I wrote an article a while back talking about investing in mining-friendly jurisdictions and why, as an investor, you need to be aware of the less friendly places. Basically, the gist of the article was that looking to invest in companies that have projects in "mining-friendly" places is a good place to start. Mining is high-risk, and the last thing investors need is government policies that are skewed against the mining company. This is one of the reasons why I like to look at companies that are working in either Canada or the USA. When looking at places in the USA, I favor places like Nevada and Alaska. In both these states, the resource industry plays a big part of the economy, and rules and regulations are sometimes easier to handle.

The other reason why I like Nevada is that it has a long history of mining, and you can't forget the world-famous Carlin Trend. Just like trading stocks when you hear the saying, "the trend is your friend" the same is true with the Carlin Trend of Nevada. There are several companies exploring and developing mines in Nevada. I did an article on Gold Standard Ventures back in January of 2016. Today we will take look another junior that is active in Nevada. Pilot Gold PLG is a junior that has an active project in Elko county called the Kinsley Mountain. Kinsley Mountain is a Carlin-style, sediment-hosted Pilot gold property located south of Newmont Mining's Long Canyon deposit.

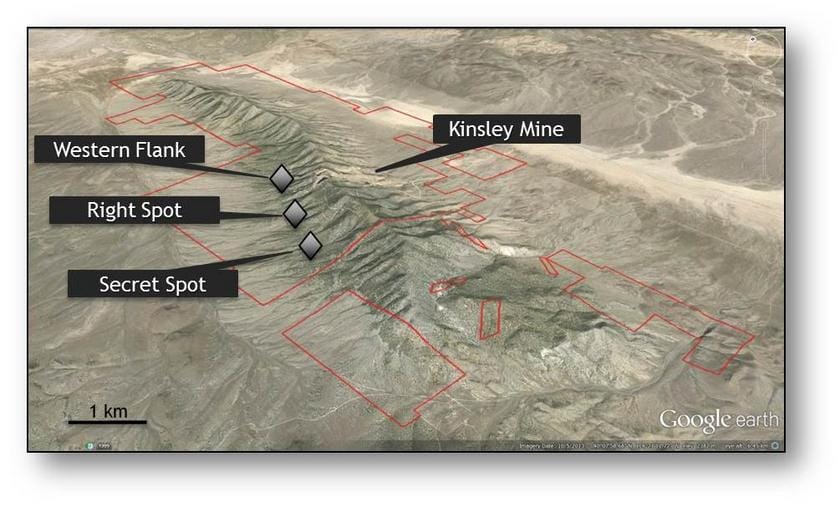

The Kinsley Mountain is a past producer mine. Pilot gold mineralization was discovered on Kinsley Mountain in 1984. Alta Gold Company purchased the property in 1994 and started open-pit mining in 1995, producing about 135,000 to 138,000 ounces of gold at grades of 1.4 g/t through 1999 from a series of six small pits aligned in a NW-SE direction. The mine closed when Alta Gold declared bankruptcy during a period of very low gold prices. Building on past data and new exploration today, Pilot Gold has identified some very interesting new targets. Drill results from an area approximately 150 metres northeast of the high-grade Western Flank intercepted high-grade gold in two key stratigraphic horizons, indicating the presence of a new mineralized zone that remains open to the east and wes

There is some very high grade potential on the project. The company recently completed an independent resource estimate that defines a significant high-grade zone at the Western Flank, along with near-surface oxide ounces. Mineralization hosted in the Secret Canyon Shale in the Western Flank zone includes 284,000 Indicated ounces at an average grade of 6.04 g/t gold. At a 3 g/t cut-off grade, most of the resource remains, delineating 248,000 Indicated ounces at an average grade of 9.15 g/t gold. Some highlights include:

The company's exploration strategy is focused on identifying additional areas of high-grade mineralization in the Secret Canyon Shale horizon, especially targeting the Kinsley North claims which have never before been drilled. Drilling at the Secret Spot target, located two kilometres to the south of the Western Flank target, resulted in the discovery of a thick zone of gold mineralization in the Secret Canyon shale, which is the same host for high-grade mineralization in the Western Flank. The existence of gold mineralization in the same unit two kilometres from the Western Flank suggests that mineralization could be wide-spread in this unit; follow up drilling is planned to test the extent of gold mineralization in this area.

The company also has a project in Utah called the Goldstrike and a project in Turkey. Goldstrike is host to a past-producing mine with an extensive exploration database, a large number of shallow drill holes with unmined oxide gold intercepts, and numerous untested gold targets. Goldstrike was an oxide, heap leach mine from 1988 to 1994. It produced around 209,000 ounces of gold and about 197,000 ounces silver from 8 million tonnes of ore at an average recovered grade of 1.2 g/t gold from 12 shallow pits. It closed due to low gold prices.

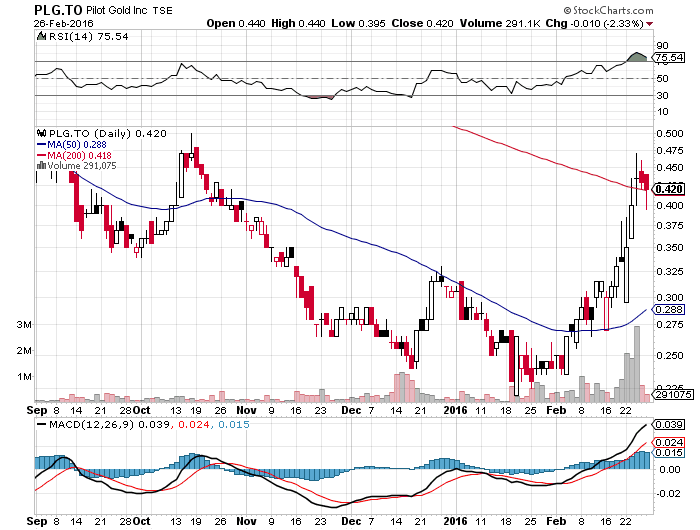

Just this past week Pilot Gold issued a news release about a new appointment of CEO along with $4.45-million PP. The company has around 110 million shares O/S and the PP will account for an aditional 17 million. Shares prices have seen a 22 cent low and $1.10 high for the past 52 weeks. In 2011 the stock prices was as high as $3.50.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.