1. Limited exploration and production capabilities - NV Gold Corporation has limited exploration and production capabilities compared to its peers, which may limit its ability to identify and develop new mineral deposits.

2. Small market capitalization - The company has a relatively small market capitalization compared to its peers, which may limit its ability to attract investment and finance its operations.

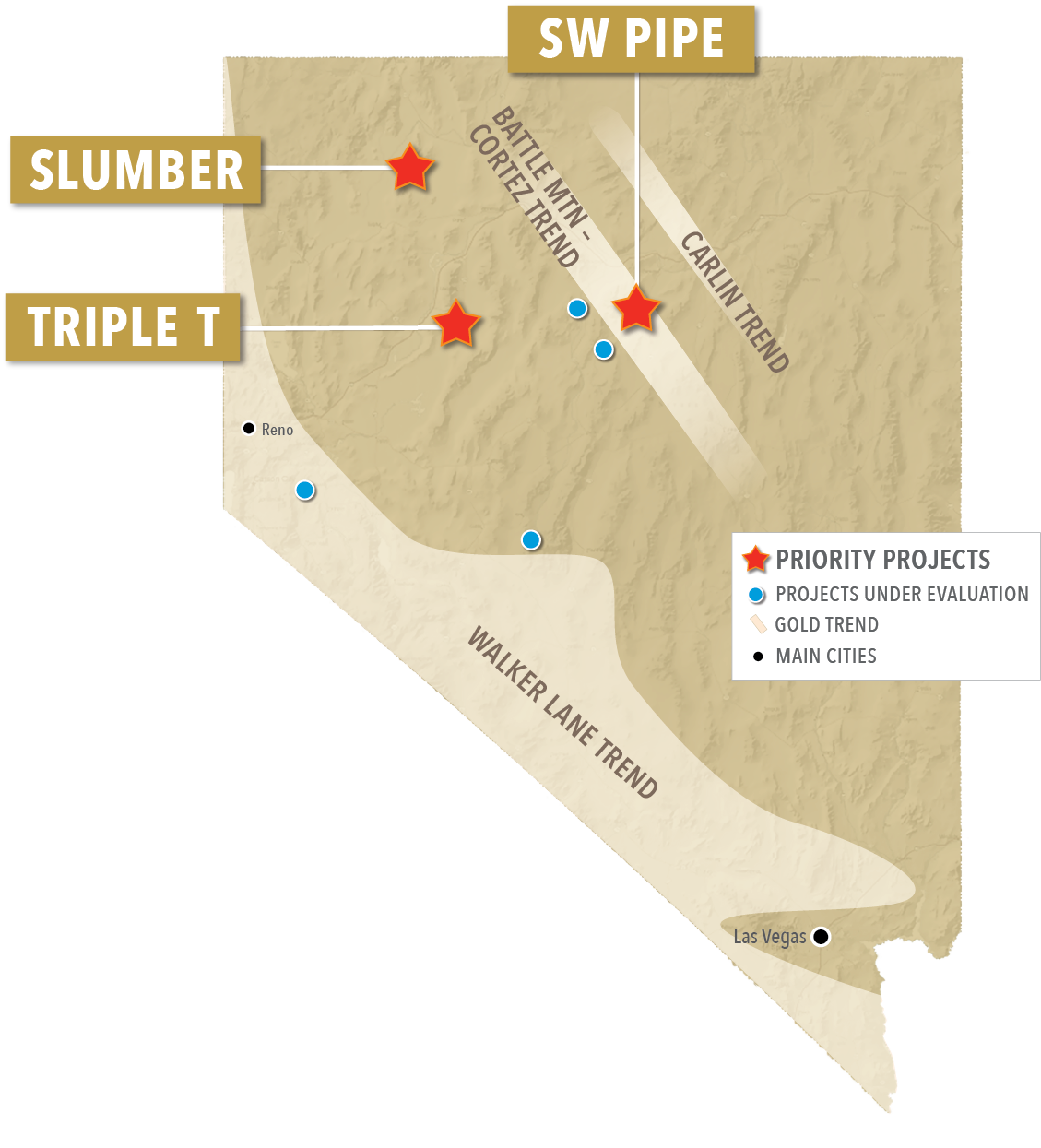

3. Limited geographic diversification - NV Gold Corporation's operations are primarily focused in Nevada, which may limit its ability to diversify its operations and reduce its exposure to regional risks.

4. Limited financial resources - The company has limited financial resources compared to its peers, which may limit its ability to invest in exploration and development activities.

5. Dependence on key personnel - NV Gold Corporation is highly dependent on the expertise and experience of its key personnel, which may pose a risk to the company if they were to leave or become unavailable.

6. Limited track record - The company has a limited track record of successful exploration and development projects, which may make it less attractive to investors and partners.

7. Exposure to regulatory risks - The mining industry is subject to a range of regulatory risks, including environmental regulations and permitting requirements, which may pose a risk to NV Gold Corporation's operations and profitability.