Today we're going to take a look at a junior mining company that is not only exploring for gold but it is actually mining gold also. You will want to pay close attention because there is also a two fold reason why I'm doing this write up. You see this one company also has information about what could very well happen to another company that we are featuring. The company we'll be looking at today is Roxgold ROG and the country, Burkino Faso that they are working in and at the end of the article we will be able to see how their success could very well relate to the success of another company that is just getting started right close by.

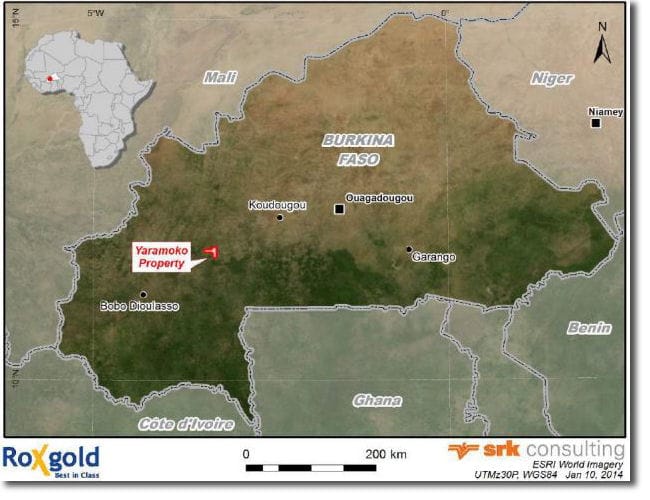

Roxgold is a gold mining company with its key asset, the high grade Yaramoko Gold Mine, located in the Hounde greenstone region of Burkina Faso, West Africa. The Company has been active in Burkino Faso on this property since 2010 and it had expected to reach commercial production in Q3 2016. In May of this year 2016 the company had it's first gold pour. So far this year there has been a total of 14,482 ounces of gold production.

Riverstone Resources started exploration work on the Yaramoko property in 2005 before Roxgold became involved in late 2010. Since that time the exploration programs have comprised of soil and rock sampling along with airborne and ground geophysics and various types of drilling including core drilling. During the summer of 2013, Roxgold commissioned SRK Consulting to lead a team of consultants to prepare a feasibility study. The objective was to demonstrate the economic viability of a proposed underground mine and onsite concentrator targeting the indicated mineral resources contained in the 55 Zone. This area or zone is the main area of interest and Roxgold is currently advancing this significant high-grade gold discovery which was fully permitted for construction in January 2015. The Company released the results of a positive Feasibility Study on April 22, 2014 and it was at that time that the company calculated on a life of mine of seven years and producing around 100,000 ounce of of gold per year.

At another area of the property called Bagassi South, Roxgold is continuing to evaluate the QV1 target which has returned high grade results in successive drill campaigns including results up for 41.4 g/t over 4.4 metres. The high grade nature of the initial results are very encouraging and will be followed up on in the current regional drill program as Roxgold continues to define and delineate more gold within this area.

So all of this information so far brings us to the the two fold part of this article. The second part has to do with not only the article I did on Burkino Faso but also has to do with Nexus Gold which at this time is our featured miner. You see Nexus Gold is also working in Burkino Faso and will be drilling possibly as soon as September 2016. The area they are drilling on is actually what was some of the property that Roxgold had and infact the lead geologist that is going to be in charge of this project for Nexus Gold is one of the very same geologists that was working with Roxgold a few years when the NI 43-101 in 2014 was done.

By going by the timelines of work that Roxgold did, this could very well be an example timeline of how a work program with Nexus Gold could be. Having a lead geolgist with expertise and already familiar with the geology of the area, the timeline and costs could be even less as a lot of the guess work is taken out of the equation now.

The above article is one example of how following and reading history in the junior mining sector can help you spot potential winners. At this present time Roxgold has a market cap of $600 mil and Nexus Gold has a market cap of just $3 mill.

If you enjoyed this article, please feel free to share. When seeking out mining stocks always use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.