Purchasing an Alaska gold mining claim is a highly attractive investment opportunity, but it should be carefully considered to ensure long-term profitability and legal protection. Alaska has a rich mining history, a variety of terrain, and gold deposits with high potential, such that the choice of claim could prove to be the difference. This is the complete guide on how to select the best Alaska gold mining claims for sale; each point is clarified in clear and organized detail.

It is essential to be aware of the various mining claims in Alaska before purchasing them. The two are placer and lode claims, which are the most common. Placer claims have to deal with gold that is present in streambeds, gravel, and sediment, whereas lode claims are associated with gold that is entrenched in solid rock. They all involve various mining methods, investments, and equipment. The knowledge of these differences will allow you to select the type of claims that fits your skills, budget, and long-term objectives.

The distribution of gold is also highly diverse in Alaska, and geological studies are a priority. Read geological maps, the record of past mining and assays to find out what the area has the potential to produce in terms of gold. Prospects in proximity to known gold belts, old workings, or productive placer streams are generally more promising. By examining the soil composition, mineral indicators, and local river operations, one can conduct a further evaluation to determine whether the claim has a good chance of recovering gold in large amounts and is valuable.

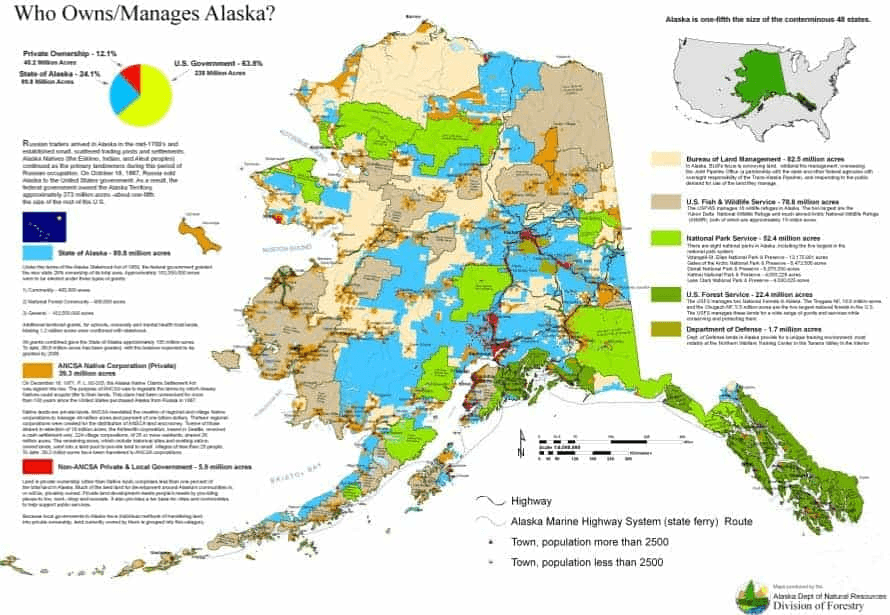

It must be ensured that the claim is legally valid to make purchases. Verify ownership with the Bureau of Land Management (BLM) and ensure that all annual returns, fees, and documentation are up to date. The claims can include disputes, lapses, or unrecorded transfers. It is advisable to review the history of ownership and ensure that the seller is within the law to transfer the claim, thereby preventing any possible legal complications or financial losses in the future.

Accessibility contributes significantly to the practicability of a claim and its associated running expenses. The accessibility of some Alaska claims can only be accessed by bush planes, boats, or off-road trucks, which can make logistics costs very high. Consider the ground and climatic conditions, as well as the distance to supply towns. A claim that can be accessed with less difficulty means that transporting equipment, fuel, and personnel can be carried out easily. Knowing the terrain conditions also prepares one for difficulties such as steep slopes, dense vegetation, or water barricades.

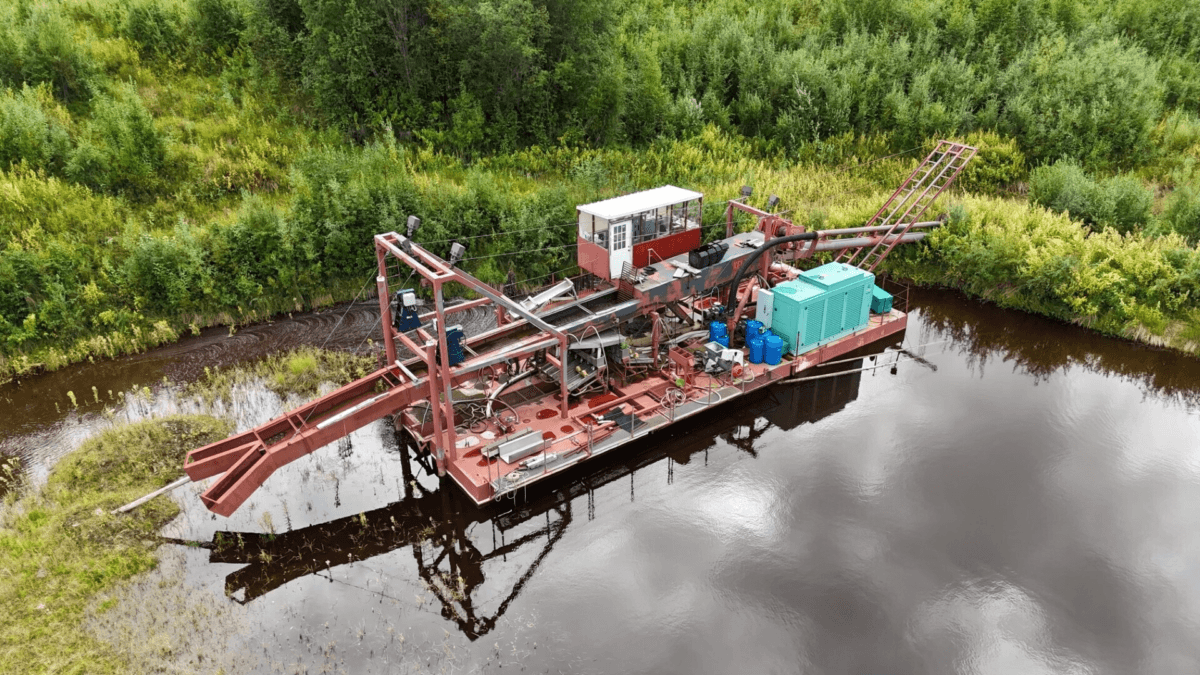

Placer mining requires the availability of water, particularly in the use of sluice boxes, dredges, or wash plants. Establish access to reliable sources of water, such as streams, rivers, or natural springs. Water flow can be influenced by seasons; therefore, it is essential to ensure it is available throughout the year. Ensure that the water supply is legally accessible and complies with Alaska regulations for water. Access to clean water enhances productivity, lowers expenses, and has no impact on mining activities.

A claim that has been produced historically can provide one with a good idea as to whether it is a profitable claim. Check any mining records, assays, or records of the operators. Investments that have consistently paid off throughout history are generally considered safe. However, without historical mining data, it does not necessarily imply low potential, as some areas have not been thoroughly explored. Nevertheless, the claims where previous production has been proven have less uncertainty and allow you to estimate the future returns more accurately.

The equipment requirements of each mining claim vary based on the terrain, depth of gold, and the type of mineral deposit. Divide the total investment required, which would be the machinery, labor, permits, transport, and fuel. Claims that involve heavy equipment can yield greater returns, but also require more substantial start-up capital. Create a budget and compare it against the operational costs expected to fall within your budget to ensure the project is viable. This analysis helps you avoid unexpected expenses in the future.

One of the most significant processes is physical inspection. Being at the site gives you the opportunity to identify its location, limits, topography, water accessibility, and potential risks. It is also possible to determine the density of vegetation, the type of soil, and the land use. A meeting with residents or miners provides a valuable insight into the actual productivity of the claim. By visiting the land, you will no longer get caught by any unexpected circumstance and will have an eye view of the mining potential of the claim.

The environmental and mining laws are very stringent. Before acquiring a claim, familiarize yourself with the permits required, including Alaska DNR mining approvals, water use permits, and environmental compliance documents. These policies safeguard the natural habitats but could restrict some mining operations. This knowledge of the permitting requirements enables you to approximate timelines and costs more efficiently. Appropriate compliance also ensures that your mining operations are safe, legal, and environmentally responsible.

To select the optimal Alaska gold mining claims for sale, one must conduct thorough research, examine them, and have a clear understanding of the geological and legal factors. The decision made by assessing the gold potential, accessibility, water, and regulatory demands, as well as the long-term value, will help you make a sound decision, which will maximize your opportunities for success. Starving in a small-scale miner or an investor in search of a high-value asset, the appropriate Alaska gold mining claim could be the reward in terms of both profitable financial and exploration opportunities.

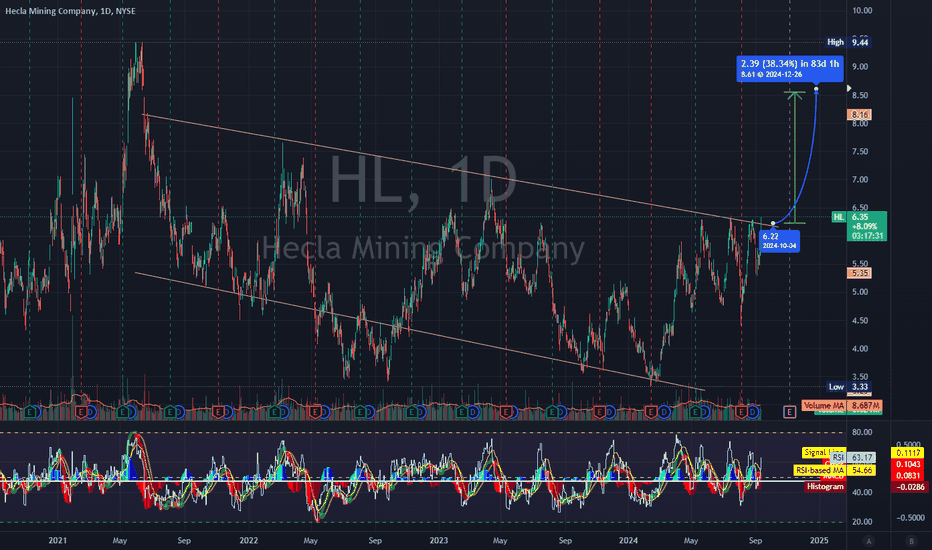

Hecla Mining Company (NYSE: HL) is over 100 years old in the mining of precious metals in North America. For investors who have considered taking exposure to the mining sector, particularly silver and gold, Hecla is a collection of attractive features that may be added to a diversified portfolio. We have listed below the best advantages of investing in the Hecla Mining Company, the reasoning behind them, and the few risks to take note of so that you can make a well-rounded judgment.

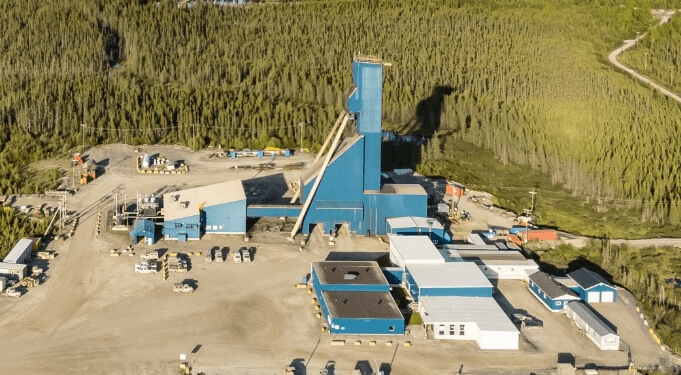

Hecla is the biggest silver company in the United States and Canada with numerous producing mines (Greens Creek, Lucky Friday, Keno Hill, Casa Berardi, and others). Such a scale provides Hecla with operational leverage in times when silver prices are increasing, and allows for diversified production across mines and jurisdictions. The fact that it is a major domestic producer also contributes to regulatory visibility and skilled local workforces.

The operations of Hecla are concentrated in moderately stable, mining-friendly jurisdictions (Alaska, Idaho, Quebec, Yukon) that reduce geopolitical and sovereign-risk exposure compared to miners with a high presence in high-risk countries. The company also balances silver-dominant assets with substantial gold and by-product silver streams of lead and zinc, which serves as a useful natural hedge under the condition that metal prices have disparate reactions.

More recently, Hecla demonstrated significant material gains in silver production and successfully re-entered assets into full production (e.g., Lucky Friday and Keno Hill), which will lead to a substantial growth in quarterly silver production in 2024. With improved throughput and grades, operating execution can be strong, boosting margin growth and cash flow upside.

Hecla has a proactive investor relations program, regularly hosting earnings presentations, annual reports, and filings. Such openness, including forward disclosure and cost indicators in its reports, helps investors assess performance trends and management plans. That amount of disclosure is an advantage to investors who like to see operations and capital allocation.

Although the mining firms tend to reinvest at a high rate, Hecla has managed to pay a quarterly minimum common dividend (a small amount), indicating that it is open to returning part of the capital to the shareholders in cases where it is possible to do so. That policy has additional appeal to yield-seeking investors who would like to have exposure to metals, but also receive periodic cash payments. (Dividend payout is low compared to other income stocks; thus, consider this as secondary and not primary income.)

The revenue mix of Hecla comprises silver, gold, zinc, and lead. That multi-metal exposure will minimize single-commodity concentration risk: in case silver is weak, the revenue can be smoothed by gold or base-metal by-products. It is an advantage that renders Hecla desirable among investors seeking precious-metal upside without pure single-commodity exposure.

Hecla has traditionally traded with bouts of extreme volatility (as most miners are). In the long term, the disciplined investor may view volatility as an opportunity to buy, especially when operational improvements (ramp-ups, efficiency gains) are realized, but the market becomes cautious. Value-oriented investors may be interested in the combination of enhancing production and attractive valuation multiples (at times).

Hecla also releases sustainability and governance reports, focusing on safe operations and adherence to environmental regulations. As an ESG-conscious investor, one needs to be able to evaluate environmental and safety information and observe tangible commitments in disclosures/reports; Hecla's public materials offer such visibility. Although mining is a resource-intensive process in itself, reputational and regulatory risks are minimized through the creation of clear policies and effective reporting.

Experienced board members and long-term management have been mentioned as strengths in the past; however, changes in leadership should be closely observed by investors. According to public reporting, the company has established executive succession and board management processes, which are crucial when directing capital allocation, authorizing, and making decisions related to mine development. (Note: recent leadership changes and transitions that the investor needs to know about; the most recent filings will be updated here, but always look at them to be up to date.)

Hecla continues to invest in exploration and mill throughput improvements. Exploration discoveries or further enhancement of the ramp of current assets (increasing throughput, better recoveries) can significantly increase reserves, extend mine life, and raise per-share cash flow—the traditional path to upside in mining shares.

Hecla will be most suitable for investors who desire leveraged exposure to both silver and some amount of gold, tolerate commodity and operational volatility, prefer a producer with a jurisdiction in stable North America, and appreciate the upside of operational enhancements and exploration. That makes Hecla Mining Company a decent place to have a satellite position in a diversified portfolio, rather than a core position for conservative income investors.

When buying Hecla, you can do three things before you buy: (1) read the latest quarterly presentation and management commentary, (2) assess the current metal price situation and stress-test your assumptions on returns, and (3) position size with respect to risk sensitivity and time horizon. Hecla is an investment offering true benefits, including leadership in U.S. silver, asset diversification, recent production trends, and effective investor communications. However, like all other miners, it is part of a well-planned diversification strategy.

Gold was historically considered the symbol of wealth, stability, and security. Investors have long relied on the precious metal to cushion against inflation, currency devaluation, and market volatility. However, in the current dynamic economic environment, where economic times are shifting swiftly, many are discovering that gold stocks with dividends can provide a contemporary version of this age-old investment: the stability of gold and the regular payment of dividends from shareholding companies.

This is why gold dividend stocks are emerging as a smart investment for investors seeking steady returns with long-term potential.

Gold has earned a good reputation as a hedge against inflation. As the cost of living increases, fiat currencies are losing their purchasing power; however, gold tends to retain its value or even increase in value over time. The gold mining companies with a strong balance sheet are able to remain profitable even during inflationary periods and pay dividends.

This renders them an important instrument of saving capital, as well as earnings during economic unpredictability.

Not every gold company is able to pay dividends to its investors; only a few financially sound companies can do so. Companies with a high cash flow, controlled debt, and efficient operations usually pay dividends to their shareholders. These companies typically:

To investors, it will be more stable and have a lower risk profile compared to speculative mining operations.

Dividend-paying gold stocks are a very good diversification tool. Their correlation with traditional equities and bonds is low, indicating that they do not necessarily move in tandem with them. You can also minimize some of the overall risk by adding dividend-paying gold assets to your portfolio, but this will enhance your chances of relatively steady returns, particularly in such cases as a market fall, when defensive assets perform better than other investments.

The strength of dividend reinvestment is one of the advantages that should not be overlooked. The investors are able to compound their returns over time through reinvesting dividends in more shares (this will increase their wealth in the long term by a large margin). This strategic move converts a fixed source of income into a growth engine, especially when the dividends in certain industries, such as gold mining, are typically linked to rising commodity prices.

Environmental, Social, and Governance (ESG) standards are becoming increasingly important to modern investors. It has become a common practice among many major gold producers to adopt eco-friendly production and management practices, community development initiatives, and open governance policies. Such companies, with sustainability as part of their business models, are likely to have better reputations, long-term profitability, and less regulatory risk, all of which help maintain steady dividends and investor trust.

Physical gold possession can lead to increased taxation when sold, including in most jurisdictions where it is treated as a collectible. By contrast, dividend-paying stocks of gold can be taxed more favorably. Dividends can be taxed at a lower rate, and investors can postpone capital gains until the sale of the stock. The benefit increases the net returns in the long term, particularly among investors in higher tax brackets.

Physical gold is also awkward to sell - you need to find someone willing to buy the gold, check its purity, and incur storage expenses. By contrast, gold dividend stocks are easily liquidated on large exchange platforms immediately. This flexibility enables investors to quickly rebalance their portfolios or respond to market trends without the hassle of owning physical gold.

Investing in gold companies, you are not just gambling on the gold price, but on the management team of professionals who are knowledgeable of the mining industry. These units focus on exploration, extraction, hedging, and production efficiency, all of which have the potential to enhance profitability and sustain dividends even in challenging markets.

When the world encounters a recession or a worldwide crisis, investors tend to rush to safe-haven commodities such as gold. When demand for gold increases, mining companies directly benefit, and their earnings and dividend prospects are strengthened. Gold stocks that pay dividends may provide defense and serve as a buffer in your portfolio against wider economic declines. This is their protective nature, and hence, a great addition to any risk-averse investment strategy.

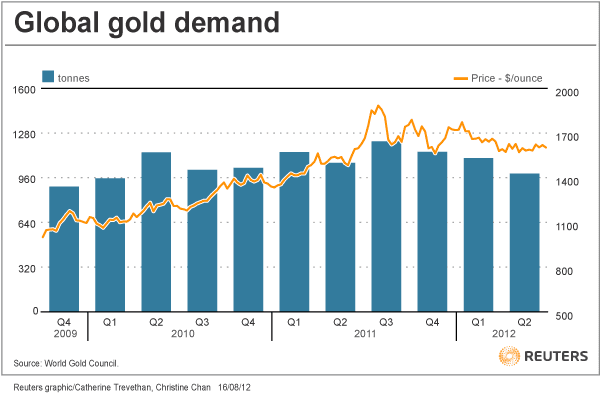

A growing global demand for gold, combined with a short and expensive supply, is one of the best reasons to invest in gold dividend stocks. Gold remains a crucial asset among central banks, jewelry markets, and emerging economies, particularly in countries such as India and China, where it is deeply ingrained in culture and drives significant economic demand.

Meanwhile, new gold finds are becoming increasingly rare, and mining activity costs are rising, accompanied by stricter regulations and environmental concerns. Such a mismatch between supply and demand typically leads to a long-term increase in the price of gold.

Gold stocks with dividends provide a balanced and intelligent approach to investing in precious metals. They blend the perennial and inflation protection capabilities of gold with the stability of earnings and growth prospects of well-managed corporations. Gold dividend stocks are a smart investment, particularly during uncertain economic periods, for investors seeking consistent returns and long-term wealth preservation.

You can be a conservative investor and seek stability, or you could be the diversifier in your portfolio for the future. Regardless, these are the golden opportunities that will enable you to find the right mix between security and profitability.

The Alaska gold mining claims are few that can offer as much adventure, history, and financial potential as one can find in a single investment opportunity. Alaska has been the golden parachute for prospectors due to its spectacular scenery and abundant minerals. However, in addition to the adventure of gold, investing in Alaska gold mining claims for sale offers a variety of unseen rewards that investors often overlook. This kind of investment is associated with amazing long-term benefits, since it goes beyond portfolio diversification and the actual ownership of assets to passive income and the development of sustainable resources.

A gold mining claim is literally a piece of land, unlike stocks or digital property, which can be devalued overnight. You are buying yourself the right to get the gold and other precious minerals in a particular region when you invest in a claim. It is this physical linkage with the earth that endows the investment with inherent and enduring value, making it safe even in times of economic turmoil.

Gold as a commodity has been popular worldwide for centuries. Its stability and demand across industries, such as jewelry and electronics, make it a sure hedge against inflation. Having an Alaska mining claim means first-hand access to a commodity that will never become obsolete, so that your investment will not be wasted regardless of how the market trends change.

Many investors believe they need to dig into their claims to be profitable; however, this is not the way. You have the option of leasing your gold claim to professional mining operators or collaborating with the established companies. This will enable you to receive income in the form of royalties without participating in the daily mining process.

For example, leasing contracts usually provide a specific percentage of returns or a fixed monthly payment. This turns your investment into an uninterrupted stream of passive income, which is why it is the best solution for investors who do not want to be directly involved in natural resources. Over time, as mining activity increases or the gold price rises, your returns can be quite high.

Financial markets are unpredictable. Stocks, bonds, and even cryptocurrencies tend to fluctuate due to inflation, policy changes, or global instability. Compared to this, gold has a strong history as a safe-haven asset. When the economy is not doing well, investors typically invest heavily in gold, and its price rises.

With a gold claim in Alaska, you are in a position to impact high gold prices directly. The more the world needs, the more profitable your claim can become, as the higher the value of its extraction and resale price will be. This is not only a mining opportunity, but also a strategic inflation hedge to your overall investment portfolio.

Mining investments usually have tax-induced boosted returns. Some mining-related expenses in the U.S. will be deductible business costs (exploration, equipment, and operational costs). Investors can also depreciate equipment and write off the improvements made to the property.

Moreover, the IRS considers many gold mining enterprises to be business operations, not passive investments. This categorization provides the opportunity to make further inferences and even long-term capital gains advantages once you sell your claim. These benefits can significantly reduce tax payments and make investors very profitable, provided they are organized properly.

Alaska continues to be among the most unexploited and richest in gold in the world. A vast expanse of land continues to conceal untapped areas where new reserves are frequently being discovered. Mining technologies now allow identifying and developing high-potential claims more than ever, thanks to advanced surveying, sampling, and environmental friendliness.

By investing in the early stages of underdeveloped gold areas, you can be in the market before prices escalate. With the growth in exploration exercises and the growing pressure on the issuance of the mining rights, the value of your claim can grow significantly. This is one of the most profitable aspects of having an Alaska gold mining claim as an early mover.

Beyond the financial dimension, the investment in Alaska is also an adventure-filled venture: owning a gold claim. Numerous investors love the idea of checking out their claims, panning for gold, and just being in the wilderness. It is an adventure that involves enjoying nature, history, and adventure. A gold claim offers a sense of freedom and a bond with nature to those interested in more than money. It is a reminder that money is not always digital deals or company stocks, but it might be the land itself. Several claim owners report that their investments were profitable and personally enriching.

Investing in Alaska gold mining claims for sale is more than a speculative betting game; it is an opportunity to own a real, appreciating investment that will tie you to one of the most historically relevant industries in the world. The concealed benefits of owning gold claims include economic stability and tax breaks, the adventure of discovery, the opportunity to contribute to a sustainable future, and enjoyment.

In a world where digital assets and paper money can lose value overnight, Alaska’s gold offers something rare—security, adventure, and a lasting legacy. Whether you’re a seasoned investor seeking portfolio diversification or a nature enthusiast drawn by the frontier spirit, Alaska’s gold mining claims represent a golden opportunity waiting to be explored.

Acquisition of a placer gold claim may be such an exciting experience among prospectors and investors wishing to exploit one of nature's most persistent treasures, gold. Nonetheless, it requires a good understanding of mining rights, property law, and the mining process. This manual will assist novices in navigating the process of acquiring a placer gold claim for sale without going bankrupt.

The placer gold claim is a right to harvest alluvial gold in any river, creek, or streambed. In contrast to hard rock mining, placer mining targets loose material. Such claims are found on federal or state land, and are usually leased or sold to the former owners. Knowing this difference will help buyers determine the true value of the claim and its potential to be fruitful.

Before purchasing a placer claim, it is important to understand the legal regulations that govern mining in your area. The Bureau of Land Management (BLM) regulates claims in the U.S. Other states may impose additional requirements, such as payment of fees and annual maintenance, as well as environmental limitations. Get to know these laws so that you do not get into trouble with the law in the future. Any failure would lead to the loss of rights to claims.

Everything is location when purchasing a placer gold claim. Traditional gold mines have better chances of producing. The history of placer mining in states like Alaska, California, Nevada, and Colorado is long. Research local geological reports, topographical maps, and mining records to identify potential locations. The location can also be visited prior to purchase to ensure accessibility, that the terrain can accommodate the mining activity, and that it is not too far from water sources.

Before making a payment, always confirm the legality of the claim. Confirm whether it is an active claim, not subject to litigation, and the same is registered with the BLM or the local mining department. Numerous scam entries exist in which sellers attempt to sell imaginary or expired claims. Compare the number of claims received with the official records, the owner information, and the filing date. Due diligence makes sure that you are purchasing a valid and legal mining right.

The real value of a placer claim is its potential for gold. Sample gold presence and concentration-Request sampling reports or on-site test panning to establish the presence and quantity of gold. There can be useful information in historical mining records, the composition of the sediment, and the proximity of the claim to known gold streams. Although a few of the claims could be a promotion of easy gold, it needs to be realistic; not all claims can yield high returns.

The best placer claim ought to be reachable through road or trail, and the topography ought to be manageable to install equipment. Remote and isolated places might have richer deposits but pose greater operational challenges. Look into water, power supply, and facilities in the camp. Claims are made closer to towns or supply centres, so logistics costs are low. Assessment of accessibility makes mining activities efficient, economical, and sustainable within the season.

One of the most important points that an amateur should not ignore is the distinction between surface rights and mineral rights. A placer claim purchase typically provides the right to extract minerals, but not the right to the land. The surface owners are still allowed to graze, log, or use recreational rights. It is best always to explain such differences to the local authorities or landowners to avoid conflicts. The right knowledge protects your investment and enables the operations to run smoothly.

Contemporary gold mining includes environmental regulations, which are an important component of the process. Prior to the purchase of a claim, you should examine whether the claim has any restrictions or reclamation requirements attached to it. The zones can also be considered areas under protection, restricted for mining. Ensure the statement complies with environmental standards to avoid fines or closures. Responsible mining goes beyond the protection of nature; it will ensure that your claim has long-term value.

Other placer gold claims may have pending debts, taxes, or lawsuits. Do a title search of the property to determine that there is no lien or encumbrance on the property. This is either through the County's local offices or the BLM. This step should not be disregarded, as it would lead to costly lawsuits in the future. All transactions and mining activities must also have clear ownership records before finalization.

Do not work with sellers who have no reputation and offer unclear terms of transaction. Survey the online reviews, mining forums, and referrals from previous customers. A good seller must be willing to provide assay reports, claim maps, and filing certificates. Sellers who hurry you to pay or do not give complete records should be avoided. Checking credibility helps avoid fraud and provides a secure way to buy.

Acquisition of a placer gold claim for sale may be an adventure and a good investment - but of course, it is only when done with care and expertise. Legal research, field inspections, and environmental compliance are essential to making everything successful. You may be a weekend prospector or an investor, but with this knowledge of these basics in hand, you can make sound decisions and find the gold responsibly and profitably.

Arizona has always been among the most desirable destinations for gold prospectors and mining investors. As the state with a rich mining history, positive geology, and favorable regulations, the placer gold claims are the best opportunities available. Direct access to valuable resources is afforded to people and businesses when they buy such claims. Arizona placer gold claims for sale offer long-term ayoffs, including financial returns, wealth preservation, and flexibility in land use, making them a good decision for contemporary investors.

One of the most obvious benefits of buying a placer gold claim in Arizona is direct access to natural gold deposits. The key difference between the two lies in the fact that, unlike investments in stocks or futures, owning a claim to a good allows one to mine and extract real and tangible resources. The placer gold produced in Arizona has a long and rich history in its gold-bearing regions, which include Prescott, Wickenburg, and the Bradshaw Mountains. Such a close linkage to assets makes investors assured of the worth of their claim.

Placer gold claims are a physical asset in a world where digital assets and paper investments are the main order of things. When you buy a claim, you are not only acquiring potential gold resources, but also legal rights to a specific piece of land. This ownership brings about certain stability to an investment portfolio, especially when the market is uncertain. The tangible property, such as gold claims, usually holds more value than the intangible property and, therefore, is a safe way of securing wealth.

Gold has always been among the safest and most profitable investments. Through the acquisition of a placer claim, investors are provided with the right to mine and sell gold directly, which can lead to substantial profits. Small operations are also attractive, even when the data is about small resources, particularly with the latest equipment and effective mining methods. The growing global demand for gold will provide the Arizona claims with an opportunity to capitalize on market trends and generate consistent revenue from natural resources.

Gold has never been regarded as anything more than a safe-haven commodity. In inflationary periods, when a currency is being devalued or there is an overall economic uncertainty in the world, gold does not lose value, but it appreciates. Buying the placer gold claims in Arizona provides an investor with a first-hand supply of this precious metal. Instead of owning only gold ETFs or bullion, the owners of claims can extract and store gold independently, providing a high level of hedge against any economic risks. This is why placer claims offer a sure way to long-term financial security.

Not every placer gold claim is sold on a large-scale commercial mining. Many people purchase them on a small-scale or hobby basis. The available topography and climatic conditions of Arizona contribute to its viability as a destination among weekend treasure hunters or as a family holiday destination in search of a convenient experience. Possession of a claim enables hobbyists to mine within the law, but they can also make a profit on the discoveries. This special mix of entertainment and investment attracts the attention of people who can appreciate the financial gains and outdoor adventure.

With a placer gold claim that you have bought, you have some rights to the land and mineral resources in the land. This provides claim owners with permanency and stability of their mining operations. In most instances, they can inherit, resell, or rent such rights, making them valuable long-term assets. The freedom to explore, mine, and make a profit in a specific piece of land gives the necessary flexibility and ensures that the law guarantees your investment.

The world demand for gold does not indicate a downturn. Gold is also very popular with its applications in technology, jewelry, and as a central bank reserve currency. Investing in Arizona placer claims enables individuals to secure a stable asset in the global market. With markets undergoing tension and industries being dynamic, gold remains a resource of its own. Position ownership enables investors to reap direct benefits from the long-term and increasing demand.

Having an Arizona placer gold claim does not imply that you have to mine it yourself. Most investors purchase the claims and lease them to miners or companies. This gives a constant passive income without direct operations. Furthermore, claims might be valuable over a period of time, particularly when the prices of gold increase. The returns of reselling a claim would become very high. Therefore, it is not only an opportunity to extract resources but also a valuable investment in the form of a real estate property.

In addition to monetary incentives, the right to acquire a placer gold claim has lifestyle rewards. To most of us, prospecting is not all about money but an adventure, exploration, and an opportunity to spend time in the open air. The landmarks of Arizona are very varied, as the canyons of the desert and the streams of the mountains offer a unique setting where mining activities can take place. Having a claim provides families and individuals with a motive to go out and explore nature when they are pursuing an exciting as well as rewarding hobby. The synthesis of these two elements, lifestyle and investment, makes placer claims so special.

Buying Arizona placer gold claims for sale is not merely a matter of acquiring mining rights. Still, it is also a strategic investment in physical resources, monetary security, and life opportunities. These claims have good assets since they have access to good deposits, have the possibility of good returns, and are not affected by economic instabilities. Arizona has a better opportunity than any other country due to low entry barriers, favorable documentation, and the world demand for gold. Placer gold claims offer investors a unique opportunity to make a profit while experiencing an adventure.

Gold prospecting activities have been a dominant practice throughout the entire history and stunning scenery of Colorado for many decades. Since the mid-19th century mining started, Colorado has become an excellent setting where people, together with investors, can pursue gold industry interests. Anyone planning to buy a Colorado gold claims for sale should start by studying market dynamics and legislative procedures as well as implementing optimal operational methods.

Gold claims in Colorado are classified into two main types: placer claims and lode claims.

Every claim type brings distinctive difficulties along with its own set of prospects. The working process of placer claims is usually simple, with limited equipment requirements, although lode claims demand major investments in machinery and infrastructure development.

An extensive research process should precede buying a gold claim in Colorado. The following points should be evaluated during consideration:

Gold claims in Colorado fall under federal and state laws governing mining rights. When purchasing a claim, be sure to:

There are several sources to find gold claims for sale in Colorado:

Once you've found a claim of interest, conducting due diligence is critical.

Gold claim prices in Colorado vary based on location, size, gold yield, and accessibility. Typical costs include:

If you're looking to profit from a Colorado gold claim, consider the following strategies:

Potential investors must combine scientific research with legal expertise together with careful planning strategies when they enter the Colorado gold claims for sale marketplace. Success in buying a Colorado gold claim depends on proper due diligence because hobbyists and investors both need it for different purposes. North Coloradans who understand claim types together with legal requirements and profitability models stand to find their fortune in the Centennial State.

Gold mining in Canada has been a profitable business for many years, and investment opportunities are available to those interested in prospecting. Buying gold claims is one way to access potential gold-bearing land, but it requires careful research and due diligence. This guide outlines the steps to effectively purchase Canada gold claims for sale, ensuring a profitable and legally secure investment.

A gold claim exclusively authorizes the owner to seek and mine minerals within a described area. In Canada, mineral rights are usually vested in the Crown, so for prospecting or mining to occur legally, owners must obtain a claim. Rules and procedures regulating gold claims differ from province to province and territory to territory.

Each province or territory has distinct laws governing gold claims. For instance:

Visit the official government websites of your target province or territory to understand local requirements. Make sure you know what fees are charged, what's restricted, and how to renew. Also, familiarize yourself with environmental regulations and indigenous land rights that may be applicable to the area.

Determine the purpose of your investment:

Knowing your objectives will help you select the right type of claim and guide your budget. For instance, a placer claim might be ideal for hobbyists, while lode claims are better suited for large-scale mining operations.

There are several ways to find gold claims for sale:

When browsing claims, pay attention to details such as claim size, location, and previous exploration results. Many sellers provide maps and historical data that can offer valuable insights into the claim’s potential.

Before purchasing, assess the claim’s gold-bearing potential:

Ensure the claim is valid and transferable:

You can often confirm these details through provincial mining registries. In some cases, it may be necessary to conduct a title search to uncover potential legal issues.

When negotiating the purchase:

Once the purchase is complete, transfer the claim’s ownership by:

Ensure the registration process is completed promptly to avoid lapses in claim tenure. A delay in registration could result in losing rights to the claim.

Research every aspect of the claim, from historical gold production to current market trends. Overlooking key details can result in financial losses. Understanding the geological formations and soil types can provide insights into the likelihood of finding gold.

Gold mining involves significant additional expenses:

The activity of gold mining is lucrative because of the volatility of gold prices. There is a need to watch market trends in an effort to establish the most appropriate time when to open operations or when to sell a claim. They recommended subscribing to industry reports or joining mining forums to be informed.

Consult geologists, surveyors, and legal consultants so that you can have a proper decision to make in reference to the issue. It means that with their experience they can reveal the potential risks and opportunities that are often concealed from plain sight. It is often far better to spend a few hundred dollars on professional help than to lose thousands of dollars down the line.

Minerals mining is a strategic activity facing the challenge of sustainability in the current world. The various standards mentioned in the best practices can improve the way a company relates to its communities/communities or avoid legal problems. Some of the recommendations to be undertaken include; Water recycling, Minimal land disturbance.

Neglecting Research: Skipping the opportunity without exploring the claim’s background, geophysics, and legalities of the claim may bend us. It’s always important to do your homework to find out whether any signs should make one avoid a particular investment.

Canada gold claims for sale are a lucrative investment if one takes time and does proper research before going for the purchase of gold claims. If one comprehends the ordinances governing a particular type of investment and invests time in researching and consulting experts in relevant fields, many opportunities and minimal risk can be achieved. As a novice gold enthusiast or experienced prospector you must follow these recommendations so as to achieve success in the Canadian gold mining industry.

Always bear in mind that the success formula for investments is preparation and flexibility. It is very possible to bring life back to your gold claim and transform the site into a commercially viable and environmentally friendly venture.

The market for copper has increased in the global market in the past few years due to increased demand for electric vehicles, renewable energy and technology. Because these industries are heavily dependent on copper, juniors have begun to attract more attention as possible investment prospects. Such are the smaller mining companies that are usually in the exploration stage and, at best, in the early development phase and that usually represent high-risk/high-return opportunities. This article takes a look at things that investors and stakeholders ought to look out for when assessing junior copper miners.

Junior copper miners themselves are companies that are principally engaged in the exploration and development of copper assets. While numbered amongst many large mining companies, juniors are generally not well-endowed by comparison and have limited operations or mineral portfolios. Mining’s objectives focus solely on finding potential copper prospects that can either be brought into production or sold to other mining companies. Where juniors are often seen as the initial exploration stage in the mining life cycle, this stage contains a number of risk factors that include the extent of their exploration knowledge, reserves and resources estimates, and financing. Knowledge of these elements is vital in making an assessment relating to the viability of each of them.

Based from the assessment made above, one can firmly state that the localization of a mining project plays a determining role in its potential economic efficiency. Copper deposits are frequently in politically sensitive or remote locations, and thus, political stability, regulatory environment, and local communities are important factors.

The success of a junior miner often hinges on its exploration capabilities. Accurate resource estimates based on geological surveys, drilling results, and mineral assays are critical to attracting investment and advancing projects.

A competent management team with a proven track record in exploration, development, and navigating regulatory challenges can significantly enhance a junior miner's prospects. Key personnel should demonstrate:

Junior miners often rely heavily on external funding to finance their exploration and development activities. Evaluating their financial health involves analyzing the following:

Mining projects require robust infrastructure, including roads, power supply, water resources, and proximity to ports. A lack of infrastructure can significantly increase project costs and timelines.

As environmental, social, and governance (ESG) principles become integral to investment decisions, junior miners must adhere to sustainable practices. This includes:

The shift toward green technologies, such as EVs, solar panels, and wind turbines, has driven unprecedented demand for copper. The metal’s conductivity, durability, and recyclability make it indispensable in these applications. Junior miners who can tap into new copper deposits stand to benefit significantly.

Many junior miners aim to be acquired by major mining companies once they prove their resource viability. These acquisitions often result in substantial premiums for early investors.

Due to their smaller size and lack of production, junior miners are often undervalued by the market. Savvy investors can capitalize on these opportunities by identifying companies with strong fundamentals and growth potential.

Advances in exploration technologies have enabled miners to identify deposits in previously inaccessible or overlooked areas. Juniors operating in these regions could uncover significant resources.

Exploration is capital-intensive and does not guarantee success. Juniors often face the challenge of securing sufficient funding while managing the inherent risks of drilling and resource estimation.

Copper prices fluctuate based on global economic conditions, demand-supply dynamics, and geopolitical tensions. Such volatility can impact the financial stability and planning of junior miners.

Compliance with environmental regulations, obtaining mining permits, and navigating bureaucratic processes can cause delays and increase costs.

With numerous junior miners vying for investor attention, competition for funding is fierce. Companies must differentiate themselves through superior projects, management expertise, or innovative approaches.

Local communities and environmental groups often oppose mining projects due to concerns about land degradation, water pollution, and displacement. Gaining community support is crucial but challenging.

Junior copper miners are crucial to meeting the demand for copper. Investments in such miners are also quite promising, especially for investors who are willing to take calculated risks. However, the challenges associated with such investments are inherent, including high costs, regulatory complexities, and market volatility. Through careful evaluation of resource estimates, financial health, ESG practices, and management expertise, stakeholders can identify companies that are likely to grow.

Junior copper miners will remain an important aspect of the world's greener future. By balancing opportunities with risks, investors can now unlock the full potential of the emerging players in the copper mining sector.

Gold has always occupied a unique and enduring place in the investment world. Whether serving as a hedge against inflation, a safe haven during economic uncertainty, or a tool for diversification, gold has consistently proven its value over centuries; for investors looking to combine the benefits of gold exposure with the advantage of regular income, gold stocks with dividends present a compelling opportunity. This article delves into the most effective strategies for investing in gold stocks dividend, focusing on achieving a balance of stability and returns.

Gold stocks represent shares in companies involved in the mining, production, and exploration of gold. Unlike physical gold, which does not provide income, gold stocks can offer dividends—a portion of a company's profits paid out to shareholders. Dividends make these stocks particularly attractive for income-focused investors, offering a dual benefit of capital appreciation potential and steady income.

Not all gold companies are created equal. When selecting dividend-paying gold stocks, prioritize companies with strong fundamentals, such as:

Gold mining companies operate in different regions, each with unique political, economic, and regulatory environments. Diversifying your gold stock investments geographically can reduce risk. For example:

Evaluate the dividend yield—the annual dividend as a percentage of the stock price. A higher yield is attractive, but it’s important to ensure sustainability by examining the payout ratio (the percentage of earnings paid as dividends). A payout ratio between 40% and 60% is typically considered healthy.

Royalty and streaming companies do not mine gold themselves but finance mining operations in exchange for a portion of future production or revenue. These companies, such as Franco-Nevada or Royal Gold, often have lower operational risks and more consistent dividends than traditional miners.

Gold prices are influenced by macroeconomic factors such as interest rates, inflation, and geopolitical events. Staying informed about these trends can help you time your investments effectively.

Exchange-Traded Funds (ETFs) like the VanEck Vectors Gold Miners ETF (GDX) or specific dividend-focused gold ETFs can provide exposure to a diversified basket of gold stocks, minimizing the risks associated with individual stock selection.

Here are some of the leading dividend-paying gold stocks to consider:

While gold dividend stocks offer numerous advantages, investors should be aware of potential risks:

To maximize the benefits of investing in gold dividend stocks, consider the following:

Gold stocks dividend investments that pay dividends offer an excellent opportunity for investors seeking income and exposure to the gold market. By focusing on quality companies, diversifying geographically, leveraging dividend metrics, and staying informed about market trends, you can develop a robust strategy to maximize returns and minimize risks. Remember to align your investments with your financial goals and risk tolerance, ensuring a balanced approach to wealth creation through gold dividend stocks.

Gold junior miners are first-stage miners who explore and develop gold projects that contribute significantly to the world’s gold supply. Junior miners, on the other hand, are mostly involved with the identification of new gold resources and taking those resources to the feasibility level. As highly volatile with potential high returns, the nature of this business area has changed with new economic, technological, and geopolitical environments influencing its future. In the following article, the author discusses future perspectives for gold junior miners depending on the most important factors, the pros and cons of the activity, as well as possible difficulties.

The noble metal gold has been used throughout history as a measure of wealth, as an inflation-busting commodity, and as a haven from turbulent economies. Then, in recent years, the buys have come from central banks, jewelry, and investment barrels such as exchange traded funds. Their prospects are likely to remain more or less the same for junior miners given the fact that gold is revered to remain a vital commodity in the ongoing as well as future challenges the world economy is bound to encounter, such as inflation, fluctuations in currencies, tensions in geo politics among others.

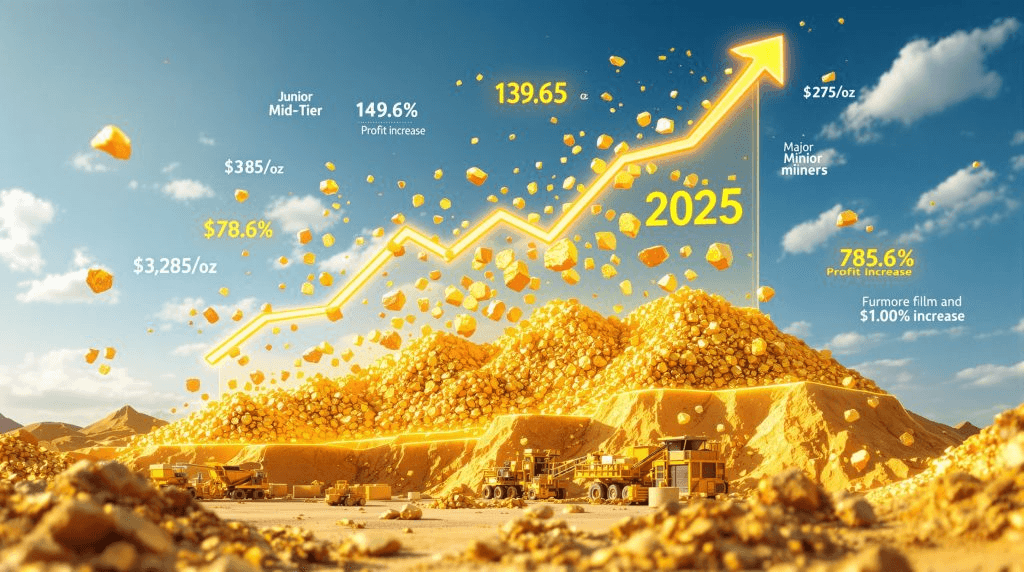

The gold price has been on the rise in the past couple of years owing to the volatile global economy and the rising use of gold. When gold prices are high, this is desirable because it increases recoverable reserves, and mining projects appeal to investors that fund exploration work.

Exploration and mining technology advancement is easing costs and precision of the resource estimates. Junior miners can now easily use Geographical Information System (GIS), AI, and remote sensing techniques for better identification of potential deposits and therefore, raise their first pass success ratio substantially.

Many major mining companies rely on juniors to provide a pipeline of new projects. Partnerships, joint ventures, and acquisitions are becoming more common as major miners look to juniors for growth opportunities. These collaborations can provide juniors with the capital and expertise needed to advance projects to production.

With a global shift toward sustainability, gold’s role in green technology and as a low-carbon investment is gaining attention. Investors focused on environmental, social, and governance (ESG) criteria are showing interest in junior miners that adopt sustainable practices, creating a niche market for those companies.

In resource-rich countries, governments are offering incentives to promote mineral exploration and development. Tax breaks, grants, and streamlined permitting processes can benefit junior miners, particularly in jurisdictions with a history of mining-friendly policies.

Junior miners often struggle to secure the funding needed for exploration and development. The high-risk nature, coupled with long lead times, makes attracting investors challenging, especially during periods of market downturns.

Stricter environmental regulations and lengthy permitting processes can delay or even halt projects. For junior miners, navigating these complexities without significant resources can be particularly burdensome.

Many promising gold deposits are located in politically unstable regions. Juniors operating in such areas face risks such as expropriation, civil unrest, and changes in mining laws.

Gold prices can be volatile, influenced by factors such as interest rate changes, currency fluctuations, and global events. For junior miners, this volatility can affect project viability and investor confidence.

As the demand for metals like lithium, cobalt, and nickel increases due to their use in green technologies, junior miners may face competition for investment dollars. Diversifying into these metals may be an option, but it requires strategic adjustments.

Investors are increasingly prioritizing ESG compliance, pushing junior miners to adopt sustainable and ethical practices. Companies that integrate ESG into their operations are more likely to attract funding and partnerships.

The integration of digital technologies is becoming a game-changer. Data analytics, machine learning, and automation are enhancing exploration efficiency and reducing operational costs.

Royalty and streaming agreements are providing juniors with alternative financing options. By selling future production at a discount, juniors can secure immediate funding without diluting equity.

With geopolitical risks on the rise, many companies are prioritizing projects in politically stable and mining-friendly countries. This trend could lead to increased exploration in regions such as Canada, Australia, and the United States.

Mergers and acquisitions (M&A) are expected to increase as larger miners seek to replenish their reserves. For juniors, this trend offers exit opportunities and pathways to production.

Investing in cutting-edge exploration technologies can improve discovery rates and reduce costs, enhancing the attractiveness of projects to investors and partners.

Demonstrating a commitment to sustainability can differentiate junior miners in a competitive market. Transparent reporting and responsible practices are key.

Collaborating with major miners, government bodies, and technology providers can provide the resources needed to overcome challenges and accelerate project development.

Expanding into other commodities or focusing on multiple projects can mitigate risks and provide additional revenue streams.

Building strong relationships with investors through clear communication and consistent performance is essential for securing capital.

A mix of promising opportunities and formidable challenges shapes the future of gold junior miners. While rising gold prices, technological advancements, and strategic partnerships present significant growth potential, issues like regulatory hurdles, geopolitical risks, and market volatility require careful navigation.

For junior miners to succeed, a focus on innovation, ESG compliance, and strategic collaboration will be crucial. As the global demand for gold continues to grow, these small but ambitious companies are well-positioned to play a pivotal role in the mining industry’s evolution. Investors willing to embrace the risks may find that gold junior miners offer not just financial returns but also the excitement of contributing to the discovery of the next big gold deposit.

Gold holds an interesting fascination for longstanding adventurers and miners as well as investors at present. Alaska, commonly known as the “Last Frontier,” gives any intended gold miner an exciting chance in the rich placer ground. For this purpose, these kinds of ‘ploring’ claims, where gold can be panned right out of loose sediment and gravel, represent a major investment. However, to wade right in, one must learn more about several particularities of investing in Alaska placer claims for sale. As a result, this article gives a detailed analysis of the topic, paying much attention to the possibilities of advantages, threats, and guidelines.

Placer claims refer to mineral claims where valuable minerals, such as gold, are found in loose deposits rather than embedded in solid rock. These claims are often located along rivers, streams, and ancient riverbeds where water has deposited gold particles over time. In Alaska, placer mining has a rich history dating back to the Gold Rush era and continues to be a viable investment avenue today.

Rich History and Proven Reserves: The state of Alaska contains some of the richest pay gravels in placer gold in the world. Some of the areas that have a rich history of gold mining include Fairbanks, Nome, and the famous Klondike belt, therefore are some of the most favorable areas to invest in.

It is recommended to acquire a legal placer claim and to confirm its legal compliance as well as the possession of necessary licenses. The Alaska authorities regulate and control any mining activities, including water utilization and discharge.

The location of the claim significantly impacts its value and feasibility. Claims near established mining areas often have better infrastructure and higher chances of success.

Conduct a thorough assessment to estimate the gold reserves on the claim. This may involve geological surveys, sampling, and consulting with experts.

Evaluate the accessibility of the claim. Remote locations may have untapped potential but can be challenging and expensive to operate.

Factor in the costs of equipment, labor, transportation, and compliance with regulations.

Begin by understanding the placer claim market. Online platforms, local mining organizations, and government resources can provide valuable insights.

Whenever possible, visit the claim in person to assess its potential. This allows you to evaluate the terrain, water availability, and other critical factors.

Verify the claim’s ownership and ensure there are no legal disputes or environmental violations.

Negotiate the purchase price based on the claim’s potential and market value. Engage a legal expert to ensure a smooth transaction.

Create a detailed plan outlining mining operations, budget, and timelines. This should include strategies for gold recovery, waste management, and compliance with environmental regulations.

Secure all required permits from the Alaska Department of Natural Resources (DNR) and other relevant authorities.

With proper management, placer claims can yield significant profits, especially during periods of high gold prices.

Placer claims are tangible assets that can be sold, leased, or mined directly, offering flexibility to investors.

For many, investing in placer claims offers more than financial returns; it’s an opportunity to experience Alaska’s rugged beauty and mining heritage.

The amount of gold in a placer claim can be unpredictable, and not all claims are profitable.

Strict environmental and mining regulations can pose challenges and increase costs.

With respect to environmental factors that affect mining operations, extreme weather, geographical location and some other problems of logistics are some of the well-known difficulties inherent in mining.

Gold prices can fluctuate significantly, impacting the profitability of placer mining.

Begin with a smaller claim to gain experience before scaling up to larger operations.

Collaborate with experienced miners, geologists, and legal experts to maximize your chances of success.

Do not make all your efforts in one basket as this will likely not help your case. It is worthy of note that, diversification across multiple claims can act as a risk precipitous measure.

Use modern mining equipment and technology to increase efficiency and gold recovery rates.

Develop awareness of important changes in laws, markets, and improvements or innovations in the methods of mining.

There is the availability of Alaska placer claims for sale, which should be urged to be developed to expand value from one of the richest gold deposits on the surface of the world. However, as it is with any investment venture, there is always the risk factor and the challenge that accompanies it.

So, while it’s possible to realize the potential of these claims through conducting the necessary research, doing the relevant due diligence, and incorporating the data obtained from experts, it’s still possible to attract investors and gain commercial success that will bring significant benefits to the participants of the resource extraction and the local community as well. For experienced investors, depending on the property, Alaskan placer claims can be very lucrative, or for those willing to go gold mining, alternatively, Alaska proves to be an exciting new world.

Mining juniors, defined as small-cap companies engaged primarily in exploration and early-stage development of mineral projects, represent an intriguing yet high-risk sector of the investment landscape. For investors seeking exposure to the commodities market, mining juniors offer significant upside potential, often driven by resource discoveries, favorable market conditions, and strategic partnerships. However, the inherent risks demand a comprehensive understanding of the sector, thorough due diligence, and a diversified investment approach.

Exploration and development is a core activity of mining juniors, who are usually classified as small-cap ventures involved in mineral exploration. However, juniors are also explorationists who look for deposits that are still not commercially developed and, in many instances, may grow up to become the major mining companies of the future. Such companies generally have less cash reserves, and they have to rely on financial assistance for their prospecting ventures. The spot for mining juniors attracts proportionate attention due to the opportunity of getting higher value returns.

A positive development in a prospect or a positive feasibility study can lift the value of a junior mining company to an extent that attracts the attention of majors who may take over the project or the whole company. It forms a situation in which large prospects of capital appreciation are attainable but always with very high velocity and uncertainty.

Several factors influence the investment potential of mining juniors:

Despite the opportunities, investing in mining juniors carries substantial risks:

To maximize the potential of investing in mining juniors while mitigating risks, consider the following strategies:

Mining juniors remain a very risky investment category for the provision of which can attract very high returns and with increased preparedness to deal in the industry. They are able to emulate the growth path pursued by such companies by investing in quality projects, researching extensively, and building a diversified portfolio. Despite these challenges, risk driven by the potential discovery of the next big mineral deposit makes mining juniors a very exciting area for the adventurous investor who wants to participate in the evolving commodities cycle.

Junior copper mining companies are a major component in the supply chain of copper around the world. As is the case with most industries, medium to small-size mining companies are the ones that go unnoticed, but they are the ones who form the industry backbone that sustains and powers the industry and produces something of value. As copper is used in renewable energy systems, electric cars, and new-age structures, the need for this primary metal is set to soar. Innovations in junior copper mining successfully provide such demands and, at the same time, influence the formation of the sector’s future.

A junior copper mining company may be defined as a relatively small enterprise engaged mainly in exploration for the new mineral assets. These companies first expel the risk of exploration and discovery of assets and provide then an entry point for larger mining companies to enter for the initial mass production. Since new copper sources are needed to meet these emerging green energy and electrification projects, juniors are now essential in locating the red metal.

One of the most significant challenges for junior miners is locating economically viable copper deposits. Recent technological advancements are revolutionizing how these companies explore and evaluate potential mining sites:

Once deposits are identified, the challenge shifts to extraction. Junior copper miners are adopting innovative methods to extract copper more efficiently and sustainably:

Sustainability is at the forefront of innovations in junior copper mining. Companies are adopting practices that prioritize environmental stewardship and community well-being:

Collaboration between junior miners, technology providers, and research institutions is driving innovation in the copper mining sector. Partnerships allow companies to share expertise, access cutting-edge technology, and pool resources to tackle challenges effectively. Additionally, government grants and private sector investments are providing much-needed financial support for research and development in the junior mining space.

Digital transformation is reshaping the way junior copper miners operate. From exploration to production, digital tools are enhancing efficiency and decision-making:

Despite the exciting advancements, junior copper miners face several challenges, including:

Junior copper mining is most advanced in terms of technology and sustainability to cater to the increasing global copper requirement. A look at these companies shows that not only are new copper deposits being discovered through the application of the latest methods, technologies, and ideas in exploration, mining, and digital transformation, but these firms are also leading the way in terms of sustainability in this industry. With the world turning into a green and electrified society, the roles of junior copper miners will be crucial when it comes to the supply of this essential resource.

In the recent past, nickel demand has increased significantly, boosted by the fact that the commodity plays a crucial role in manufacturing electric vehicle (EV) batteries, stainless steel, and many other industrial processes. Nickel stocks are increasingly an opportunity for investment now that the world is shifting towards more green sources of energy and technology. This article shall explore the basics of nickel as a commodity, factors that influence the market, and some important considerations when considering investment in nickel stocks.

Nickel is the most versatile of the metals, mainly consumed for the production of stainless steel. It accounts for a percentage of 70 in nickel consumption worldwide. In addition to this role, the production of lithium-ion batteries has recently brought this nickel into prominence. Nickel-rich chemistries, such as NCA and NMC, have been preferred over energy density and its performances; hence, they are indispensable in the EV market.

The global push for decarbonization has placed nickel in the spotlight. Governments and corporations worldwide are committing to net-zero carbon goals, increasing the adoption of EVs and renewable energy systems. As a result, the demand for high-grade nickel, especially Class 1 nickel suitable for battery production, is expected to grow exponentially.

Investors can gain exposure to the nickel market through various types of stocks:

When investing in nickel stocks, consider the following factors:

Investing in nickel stocks involves risks that must be carefully managed:

Nickel is an attractive investment opportunity given its strategic importance in the global energy transition and industrial applications; however, it requires careful research and a well-informed strategy to navigate the complexity of the nickel market. Only then can investors be informed on how to position themselves for profits resulting from the growing demand for nickel.As with any investment, always consult financial advisors and do due diligence before committing capital. Whether you opt for mining giants, battery material innovators, or diversified ETFs, investing in nickel stocks puts you on the path toward participating in the green revolution and industrial growth.

Known for its vast, wild interior and significant natural wealth, Alaska has been a land of opportunity for prospectors as well as investors. Throughout history, the state's economy and social life have been highly influenced by the gold mining industry. Buying a gold claim for sale in Alaska offers individuals and business entities the chance to get involved in this promising sector. Such benefits can include economic growth, investment potential, and others.

Alaska is one of the richest gold-producing regions worldwide. The state has great extensiveness in both placer and lode deposits. Many opportunities are available to the prospectors to unearth precious gold. Places like Nome, Fairbanks, and the Yukon region have been known for having significant amounts of gold found there. When one acquires a gold claim, the land is already established with these valuable deposits so it eliminates much of the prospecting guesswork.

Having a gold claim in Alaska will give you an exclusive right to mine and extract minerals in that designated area. Such legal ownership means state and federal laws will protect your operations. Furthermore, with a claim, the issue of dispute over the territory is not a risk since you have a legal basis for ownership and can go ahead with your mining without interruption from other parties' lawsuits.

Most investors are interested in gold mining due to the financial returns that follow. Gold is a resource that is globally known as an asset of long-standing worth, and hence, the investment yields stability even in bad times of economies. Investing in a gold claim in Alaska allows potential income generation from extracting or leasing the claim to a gold miner. As well, gold prices usually surge upwards, thus yielding considerable profits.

Incorporating gold claims into your investment portfolio offers diversification, which is essential for mitigating risk. Unlike stocks or bonds, which are subject to market fluctuations, gold holds intrinsic value. Owning a gold claim provides a tangible asset that can serve as a hedge against inflation and economic instability. Moreover, the land itself may appreciate over time, adding another layer of financial security.

For small-scale miners and hobbyists, owning a gold claim in Alaska is an excellent way to engage in mining activities without the complexities of large-scale operations. Many claims are well-suited for placer mining, which requires relatively simple equipment and techniques. This accessibility allows individuals to enjoy the adventure of mining while potentially reaping financial rewards.

Alaska’s strategic location offers unique advantages for mining operations. Proximity to key transportation routes, including ports and highways, facilitates the movement of equipment and extracted materials. Additionally, the state’s mining-friendly regulatory environment supports claim owners by providing resources and guidance to streamline operations.

Gold mining operations in Alaska may qualify for various tax benefits, including deductions for equipment, supplies, and operational costs. These incentives can significantly reduce the financial burden of starting and maintaining a mining operation. Claim owners should consult with tax professionals to fully understand and capitalize on these benefits.

Beyond the financial rewards, owning a gold claim in Alaska offers a unique lifestyle opportunity. The state’s breathtaking landscapes, abundant wildlife, and pristine wilderness provide an unparalleled backdrop for outdoor adventures. Many claim owners find immense satisfaction in the process of mining, from exploring new terrain to uncovering gold. This combination of work and recreation makes gold mining in Alaska a fulfilling experience.

The gold mining community in Alaska is tight-knit and supportive. By owning a claim, you become part of a network of miners, investors, and enthusiasts who share valuable insights and resources. This sense of camaraderie can enhance your mining experience and provide opportunities for collaboration and learning.

Modern mining practices in Alaska emphasize sustainability and environmental responsibility. As a claim owner, you have the opportunity to implement eco-friendly mining techniques that minimize environmental impact. By adhering to state and federal guidelines, you can ensure that your operations contribute to the long-term preservation of Alaska’s natural beauty while still reaping economic benefits.

Gold claims in Alaska often come with additional resources beyond gold, such as silver, copper, and other valuable minerals. These secondary resources can further enhance the profitability of your mining operation. Moreover, as technology advances, previously uneconomical deposits may become viable, increasing the long-term potential of your claim.

Gold claims in Alaska retain their value and often sell for a profit. If you choose to get out of the mining business or merely wish to liquidate an asset, having a gold claim is your marketable property in a highly sought-after commodity. The resale ability of your claim offers financial flexibility and potential huge returns on your investment.

While the benefits of owning gold claims are clear, it’s important to approach the process with due diligence. Here are some tips to consider:

There are many reasons to buy a gold claim for sale in Alaska - it is not just a way of investment but being a part of the storied industry with its rich past and promising future. Economical benefits are not less than personal benefits, whether these benefits are derived from economic success or personal fulfillment. Whosoever that one might be-investor with considerable experience, a young entrepreneur- Alaska offers that type of claim as one great option and chance. With the right kind of preparation and approach, one can unlock the infinite potential this golden opportunity represents.

From past times, Alaska has proven to be a gold miners' haven. The rugged landscapes, vast wilderness, and rich mineral deposits make this place ideal for gold search and extraction. With centuries of successful gold mining business, Alaska still attracts all investors and prospectors as part of the gold mining rush in the state. One way of entering this market is through the purchase of a gold mine claim for sale. However, what are the benefits of investing in Alaska gold mine claims for sale? In this article, we shall discuss the advantages of owning a gold mine claim in Alaska, ranging from the possibility of getting high returns to the unique opportunities offered by the state's mining environment.

Alaska is home to some of the most well-known gold mining districts in the world, such as the Fairbanks, Nome, and Juneau areas. The history of gold mining in Alaska dates back to the 19th century, when gold was first discovered in the region, sparking the famous Klondike Gold Rush. Since then, the state has continued to be a source of valuable gold deposits, and many gold mines have produced millions of ounces of gold over the years. As a result, the state’s long-standing reputation for producing gold makes it an attractive destination for modern-day miners and investors.

When purchasing a gold mine claim in Alaska, you're tapping into a well-established tradition of successful gold mining. The knowledge of where gold deposits are located, along with modern mining techniques, can help increase the likelihood of successful operations. The state’s geological survey data and mining reports offer insights into the best areas to prospect, and many claims are being sold by previous owners who have already identified the presence of gold in the area.

The primary attraction of owning a gold mine claim is the potential for substantial profits. Gold prices have historically been volatile, but over the long term, gold has proven to be a valuable commodity. In recent years, the price of gold has risen, driven by demand from investors and the global economic environment. This price increase has led to a resurgence in gold mining operations, with new investors flocking to Alaska to capitalize on the rising gold prices.

Purchasing an active or unpatented gold mine claim puts you directly on the doorstep of a possible large payday due to the presence of actual gold deposits. Even in smaller operations, great gains may be possible when you acquire a claim located within an area with proven, high-grade gold deposits. You will be in a position to operate it personally or rent it to another miner; the profit-making possibility exists.

Apart from these, gold mine claims in Alaska could prove to be a real investment. Because with time, the gold might grow. Hence, owning a claim would give long-term capital appreciation since the value of gold may grow and could be a promising source of investment.

Starting a gold mining operation from scratch requires significant capital investment, from purchasing land and equipment to obtaining permits and employing workers. However, by purchasing an existing gold mine claim, many of the initial costs are reduced. Often, a gold mine claim for sale comes with some of the preliminary work already done, such as prospecting, land surveys, and sometimes even initial mining equipment.