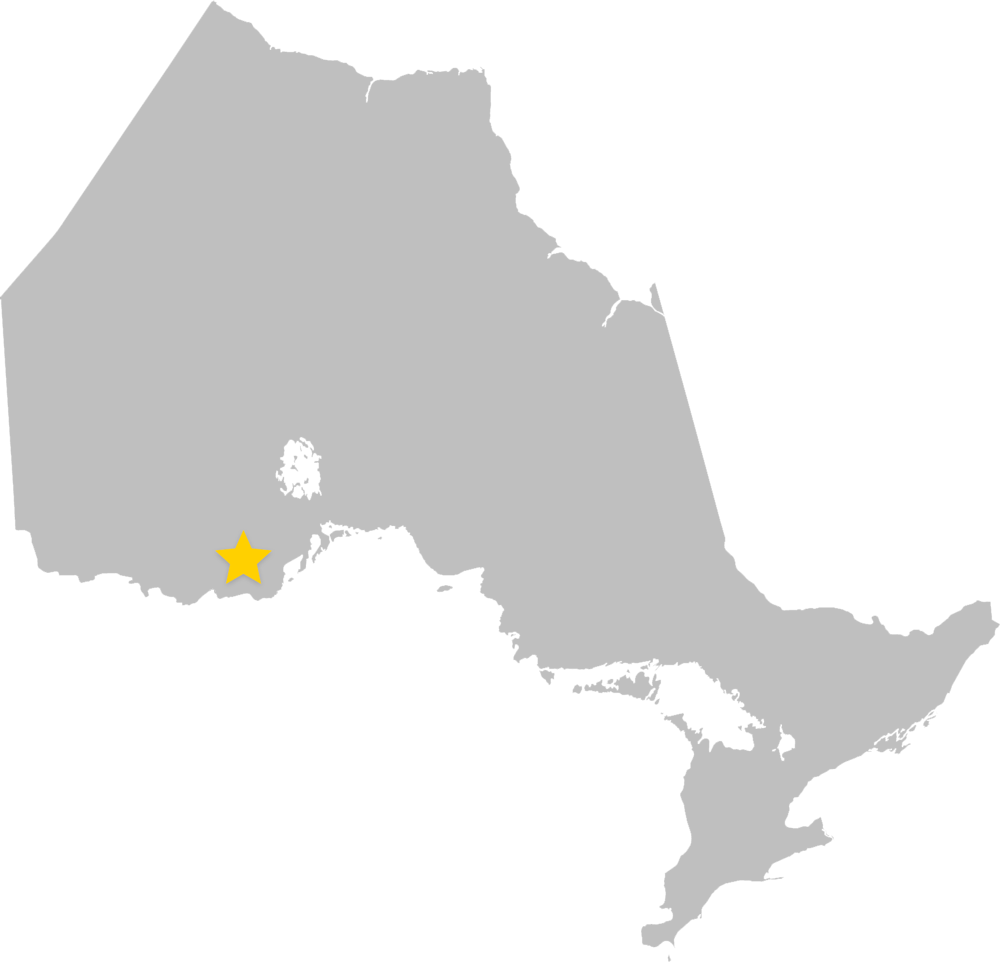

1. Limited geographical diversification - Sky Gold Corp operates primarily in Canada, which limits its exposure to other potentially lucrative mining regions around the world.

2. Smaller scale operations - Compared to some of its peers, Sky Gold Corp is a relatively small mining company, which may limit its ability to compete for resources and investment capital.

3. Limited production capacity - Sky Gold Corp's current production capacity is relatively small, which may limit its ability to take advantage of market opportunities and generate significant revenue.

4. Dependence on gold prices - As a gold mining company, Sky Gold Corp is heavily dependent on the price of gold, which can be volatile and subject to sudden fluctuations.

5. Environmental and social risks - Mining operations can have significant environmental and social impacts, and Sky Gold Corp may face challenges in managing these risks and maintaining its social license to operate.

6. Limited diversification of minerals - Sky Gold Corp primarily focuses on gold mining, which may limit its ability to diversify its revenue streams and mitigate risks associated with fluctuations in gold prices.

7. Limited access to capital - As a smaller mining company, Sky Gold Corp may face challenges in accessing capital markets and securing financing for its operations and growth initiatives.