Gold is also considered a safe-haven asset, particularly in uncertain economic times. Although many investors own physical gold, another increasingly popular alternative is gold stocks that can yield dividends. Such stocks offer the security of gold along with the potential for dividend income, making them easy to hold for growth and income-oriented investors. The following are the largest benefits of holding gold stock with dividend.

The opportunity to receive a constant income is one of the greatest benefits of having dividend-paying gold stocks. Another key difference between the two types of gold is that, unlike the former, which is physical, gold does not generate funds; dividend-paying gold stocks are periodic. This revenue can also help balance out market fluctuations and provide uniform returns even when gold prices do not rise, making it attractive to long-term investors who require a steady stream of cash.

Gold stocks enable the investor to enjoy the gains from rising gold prices without owning the gold in physical form. The rise in gold prices tends to increase the revenues and profits of mining firms, which may in turn raise stock prices. Shareholders will benefit from the potential rise in gold, in addition to dividend payments, giving them a two-fold payoff that cannot be achieved with physical ownership of gold.

Gold has a proven track record as a hedge against inflation, and gold stocks amplify the same advantage. The rise in inflation tends to raise gold prices, helping mining companies remain profitable. Gold stocks that pay dividends may also safeguard buying power by providing capital growth and income, making them a great option in times of rising costs and currency devaluation.

Gold stocks that pay dividends help diversify an investment portfolio. Gold tends to perform differently from equities and bonds, and this lowers the total portfolio risk. Gold stocks are useful for offsetting losses during a recession because the dividends are dependable. This risk-adjusted diversification and higher portfolio resilience in case of economic or geopolitical turbulence.

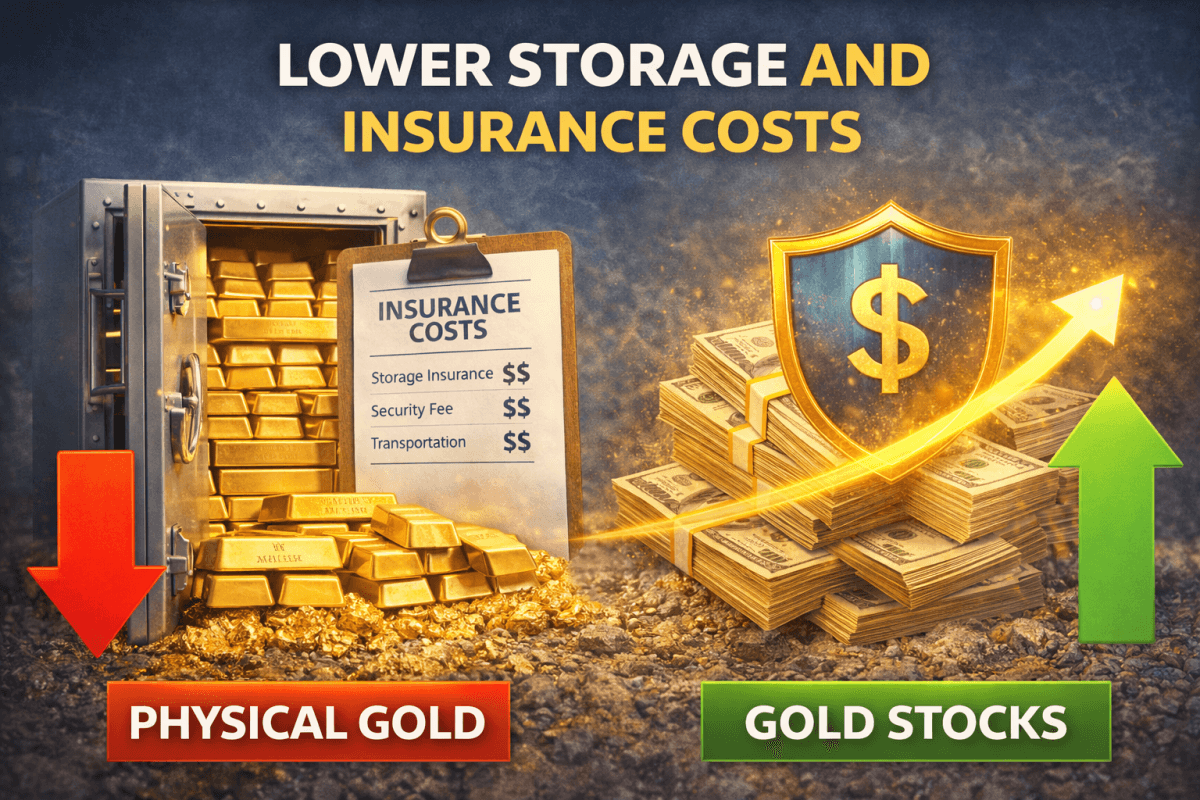

Gold stocks do not require storage or security and do not incur insurance costs, unlike physical gold. Through gold stocks, investors would not incur the costs of protecting bullion, making the stocks a cheaper way to invest in gold. It enables investors to keep more of their returns while still enjoying the value of gold and dividend payments from publicly traded companies.

Gold stocks are liquid and very easy to trade in major stock exchanges. The investor can buy or sell shares in real time in the market, unlike gold, which may require appraisal fees and dealer charges. This liquidity offers flexibility, allowing the investor to react quickly to market changes and still receive dividends over time.

Most established gold mining companies increase dividends as profits rise. This gives investors dividend growth, enabling income to keep pace with inflation. With positive changes in operational efficiencies or increases in gold prices, companies can pay shareholders more dividends, and overall returns and wealth creation will be generated over the long run.

The mining companies involved in gold mining are run by professionals who streamline operations, cut costs, and manage risks. Investors can enjoy professional management without the complications of gold mining or warehousing. Properly managed companies can pay regular dividends even in difficult market conditions, providing shareholders with dependability and assurance.

In most areas, other stocks can be taxed as dividends and long-term capital gains rather than physical gold. Such efficiency can be used to great effect to boost net returns. The dividend-paying gold stocks can also enjoy preferential tax treatment, making them an even wiser choice for investors seeking after-tax income and growth.

Gold stock dividends can be used to buy more, and their returns grow over time. Dividend reinvestment policies enable investors to accumulate wealth gradually, particularly during market declines when share prices are low. This will maximize long-term growth while still exposing it to gold's defensive features.

Gold stocks that pay dividends tend to be less volatile than gold itself. Dividend earnings help cushion price declines, making total returns stable. This predisposes them to conservative investors seeking exposure to gold, not subject to large price fluctuations, while still enjoying regular income.

Dividend-paying stocks of gold stocks are likely to do well during economic downturns, recessions, and geopolitical crises. With the demand increasing, investors tend to rush to gold-related assets in search of safety. Dividend income also increases returns, making these stocks a safe bet in uncertain times when other investments falter.

Owning a gold stock with dividend offers a powerful combination of income, growth, and stability. The investments offer exposure to the long-term value of gold, regular cash flow, diversification, and protection against inflation. Dividend-paying gold stocks are more liquid, less expensive, and tax-exempt as compared to physical gold. Dividend-paying gold stocks may be a good addition to an existing diversified portfolio for investors seeking a balance of returns and financial stability.