Zanaga Iron Ore Company Ltd is a mining company that is focused on the exploration and development of iron ore deposits in the Republic of Congo. The company's flagship project is the Zanaga Iron Ore Project, which is located in the south-west of the country.

The Zanaga Iron Ore Project is a large-scale iron ore deposit that is estimated to contain over 2.5 billion tonnes of high-grade iron ore. The project is being developed as an open-pit mine, with a planned production capacity of 30 million tonnes per year.

Zanaga Iron Ore Company Ltd is a joint venture between Glencore and the Zanaga Iron Ore Company, which is owned by a consortium of Chinese investors. The company was formed in 2010 and is headquartered in London, UK.

The company's strategy is to develop the Zanaga Iron Ore Project in a phased approach, with the first phase focusing on the development of a 12 million tonne per year operation. The company is also exploring other opportunities in the Republic of Congo, including the potential for a rail and port infrastructure project to support the development of the Zanaga Iron Ore Project.

Zanaga Iron Ore Company Ltd is a mining company that focuses on the exploration, development, and production of iron ore in the Republic of Congo. The company has a competitive edge in the following ways -

1. High-quality iron ore - Zanaga Iron Ore Company Ltd has access to high-quality iron ore deposits in the Republic of Congo. The ore has a high iron content and low impurities, making it ideal for steel production.

2. Strategic location - The company's iron ore deposits are located near the coast, which provides easy access to shipping ports. This strategic location reduces transportation costs and makes it easier to export the ore to international markets.

3. Strong partnerships - Zanaga Iron Ore Company Ltd has strong partnerships with major mining companies and investors. This has enabled the company to secure funding for its projects and access to expertise and technology.

4. Sustainable mining practices - The company is committed to sustainable mining practices and has implemented measures to minimize its environmental impact. This includes using renewable energy sources and reducing water consumption.

Overall, Zanaga Iron Ore Company Ltd's focus on high-quality iron ore, strategic location, strong partnerships, and sustainable mining practices give it a competitive edge in the mining industry.

1. Limited production capacity - Zanaga Iron Ore Company Ltd has a relatively small production capacity compared to its peers, which limits its ability to compete in the market.

2. High production costs - The company's production costs are relatively high, which makes it difficult to compete with other iron ore producers who have lower costs.

3. Limited geographical diversification - Zanaga Iron Ore Company Ltd operates in a single location, which makes it vulnerable to local economic and political factors.

4. Limited product diversification - The company produces only iron ore, which limits its ability to generate revenue from other minerals or products.

5. Dependence on a single customer - The company is heavily dependent on a single customer for its revenue, which exposes it to significant risk if that customer reduces its orders or switches to a competitor.

6. Limited financial resources - Zanaga Iron Ore Company Ltd has limited financial resources, which limits its ability to invest in new projects or expand its operations.

7. Limited marketing and distribution capabilities - The company has limited marketing and distribution capabilities, which makes it difficult to reach new customers and expand its market share.

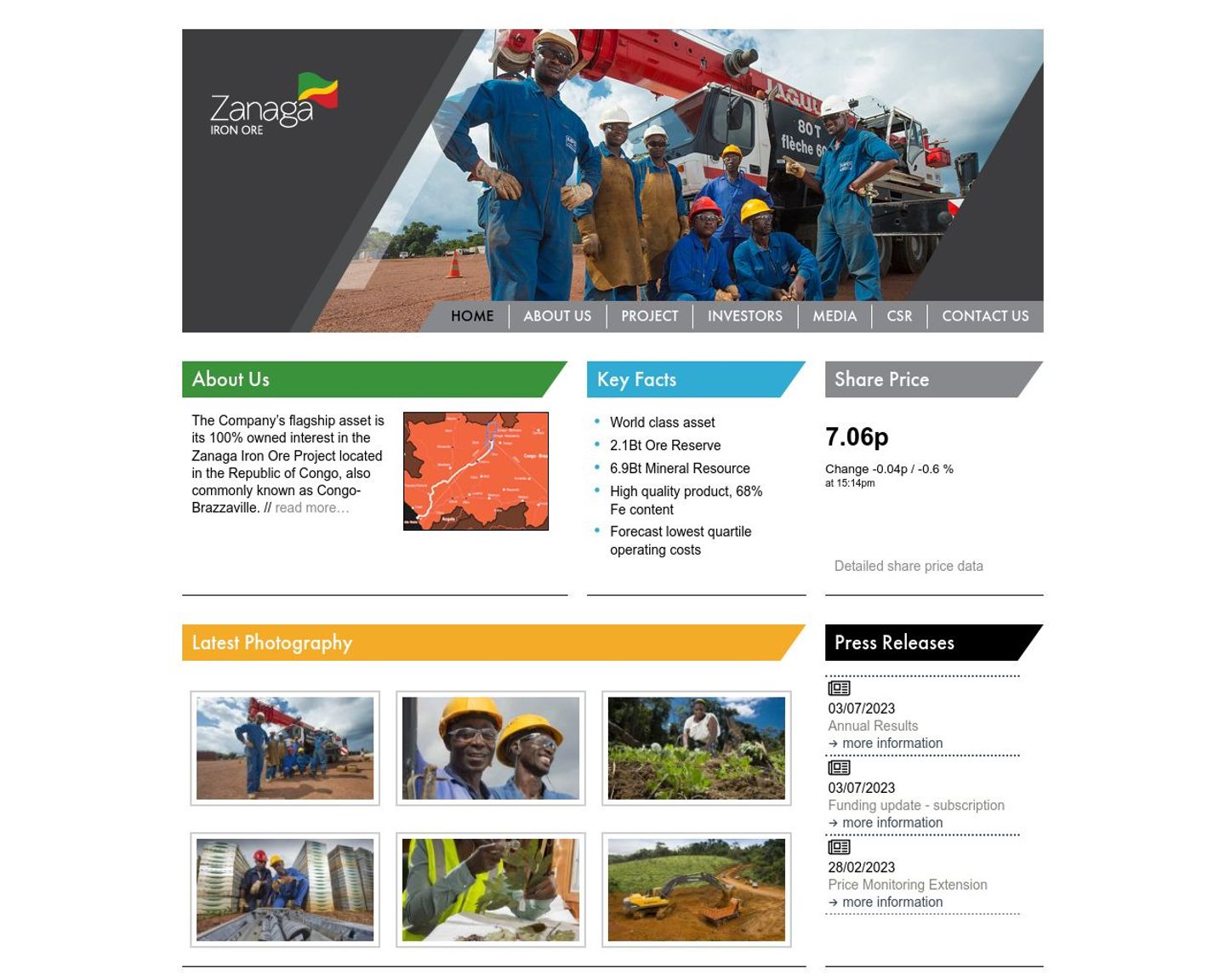

Zanaga Iron Ore Company Limited

Zanaga Iron Ore Company is a London-listed iron ore development company focused on the development of the Zanaga Iron Ore Project in the Republic of Congo.

About UsKey FactsShare PriceLatest PhotographyPress Releases

Zanaga Iron Ore - Zanaga Iron Ore

iron ore, mining, Congo, Africa, resources, exploration, development, production, infrastructure, logistics, export, freight, rail, port, shipping, commodities, minerals, metals, steel, investment, finance