Hecla Mining Company (NYSE: HL) is over 100 years old in the mining of precious metals in North America. For investors who have considered taking exposure to the mining sector, particularly silver and gold, Hecla is a collection of attractive features that may be added to a diversified portfolio. We have listed below the best advantages of investing in the Hecla Mining Company, the reasoning behind them, and the few risks to take note of so that you can make a well-rounded judgment.

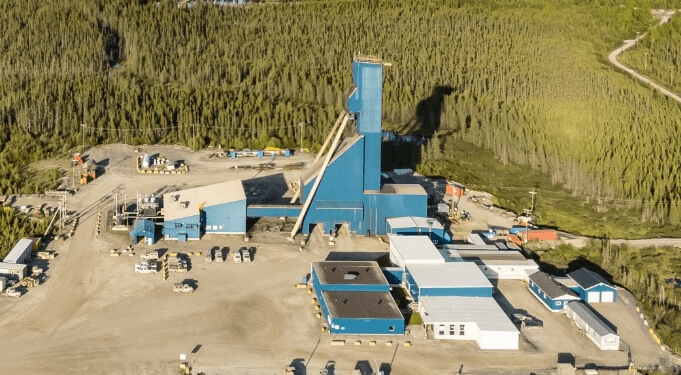

Hecla is the biggest silver company in the United States and Canada with numerous producing mines (Greens Creek, Lucky Friday, Keno Hill, Casa Berardi, and others). Such a scale provides Hecla with operational leverage in times when silver prices are increasing, and allows for diversified production across mines and jurisdictions. The fact that it is a major domestic producer also contributes to regulatory visibility and skilled local workforces.

The operations of Hecla are concentrated in moderately stable, mining-friendly jurisdictions (Alaska, Idaho, Quebec, Yukon) that reduce geopolitical and sovereign-risk exposure compared to miners with a high presence in high-risk countries. The company also balances silver-dominant assets with substantial gold and by-product silver streams of lead and zinc, which serves as a useful natural hedge under the condition that metal prices have disparate reactions.

More recently, Hecla demonstrated significant material gains in silver production and successfully re-entered assets into full production (e.g., Lucky Friday and Keno Hill), which will lead to a substantial growth in quarterly silver production in 2024. With improved throughput and grades, operating execution can be strong, boosting margin growth and cash flow upside.

Hecla has a proactive investor relations program, regularly hosting earnings presentations, annual reports, and filings. Such openness, including forward disclosure and cost indicators in its reports, helps investors assess performance trends and management plans. That amount of disclosure is an advantage to investors who like to see operations and capital allocation.

Although the mining firms tend to reinvest at a high rate, Hecla has managed to pay a quarterly minimum common dividend (a small amount), indicating that it is open to returning part of the capital to the shareholders in cases where it is possible to do so. That policy has additional appeal to yield-seeking investors who would like to have exposure to metals, but also receive periodic cash payments. (Dividend payout is low compared to other income stocks; thus, consider this as secondary and not primary income.)

The revenue mix of Hecla comprises silver, gold, zinc, and lead. That multi-metal exposure will minimize single-commodity concentration risk: in case silver is weak, the revenue can be smoothed by gold or base-metal by-products. It is an advantage that renders Hecla desirable among investors seeking precious-metal upside without pure single-commodity exposure.

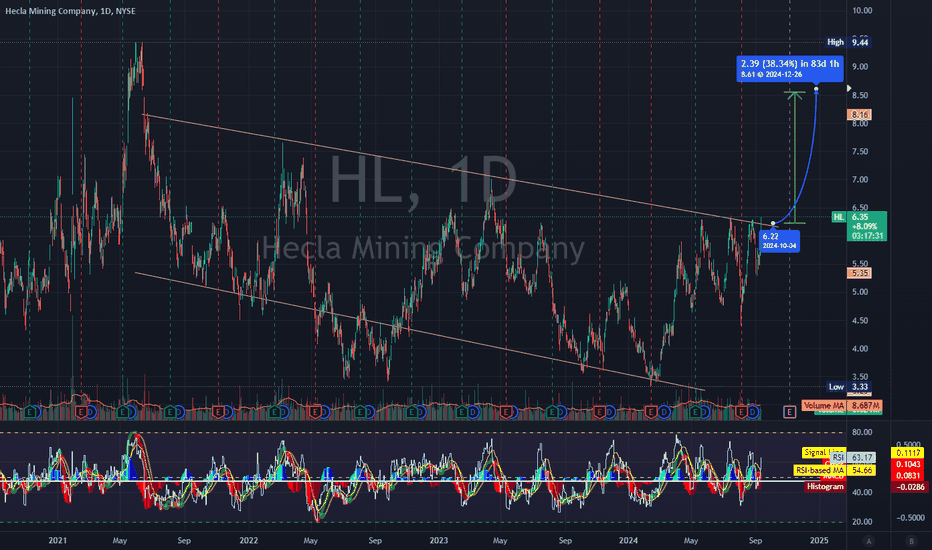

Hecla has traditionally traded with bouts of extreme volatility (as most miners are). In the long term, the disciplined investor may view volatility as an opportunity to buy, especially when operational improvements (ramp-ups, efficiency gains) are realized, but the market becomes cautious. Value-oriented investors may be interested in the combination of enhancing production and attractive valuation multiples (at times).

Hecla also releases sustainability and governance reports, focusing on safe operations and adherence to environmental regulations. As an ESG-conscious investor, one needs to be able to evaluate environmental and safety information and observe tangible commitments in disclosures/reports; Hecla's public materials offer such visibility. Although mining is a resource-intensive process in itself, reputational and regulatory risks are minimized through the creation of clear policies and effective reporting.

Experienced board members and long-term management have been mentioned as strengths in the past; however, changes in leadership should be closely observed by investors. According to public reporting, the company has established executive succession and board management processes, which are crucial when directing capital allocation, authorizing, and making decisions related to mine development. (Note: recent leadership changes and transitions that the investor needs to know about; the most recent filings will be updated here, but always look at them to be up to date.)

Hecla continues to invest in exploration and mill throughput improvements. Exploration discoveries or further enhancement of the ramp of current assets (increasing throughput, better recoveries) can significantly increase reserves, extend mine life, and raise per-share cash flow—the traditional path to upside in mining shares.

Hecla will be most suitable for investors who desire leveraged exposure to both silver and some amount of gold, tolerate commodity and operational volatility, prefer a producer with a jurisdiction in stable North America, and appreciate the upside of operational enhancements and exploration. That makes Hecla Mining Company a decent place to have a satellite position in a diversified portfolio, rather than a core position for conservative income investors.

When buying Hecla, you can do three things before you buy: (1) read the latest quarterly presentation and management commentary, (2) assess the current metal price situation and stress-test your assumptions on returns, and (3) position size with respect to risk sensitivity and time horizon. Hecla is an investment offering true benefits, including leadership in U.S. silver, asset diversification, recent production trends, and effective investor communications. However, like all other miners, it is part of a well-planned diversification strategy.