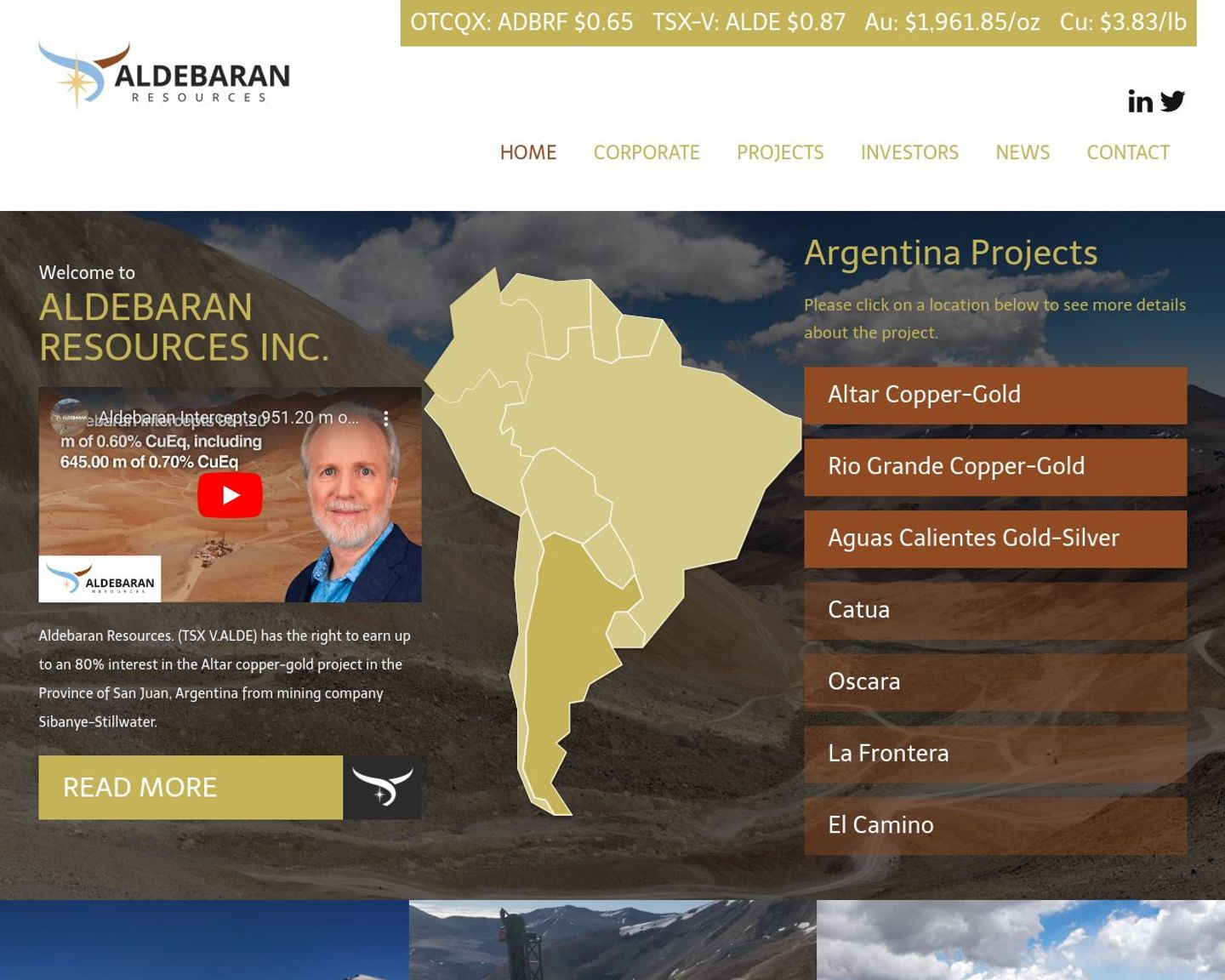

1. Limited geographical diversification: Aldebaran Resources Inc operates primarily in Argentina, which exposes the company to political and economic risks associated with the country.

2. Small market capitalization: Aldebaran Resources Inc has a relatively small market capitalization compared to its peers, which may limit its ability to attract investors and raise capital.

3. Limited production: Aldebaran Resources Inc is still in the exploration phase and has not yet started commercial production, which may limit its revenue generation potential.

4. High exploration costs: The exploration and development of mineral resources can be expensive, and Aldebaran Resources Inc may face challenges in raising sufficient funds to finance its exploration activities.

5. Dependence on commodity prices: Aldebaran Resources Inc's financial performance is highly dependent on the prices of the commodities it produces, which can be volatile and subject to fluctuations.

6. Limited track record: Aldebaran Resources Inc is a relatively new company with a limited track record, which may make it less attractive to investors compared to more established peers.