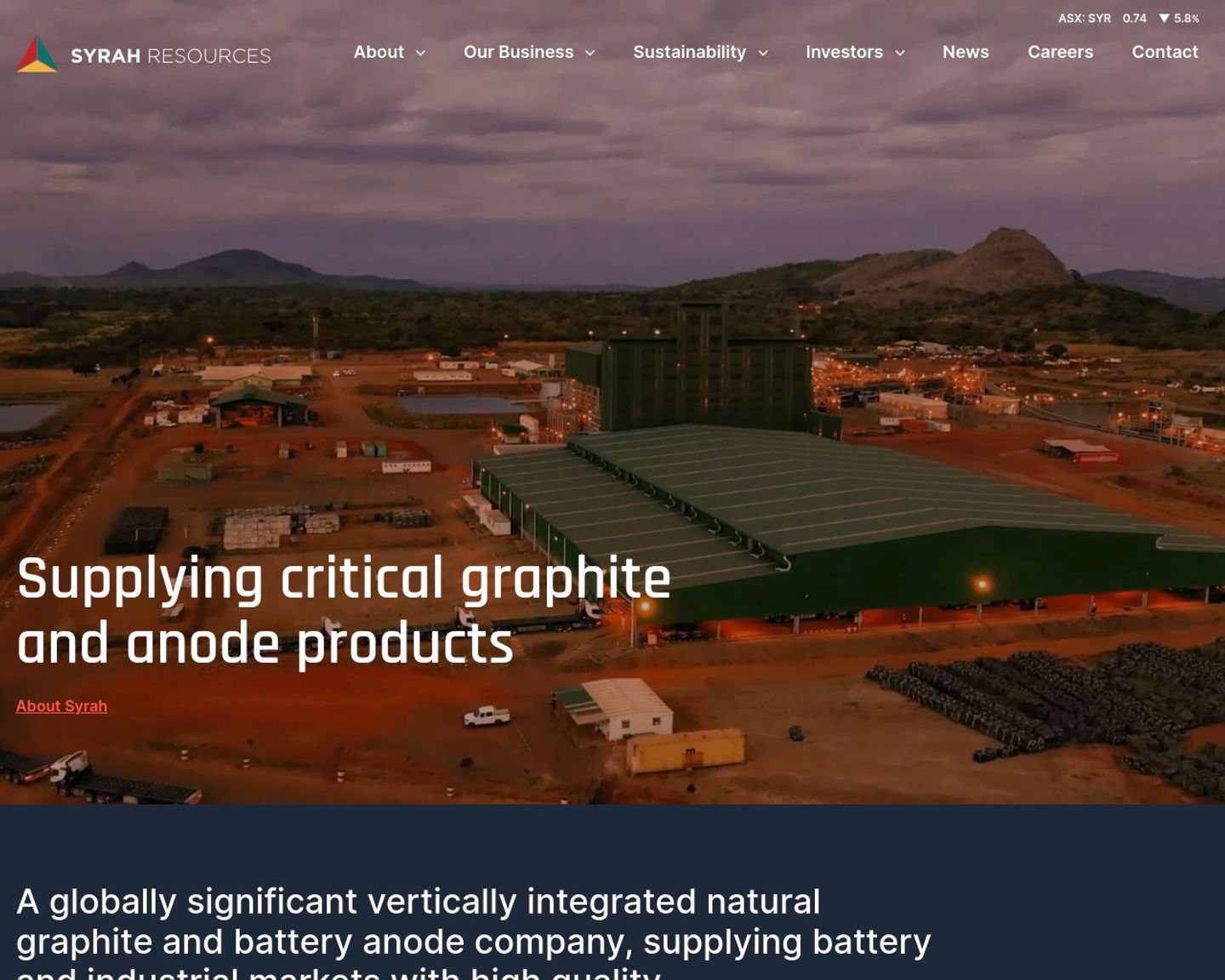

Syrah Resources Ltd is an Australian-based mineral exploration and development company that focuses on the production of high-quality graphite. The company's flagship project is the Balama Graphite Project in Mozambique, which is one of the world's largest graphite deposits. Syrah Resources also has exploration projects in Australia and Tanzania. The company is committed to sustainable and responsible mining practices and has implemented various initiatives to minimize its environmental impact. Syrah Resources is listed on the Australian Securities Exchange (ASX) and the US OTCQX market.