1. Limited production capacity - Signature Resources Ltd has a relatively small production capacity compared to its peers, which limits its ability to generate revenue and compete effectively in the market.

2. Limited resources - The company has limited financial and human resources, which can hinder its ability to invest in new projects, expand its operations, and compete with larger companies.

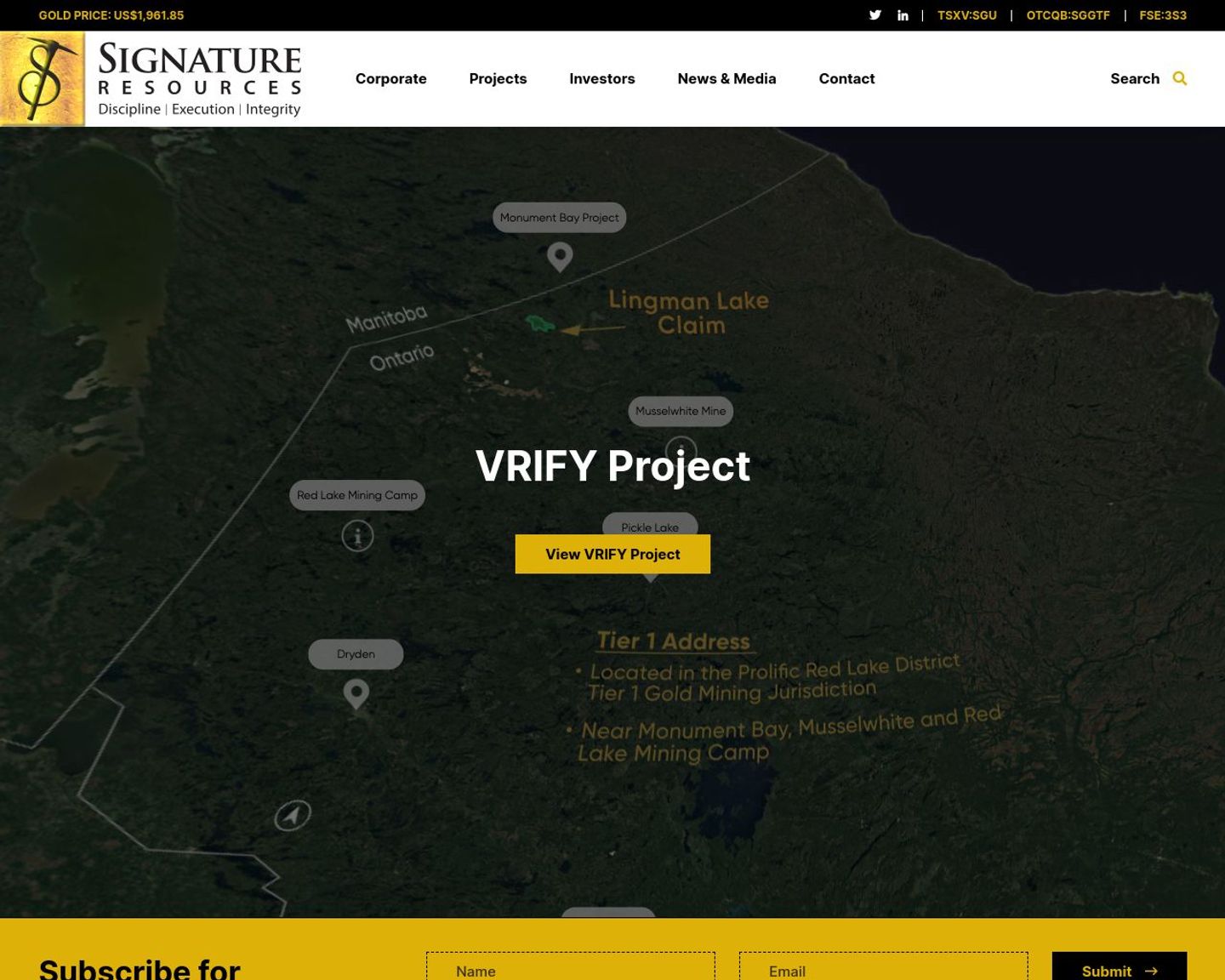

3. Dependence on a single project - Signature Resources Ltd is heavily dependent on its Lingman Lake gold project, which exposes the company to significant risks if the project fails to meet expectations or encounters operational challenges.

4. Lack of diversification - The company's focus on gold exploration and production limits its ability to diversify its revenue streams and mitigate risks associated with fluctuations in commodity prices.

5. Limited market presence - Signature Resources Ltd has a relatively small market presence compared to its peers, which can make it difficult to attract investors, secure financing, and compete for new projects.

6. Regulatory challenges - The mining industry is heavily regulated, and Signature Resources Ltd may face challenges in obtaining permits, complying with environmental regulations, and navigating legal and political risks associated with mining operations.

7. Vulnerability to market conditions - The company's financial performance is highly dependent on market conditions, such as commodity prices, exchange rates, and global economic trends, which can be unpredictable and volatile.