1. Limited exploration and development activities - Minsud Resources Corp has limited exploration and development activities compared to its peers, which may limit its growth potential.

2. Small market capitalization - The company has a small market capitalization compared to its peers, which may limit its ability to attract investors and raise capital.

3. Limited financial resources - Minsud Resources Corp has limited financial resources compared to its peers, which may limit its ability to fund exploration and development activities.

4. Limited production - The company has limited production compared to its peers, which may limit its ability to generate revenue and profits.

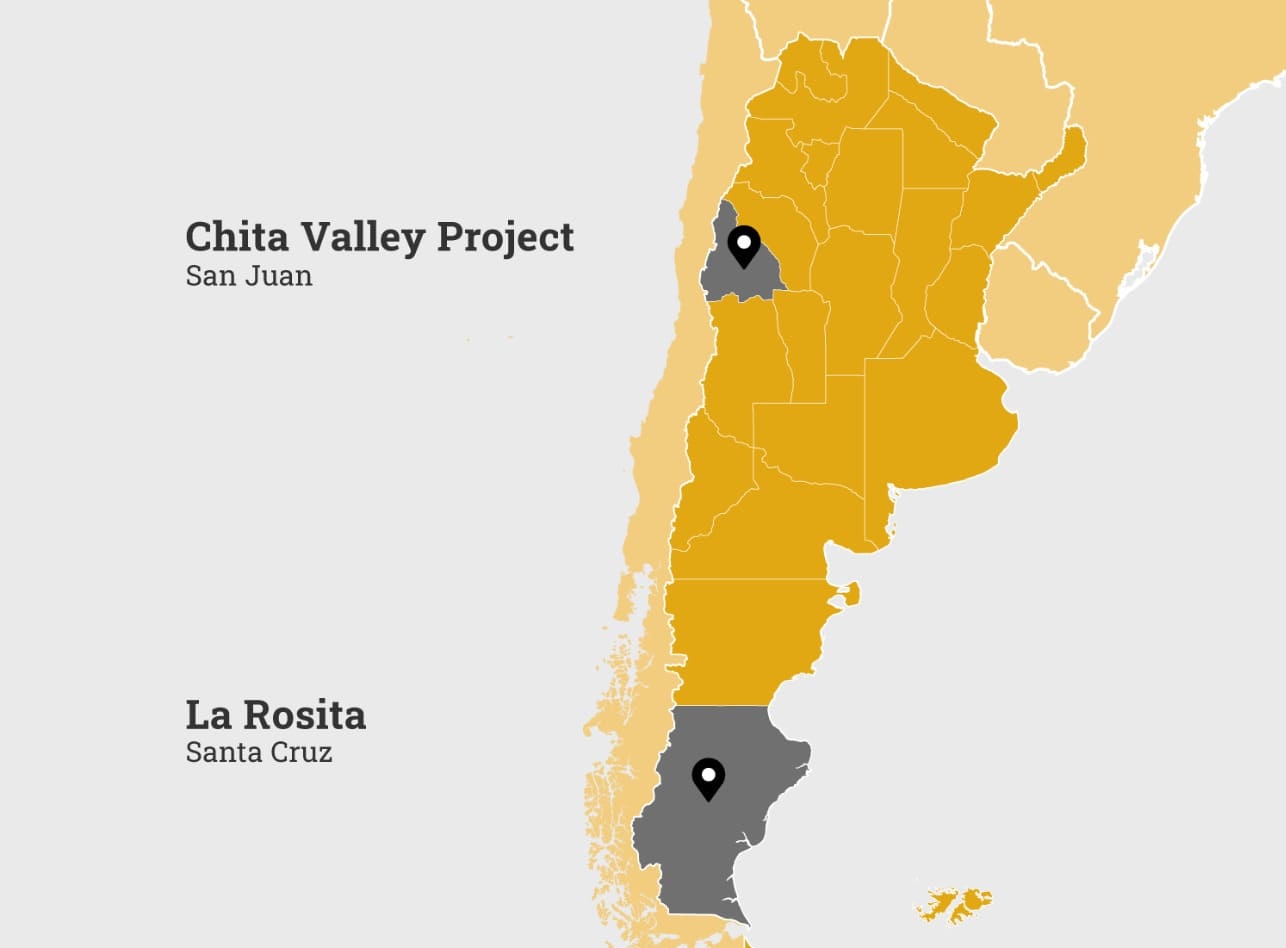

5. Dependence on a single project - Minsud Resources Corp is heavily dependent on its Chita Valley project in Argentina, which may increase its risk exposure and limit its diversification.

6. Limited geographic diversification - The company has limited geographic diversification compared to its peers, which may limit its ability to mitigate risks associated with political and economic instability in a particular region.

7. Lack of established partnerships - Minsud Resources Corp has limited established partnerships with other mining companies or industry players, which may limit its ability to access new opportunities and resources.

8. Limited track record - The company has a limited track record compared to its peers, which may limit its credibility and reputation in the industry.