long term.

The world still needs gold as jewelry, technology, and central bank reserves. Other nations, such as India and China, experience high levels of consumer demand. Central banks are also accumulating gold reserves. This constant function in the world market contributes to long-term price stability, which indirectly strengthens gold dividend stocks and gives them value to investors.

Many gold mining companies tie their dividends to gold prices or free cash flow. Dividends can increase as gold prices rise. Other firms use flexible dividend policies in which shareholders are rewarded when the company is earning good returns. This dynamic structure enables the investors to take advantage of the increasing commodity cycles and still earn income even at the stable stages.

Storing and insuring physical gold is expensive and inconvenient. These logistical problems are removed with gold dividend stocks. Publicly traded shares allow investors to easily get exposed to gold price movements and buy and sell them on stock markets. Such convenience makes gold dividend stocks an attractive option for individuals who want to expose themselves to gold without dealing in physical bullion.

In most jurisdictions, tax on physical gold is charged at high collectible rates. Gold dividend stocks can, however, be taxed on capital gains with preferential treatment on capital gains as well as dividends. This tax efficiency can boost net returns over the long term. Investors should seek tax experts, but gold dividend stocks can often offer a simpler and potentially more beneficial tax arrangement.

Investing in gold mining companies requires access to management expertise, geological knowledge, and new mining technologies. Sustainable practices, cost management, and operational efficiency are among the aspects that companies like Agnico Eagle Mines pay attention to. Shareholders gain indirect access to skilled management that helps maximize shareholder returns and long-term growth.

Gold-dividend stocks are an interesting blend of revenue, diversification, and growth potential. They offer a historically predictable investment with predictable dividends and a chance to appreciate the capital. These stocks offer various advantages to a balanced portfolio, such as inflation protection, global demand, and professional management.

Gold dividend stocks are a good addition to an investment portfolio for investors seeking stability and returns. As usual, it is necessary to do thorough research and know how to invest money and achieve personal financial goals. Gold dividend stocks can also strengthen your portfolio and support your financial sustainability when selected thoughtfully in the future.