NIMBY'S

Nov.15.13

Was reading a good article by Casey's about how the enviromental movement in the world today is right on course with shutting the world down. Everywhere you look and hear there are a bunch of do gooders that are out to make life misserable for others. Case in point is the news from Romania about the Rosia Montana mine that is for all intents and purpose a "no go". The company Gabriel Resources GBU has been working on developing this mine for around 14 years. It's not like this area has never seen any mining, it has been mined for about 2000 years but Gabriel would have liked to have mined the deposit using new technologies. After a bunch of protests from a lot of people the government decided that it would not grant the company the required go ahead.

There was a documentary done on this mine and other mines throughout the world called "Mine your own business" that went on to show how the locals viewed this mine. Poeple living is a town with no running water, outdoor crappers and no jobs. They interveiwed young men who only wanted a job but because a few enviro-freeks didn't want a mine and lobbied powers that be to get their way these young people are poised to live without. This all brings me to the next issue which is not related to mining but is still resource based and that is the issue of "Fracking"

There is a lot of Anti-Fracking in the news lately. You would almost think that it was some new crazed idea of the oil patch if you listen to all the fear mongers on the left side of society. Thing is, it isn't anything new. The fracking thing is has been going on longer that most of the anti-frackers themselves. The first ever frac was done in 1947. That's 66 years ago but you would almost think by the way these people talk it's all new in the last year or so and totally unproven and needs to be regulated and needs to addressed and needs to be studied and we need to be educated about all the comings and goings. In reality none of these anti frackers want to be educated in the science of fracking. They have already made their minds up that it is bad and should be banned. In reality though these anti frackers or nimbys are just a bunch of hypocrites. Take a look at just how hypocritical these guys are. Take a look at the photo below of a camp out at an anti-fracking protest over in England.

So when it comes to investing in fracking, where do you look? Well there is the usuals like Halliburton and Schlumberger, but there is also some smaller Canadian companies that are quite affordable and have a good positioning in Canada. Three companies worth looking at are Trican Well Service TCW,

Canyon Services FRC and Calfrac CFW. All three are TSX listed and pay dividends.

That's my rant for the day and as always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

When Stocks Just Don't Perform

Nov.10.13

Buying stocks whether it be mining stocks, tech stocks, blue chip industrials or what have you, the underlying issue is for the investor to make money. In order to make money you need to go long as in buy low and sell high or take a short postion on stock and hope it drops further. It seems like the old way of buy and hold strategy just doesn't seem to work any more. Low priced stocks just keep going lower, especially mining stocks. Good news of any kind of discovery is met with immediate profit taking akin to "buy the rumor sell the news". Great news is met with yawns an shrugs. So what are the options for someone who wishes to stay in metals to invest in aside from buying physical metal or out right buying into a mining operation?

One great way to invest or trade is by trading the metals ETF's. When it comes to ETF's though, most people only think that there is one or two ETF's that trade in metals. Those two being the

GLD SPDR Gold Trust (ETF) and the SLV being the iShares Silver Trust (ETF). what a lot of people do not know is that there are a lot of different ETF's to trade or invest in that are involved with mining and metals.

With silver ETF's there is the AGQ ProShares Ultra Silver (ETF). To compliment the AGQ there is a silver short ETF also. The ZSL is a an ETF that can be traded as a short side trade if you feel silver is going to be going down. In fact had you been a silver bear and traded this ETF, you would be up 50% YTD.

There are lot of different ETF's for you to choose from. Almost all large funds now have some kind of bull and bear gold or silver fund. One google look into gold ETF's and you will about 17 different gold related ETF's. While the GLD is by far the most known I learned that had I been a gold bear this year I could have bought DZZ the Deutsche Bank AG DB Gold Double Short ETN and been up 61% YTD on my investment. (However being a gold bull would have made it a tough decision to make a purchase on a gold bear play).

There is also ETF's for the miners. The most popular is the GDXJ being the Market Vectors Junior Gold Miners ETF. Market Vectors also has a rare earth ETF. The REMX. BMO also has a junior gold ETF the BMO Junior Gold ZJG and there is also the Claymore Global Mining ETF CMW.

No need to worry now about wondering if you should trade mining or metal stocks anymore. With ETF's going both bull and bear there is plenty of choices out there where you can trade or invest.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Miners With and Without Money

Nov.3.13

What is the most rare thing in the world? How about a miner with money? Everyday we read about all the broke miners who can't get any financing and are having to get taken over or JV their projects. Everyone thinks it's just the little junior that is having a tough go but this past week kind of revealed some interesting stories about Barrick Gold ABX trying to raise $3 billion. Also of news is that they are temporarily suspending construction of the Pascua-Lama gold mine that sits on the border between Chile and Argentina. One aways wonders that if the big majors are having problems then who can buy out the mid tier miner or do the JV's with them. If they don't have money then who does?

But there are companies who do have money and are in fact out mining and making money. While doing some research on various miners I came across Semafo SMF. Here is a company who has three mines in Africa and is active in mining them. The company has the Mana property located Burkina Faso, the Kiniero Mine in central Guinea and the Samira Hill in Niger. The Samira Hill mine is on care and maintenance.

In 2012 Semafo produced 236,000 oz of gold and the company can produce gold for between $800-$850 per oz. The company has zero debt and in March of 2013 had $137 million in cash on hand. There is around 270 million shares O/S. The great thing about this company that I like is that the stock trading volume is higher than most equities with the average volume being 1 million plus per day. Also when running a Vector Vest scan, the stock ranks right up with the best of them for safety value and timing. One of the biggest issues these day with so many small miners is the lack of liquidity with the stock. There is nothing worse than holding a stock that just doesn't trade or holding a stock that you can't sell.

For those who like to trade warrants, I updated the warrant list finally. I was am going to put them on a page of their own but for now I just posted them on this page. They are at the bottom of the page so just scroll down. A lot of the warrants might not be worth much, but some are dated into 2016 and 2017 so if you think the market will be turned around by that time you just might find some jewels among the gravel. Be sure to check them out. I will try to keep them updated as much a possible.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

It's Rollback Time Again

Oct.27.13

Just like Walmart, some of these junior miners want to do the roll back too. Problem is it is not always great for those who have already been a consumer of the company stock. I am not sure what to think about companies that start the old rolling back of 1:5 or 1:10 share basis. You have a 2 cent stock that ends up being a 10 cent stock but the treasury is still empty and the stocks starts to drift down anyhow. Back down to 2 cents or maybe even less. I don't really know why some companies do this. One of the reasons is that if you have a higher stock price it can be a bit easier to get financing. A lot of funds or money managers don't like dealing with companies that a quadzillion shares outstanding with a price of 1 cent. Having said this though I have rarely seen a rolled back stock ever get to a point where you were back in the money. I can't think of any but I do know of lots that just ended up in the same situation as they were before the rollback.

Just like Walmart, some of these junior miners want to do the roll back too. Problem is it is not always great for those who have already been a consumer of the company stock. I am not sure what to think about companies that start the old rolling back of 1:5 or 1:10 share basis. You have a 2 cent stock that ends up being a 10 cent stock but the treasury is still empty and the stocks starts to drift down anyhow. Back down to 2 cents or maybe even less. I don't really know why some companies do this. One of the reasons is that if you have a higher stock price it can be a bit easier to get financing. A lot of funds or money managers don't like dealing with companies that a quadzillion shares outstanding with a price of 1 cent. Having said this though I have rarely seen a rolled back stock ever get to a point where you were back in the money. I can't think of any but I do know of lots that just ended up in the same situation as they were before the rollback.

What really bothers me is there is a cost to all this. A lot of companies roll back the stock and do a name change. This all requires a lot of legal work along with stock exchange filings etc. and that all costs money. Money that could be used on a project, a JV or something more tangible. If nothing can be found as tangible, how about maybe just sit on what cash you have for a while and seek opportunities. I personally get upset because I have been involved as a share holder in various rollbacks and have yet to come out in the green and I could never figure out the name change. For me it's like management thinks that a new name will present new opportunities or new stock holders. Maybe it worked well years ago but in todays enviroment with the internet that NEW name is still painted with the old brush in my opinion. Anyone who does any kind of DD on management can soon figure that out.

So which companies are rolling back? Well this past week Decade Resources DEC did a 1:5 rollback. Foundation Resources FDN got an OK for a 1:10 rollback along with a name change to Birch Hill Gold Corp. effective Oct. 28 2013. I am sure that there are many more in the pipeline here and I will start posting them and letting you the readers know.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

CDNX Rebound?

Oct.25.13

North American Nickel NAN has their second set of assays out in a news release this week. Grades as high as 4.6 % over a 10 meter length. The stock? Went down! I am not sure what it takes anymore to rally a crowd. Maybe 100% pure nickel? Had these results been out about 15 years ago when Voiseys Bay was in the news this stock would be well into the 10 plus dollar range. And that was back then! For some strange reason there is more hype and pomp in copper and copper is a whole lot more abundant and less valuable price wise than nickel. Could be we've all been brainwashed into the "If every china man went out and bought a toaster the world would run out of copper" thinking, so copper is the hotter commodity of the day or else we maybe it's just search engines like google which hit over $1000 a share this week. Yes, one thousand dollars per share.

Helio Resources HRC put out news today stating that they are starting a diamond drill program to test the down plunge extensions of three high-grade zones identified within the Kenge resource at the company's 100-per-cent-owned SMP gold project in Tanzania. The stock rallied up almost 100% but closed the day up 35% @ 9.5 cents.

The junior resource market has been in a real slump for a long time, something like over 2 years now although it feels like forever. Even with all the articles telling us that China is buying up tons of gold and the economy is ready to collapse and the world is coming to and end, gold , silver and the miners are tanked out at the bottom. So the big questions is, "Are we at the bottom"? or will we stay in this slump for years to come. Well a picture is worth a thousand words and charts will always tell a story. I was sent a chart today that shows the CDNX is about to break out. What's big about this is that practically all the junior miners and small resource companies are listed on the CDNX. So maybe we are on the verge on a break out to the upside in the mining sector again.

Ka Ching. Hot 1/2 cent play for those who like to scatch and "maybe" win. Habanaro HAO is a 1/2 cent to 1 cent play that is getting a bit hotter. They were involved in some kind of oil play around Ft. MacMurrey that the Alberta government is suppose to compensate them for. They are also involved in a silver play in around Keno Yukon and have some claims of aluminus clay in Quebec. These aluminous clay claims in Quebec are bordering Orbite Aluminae ORT claim. Orbite has been in the news a bit lately as it is in the process of refining aluminous clays and the company also has a huge acreage of aluminous clays. Aluminous clays contain aluminum oxide which is used in aluminum. Back to Habanaro though, they also have properties gold in the White Gold area of Yukon which is a very prominant area of exploration. Some small bit of news from any of these plays could pop the stock up a cent or two. That's like 100% plus.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Short Trading Week

Oct.18.13

For those of us in Canada, it was a short trading week. Gold started the week off in the $1280 area but close up well into the $1300 area. Palladium popped the best on a percentage basis. Maybe this is the start of a turn around in the metals.

Zenyatta ZEN has sure been on a wild ride. Below is a 10 day hourly chart or trading activity. There is probably a lot of short postions on this play after the article published by Street Sweeper a while back. Surprisingly this stock has held up well.

Speaking of graphite, Canada Carbon CCB was up 25% today. it too has been on a wild slide downward but seemed to bounce back today. Caribou King CKR had a bit of a bounce also today, up 1.5 cents to 6.5 cents while Cavan Ventures CVN found itself sitting on lows.

I always seem to talk about small penny explorers here mainly because those are the stocks that I like to play. However, once you start to look around at what some of the mid cap miners and even large cap miners are doing, I am starting to notice trading opportunities with some of those. For instance, companies like Allied Nevada ANV. This is a stock that is at $4 bucks. It's 52 week high was $40 bucks. One would really wonder just how long this stock will trade at this level.

Should be news out next week.... maybe... for North American Nickel NAN on their next set of assays from Greenland. If you never read the last batch of assays allow me to refresh your mind. Grades up to 7% nickel. One hole intersected 25.51m grading: 3.25% nickel, 0.48% copper, 0.11% cobalt. Sadly like I mentioned in my last write up below, someone dumped out stock on good news like this and really spoiled the whole day for a lot of longs. You gotta remember though that there is going to be a series of news releases with this play and the nickel is there. Make no bones about it. These guys got the goods so far so this is still very much a play to watch and yes, I do own stock in NAN. The stock closed the week out at 37 cents.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

What Happened To NAN?

Oct.13.13

Here we are all hyped about North American Nickel NAN and their news release for assays. Well the assays did come out this past week and of course they were quite impressive. Grades over 3% with some grades as high as 7%. This is good stuff. Intersects 18.62m of 4.31% Ni, incl. 7.12m of 5.18% Ni. Assays of up to 7.06% nickel in MQ-13-026 and 6.26% nickel in MQ-13-024 have been received.

So with the good news you would think that the stock would rally somewhat. It didn't! It sold off! About 70% of the stock was dumped out on the market by ANON which is Anonymous. Not sure who the ANON was but this is the sort of stuff that really makes the retail investor mad. If companies are wondering why there is no interest in their plays, here is a good reason why. When I see large dumps of stock going out hitting bids, that tells me it's one of those houses that bought in on an earlier PP and they made their money, so out goes the stock creaming the little guy out who bought the stock for long term because of the story.

Just a few days before the news there was a press release stating that the Sentient Group has excercised their warrants. I am not sure how this all fits into the picture but something smells a bit fishy here. NAN closed the week down 5 cents at 34 cents.

Now I am not saying to dump out the stock at all. There is going to be more news released of additional holes drilled this past summer and if assays are as good or better than what we have seen so far, the stock should, and I said "should" rebound somewhat from where it is at right now. Long term this is a great play as the company does have cash on hand to go back to work next season and drill a whole lot more. This play is nowhere from being over.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Mining Stocks Got You Down?

Oct.5.13

This week I was looking over charts of mining companies trying to find some that are in an upward trend. Aside from the odd uranium or graphite stock, not much seems to be moving up. Even North American Nickel NAN was down a few cents on the week and there has been a lot of hype over them since they will be publishing assays most likely this coming week from their Greenland program.

Back to charts. I was looking at some of the ETF's that follow the junior mining stocks. One chart that caught my eye was the Direxion Daily Gold Miners ETF. As you can see form the chart below, the ETF has been pretty much sitting on bottom for quite some time.

What is interesting though with the chart is you will notice that during the early parts of the sell off there was very little volume. The record volumes for trading were last in the last few months. This could very well be a repositioning of shares at the bottom. It can be where a lot of longs are throwing the towel and getting out while the bottom feeders are itching to get in. You will

It does surprise me a lot that with the rumors or war with Syria, the US government shut down and everything else that seems negative, gold just can't seem to break out of the $1300 range.

Zenyatta ZEN had a an up down week. Yesterday the stock rallied back 12% from the day before. There are a lot of short postions on this stock. Also, Canada Carbon CCB was quite active. Almost 2 million shares trading on Friday as the stock rallied back up 9%.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Locked And Loaded

Sep.28.13

One of the bigger plays being watched these days is of course North American Nickel NAN. With the summer drilling all done and results of cores in, there is just the waiting with antisipation of the up coming assays results from this summers program. So this week with everyone waiting and the company doing a road show talking to bankers, brokers, analysts and news letter writers, along comes a new release that wasn't quite what some maybe expected and so we saw the stock sell off mid week. What happened was a classic read the head line and sell and never mind reading the rest of the story. So in the end, some folks cashed out in my opinion way way way too soon, while others who have been waiting in the wings to buy up some cheap stock, well, their dream came true.

Word I have heard is assays will be out around the end of the first week to first of second week of October. Of course there is always tons of speculation going on but that's what makes these plays so much fun to be involved in. It's especially more fun when you are in the stock under 25 cents. Reason being is it has been mentioned at one of these analysts meetings that the company is doing in Vancouver and Toronto, is that this play is looking really big. The ore body defined so far could very easily rival Voisey's Bay or Norlisk and Voisey and Norlisk are the two largest nickel mines in the world. This will be an interesting stock to watch over the next few weeks.

What else is hot? Uranium plays seem to be quite hot especially Fission Uranium FCU who is working in the Athabasca Basin. They have been quite aggressive in getting new releases out along with having some fairly good results from drilling so far. Something to make shareholders smile:)

Graphite plays slowed down this past week as volumes were light. Zenyatta ZEN traded light volumes and fell to end the week at $3.27. Caribou King CKR put out news that it had aquired more claim blocks in the area. The stock traded up at the end of the week to close at .085 cents on 2 million + shares.

Interesting article about ZEN this past week. Seems some gal that writes for the Street Sweeper news letter in the US has written up a story about ZEN as being fake. Of course once word gets out like that the shorts jump in on the stock like a bunch of dirty shirts. ZEN fires back calling the article, "petty mud throwing". Now heres the good part, the company has vowed that the StreetSweeper's short position will be blown out of the water should results come out in October as positively as the company intends.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Two Must Watch Plays

Sep.19.13

For anyone who comes to this page often, they will know that the site has been active in promoting what we feel are under valued stocks. One of those under valued stocks of course is North American Nickle NAN. The company has been working hard on drilling their 100% owned Greenland project for a few years and now the results of their work are slowly starting to show.

The stock sat in the 12-15 cent range for over a year while it was still known that there was great potential in this. play. Then 3 weeks ago the company released core results along with visuals of the cores and the stock did a 100% pop from 17 cents to 38 cents in one day. Fast forward 3 weeks to today and we see the stock hit 43 cents and still no news release. This is what an under valued play looks like. Investors who have done some DD and are starting to see what this company has for potential. Assays are expected this month and there is a lot of excitement surrounding this play.

Another way to play NAN is by buying into the stock of a sister company, VMS Ventures VMS. While VMS owns about 27% of NAN or about 30 million shares, it is also just months away from bring its Reed Lake copper mine into production. For every penny that NAN goes up, VMS earns about $300,000 on paper. You can buy VMS stock for 25 cents. Look, another great undervalued play.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Graphite 2

Sep.17.13

Last week I talked abit about graphite and some graphite stocks. After doing some DD myself on some of these plays it appears that the better plays are those who are closely associated with Zenyatta ZEN. Two of these plays have land holdings bordering ZEN and are at this point in time quite active in trading. The two juniors who are quite active are Caribou King CKR and Cavan Ventures CVN. Whether these plays will amount to anything down the road has yet to be seen but news last week from CKR stated that they had identified four significant conductors on Caribou King Resources Ltd.'s 100-per-cent-owned Mulloy graphite project, located 10 kilometres west of the Zenyatta Ventures Ltd. Albany graphite project in Ontario.

Today CVN put out news stating Cavan Ventures Inc. has provided results from an airborne geophysics survey over its Cage graphite property. The airborne survey has identified a number of magnetic lows within the property. The Cage graphite property is located 36 kilometres west of Hearst, Ont. The survey collected both high-resolution magnetic and time-domain electromagnetic (TDEM) data. The Cage property is adjacent to Zenyatta Ventures Albany graphite deposits' eastern boundary and situated approximately 5.5 kilometres from its east pipe where it has encountered substantial graphite mineralization

Both of these stocks have about 60 millions shares o/s and have been trading in the half million plus shares each day so there is ample opportunity for the investor or trader to get involved.

Shares of North American Nickle NAN have been creeping up over the last few trading days also. News about the assays are due out very soon and there is a lot of excitement out there. After reading previous news and seeing photos of the cores from their 100% owned play in Greenland, things are really looking big. Nickel doesn't get the same enthusiasm as gold or some other precious metals but just think back to Voisy's Bay and you will find yourself getting excited. If you were not around during the Voisy Bay days, maybe a slight reminder will help you out. Voisys Bay was a large nickel find that saw the stock go from $1.00 to over $150.00 in about 1 years time. With NAN, this could be your last opportunity to buy at these prices. The stock closed the day up 1.5 cents to 31.5 cents and saw 500,000 + shares traded.

Did you know that you can now trade silver and have your holdings held in Toronto? That's right! Bullion Vault now offers Canadian storage and trading of both gold and silver.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Graphite

Sep.10.13

I did some articles a while back on graphite stocks and some different graphite plays. After hunting down where I had written those write ups, I noticed they were back in 2012 and in this day and age, 1 year is like forever.

Now when we talk about mining stocks here the main focus is how to trade and make money with these stocks. After all we don't buy stocks for the good of our health, well maybe we do. After all having a bit more cash is good and you will feel healthier, right? Anyhow, back to the making money part. I just put up a new page on the website listing graphite miners. You can see that list here. Whenever I do compiling of lists I like do some quick reseach about each of the stocks because in a lot of cases these are companies I have never heard about. I mean we have all heard about Zenyatta ZEN in the news lately, but what about these other explorers. Are any of them active in graphite? Are any onto some big play that could spell money for a shareholder? Turns out that there are a few other interesting plays at the moment and there are some active trading stocks too.

One of these companies is Energizer Resources EGZ. Energizer has just

completed a maiden National Instrument 43-101 resources estimate with 9,246 metres of drilling, establishing Molo as one of the largest known graphite deposits in the world in Madagacar. This deposit of graphite consists of 84.0 million tonnes indicated at 6.36 per cent carbon, 40.3 million tonnes inferred at 6.29 per cent carbon.

Now I must be honest here because I know nothing about graphite. First time I heard anything graphite was about a year ago when there was a lot of talk about Northern Graphite NGC and I proceeded to investigate to see what all the excitement was all about. As usual I was late to the party, kind of like being late to hear about Zenyatta. Energizer stocks trades a high volume in the hundred of thousands of shares and is priced in the 15 cent range. There are about 200 million shares O/S.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

South American Silver

Sep.4.13

Today was one of those days where gold traded up nice as did the other metals, but silver out traded them all. At one point in time silver was up close to $24.50 cents. Silver has been on a real tear in the last 30 days. I bought some physical silver under $20 a few months back during the lull and now wished I would have bought some silver stocks.

One stock in particular that I wished I had been a bit more aggressive with is South American silver SAC. They have a silver project in Bolivia and there was some uneasy feeling with investors maybe because Bolivia has a way of nationalizing properties and companies and so when there is talk of that going on investors get a bit shy. However if you read beyond the headlines with most articles you may find that things are not that bad after all. Looking at a chart of SAC shows a nice 100% plus up in the last 30 odd days.

News release today from North American Nickle NAN proved of little value although it did present an excellent buying opportunity for anyone wanting to get in to the stock Over a million shares traded and the stock fell to 24 cents. There is going to be more news from this summers exploration project and if the news keeps coming out the way it has there is a good possiblity for some strong upside in the stock price.

Is $150 silver for real? Some say yes and have a good argument for it. If you thought it was going to that price would you Buy Some? I know I would because I have been.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Got A Nickle??

Aug.24.13

What's a nickle really worth? You might say 5 cents but if you were a holder of North American Nickle NAN you would have a whole bunch of nickles. North American Nickle is working over in Greenland on their 100% owned Maniitsoq project. This is really an impressive project and if you do some DD you would see that there is tons of potential in this play. Anyhow the company had their stock halted last week for news. You can always tell that when a companies stock is halted for news it's going to be BIG. And big it was. Diamond drill hole MQ-13-026 intersected an 18.62 metre core length of sulphide mineralization averaging approximately 40 - 45% total sulphides, including numerous sections containing 65% to 80% sulphides, within noritic host rocks at the Imiak Hill nickel-copper-cobalt zone.

The chart above is just a 3 month chart and that chart is pretty much what a 12 month chart looked like until Friday. Of course with news like it was the stock opened at 21 cents then popped big time and shot up to 37 cents and finished the day off at 27 cents with over 4 millions shares trading hands. I did up a short video of NAN last year in November telling everyone about this project. You can see it below.

Lots of talk about silver hitting $50 bucks again in short order. Who knows, maybe there really is manipulation in the metals markets. Funny how in one article you read that silver is dead and then a week later silver is going to hit $50 bucks. If that is the case there is still time to take a look at Golden Goliath GNG @ 6 cents.

While we are on the topic of silver, J M Bullion has some great deals on silver rounds for those who like PHYSICAL silver. I've been yakkin about silver forever and really trying to promote the metal when it was under $20 again over the past few months. Now it's up over 20% and emails are asking how high I think it will go. Had you bought some, even a little, you'd be up over 20% in a world where the banks only pay 0%.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Silver Stocks

Aug.14.13

If your a gold bug like me you would also likely be a silver bug. Silver has had a tough time this year and so have the silver miners. But in the last few trading sessions, silver has turned around and gone from under $20 an ounce to over $22 an ounce. That is like a 10% jump in a matter of a few days really. And it's about time anyways. I get sick of seeing these metals markets being twisted around by big shots in fancy office towers.

With the silver price rebounding, some of the silver miners are taking off. Had you bought Silvercorp SVM last week you would be up a tidy $1 buck a share. Not to shabby for a stock that was inder $3 bucks.

Or how about Fortuna Silver Mines FVI. Also up a tidy $1 buck a share in the last 7 days. Even Sabina Silver Mines SBB had a nice 40% run in up in about 5 trading days.

For those out there that are on the look out for a penny silver miner, keep an eye out on Golden Goliath GNG. The stock was down to 3 cents for a while but has firmed up to 5 cents again. GNG offers a great exposure to silver in Mexico. Now you might think that GNG is just some small wannabe explorer but when you read that Sprott Asset Management owns 9,536,478 or 8.9%, and Agnico Eagle-Mines Ltd.owns 6,762,000 or 6.3%, then you know that some big money knows something or at leat sees something of value here.

While we are on the topic of silver, J M Bullion has some great deals on silver rounds for those who like PHYSICAL silver.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Mining Stocks Are NOT All Doom And Gloom

Aug.8.13

For anyone who thinks that the junior mining sector is dead, I got a few charts to show that they are dead wrong. Take a peek at the following two charts. The first being Kennady Diamonds KDI that had found some encouraging results and the second is from Rainmaker Mining RMG who has agreed to purchase up to 75% of some property in Arizona.

In regards to Kennady, a 2.48-carat diamond at Kennady North is something to smile about and that is when a diamond becomes an investors best friend. Diamonds are in a way an alternative to investing like gold or silver. Diamonds are more akin to maybe like collecting art but diamonds do hold some value. Unlike the metals where there is a market that has dilay prices, diamonds are in a world of their own. I don't know enough about diamonds but news like this and seeing the stock pop beings back memories of the old Yamba Lake, Taherra, Diamet days of the early 90's. It's been a long time since there has been any really good news out of the NWT in the diamond exploration.

Rainmaker Mining Corp. will undertake a non-brokered private placement to raise up to $200,000 by the issue of up to one million units at a price of 20 cents per unit. Something to keep in mind about Rainmaker is that that there are only 9 million shares so that is one of the reasons for the 100% plus pop on the day.

If you are looking for value that outlasts almost anything else, you got to have a look at silver. Silver is undervalued and silver last forever. It won't go broke or get sued. It's been around for thousands of years and is still just as good today as it was way back when. Nothing beats silver and J M Bullion has some great deals on silver rounds although there might be a wait time on delivery.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Who Is Buying All The Gold?

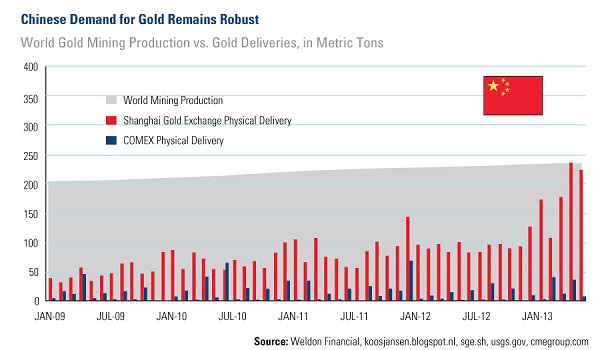

July.16.13

Ever wonder who is uying all that gold that is selling cheaply into the market? Some say it is central banks while others claim it is China. Looking at the chart below we can see that in fact China is the biggest buyer of gold in the world today. In fact they buy almost all the gold that is mined today. Ever wonder why they are buying all that gold? As a gold bug I sure do. Notice how little presence the COMEX has. A mere pitance.

For those who are followers of North American Nickle NAN, the news has been abundant this summer with drilling underway and even more ground aquired in their Greenland play. The stock has been holding up well in the high teens and low 20 cent range. With good news the stock could easily pop into the 30 cent range.

Brixton Metals BBB is drilling now in the Sulatine Valley on their Thor Property in northeastern BC. Last year the company released excellent drill results so there is a lot of hope that the company will deliver another round of good drilling this season.

Undervalued just became even more undervalued. Golden Goliath GNG stocks is at a new 52 week low of 3.5 cents. Here is a small silver explorer that has heaps of land all paid for, some of the biggest names in the business owning it's stock and the average retail investor selling out. This is one small player that deserves some DD.

How low can silver go? Or should I say, how can do you think silver will go? Nothing beats silver and J M Bullion has some great deals on silver rounds although there might be a wait time on delivery.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Fathers Day

June.16.13

To all the dad's out there that are underwater with some junior mining stock, I understand. I am a dad and am also underwater with a few junior miners. There are signs though that some of these down and out stocks have pretty much bottomed out and that there is some smart money as they say heading back into some of these plays.

Plays like North American Nickle NAN over in Greenland. I've been mentioning this play since mid winter after last years drill results on their nickle play. The stock held that 14-15 cent range no matter what the the news was. Over tha last few weeks though news has been hot and heavy and results are starting to show both in drill results and stock price. Volumes have picked up and the investing public is finally stating to take notice of this world class nickle play.

There is a video presention of North American Nickle on their website that explains this play they are involved in. To make it brief they own 100% of the Maniitsoq project in Greenland. The Maniitsoq property in Greenland is a Camp scale project comprising 4,983 square km's covering numerous high-grade nickel-copper sulphide occurrences associated with norite and other mafic-ultramafic intrusions of the Greenland Norite Belt (GNB). The 70km plus long belt is situated along, and near, the southwest coast of Greenland, which is pack ice free year round. The company has been working every summer there for the past few years and they are expecting to release news every few weeks from this new drill project they are at.

Also of news is for those shareholders who at one time owned Sidon Resources. The company did a name change and a share roll back. The new name is Cameo Resources CRU.H. It's good news do to the fact that although many are underwater on their share price, they are not out totally the money as when the company goes under.

If you are looking for value that outlasts almost anything else, you got to have a look at silver. Silver is undervalued and silver last forever. It won't go broke or get sued. It's been around for thousands of years and is still just as good today as it was way back when. Nothing beats silver and J M Bullion has some great deals on silver rounds although there might be a wait time on delivery.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Under Valued??

May.31.13

This month is over finally. Gold and silver have been range bound although gold has poked it's head over that $1400 mark a few times only to be smacked back down, like today in fact. Maybe June will be better for us junior watchers and goldbugs.

There are a lot of plays out there that are at 52 week lows stock price wise and yet the fundamentals say this just shouldn't be so. One of the small miners I watched over the years and in fact talked about them here a few years back is a small company working in Mexico. Back a fews years ago this company was busy exploring it's holdings in Mexico and the stock price was always what seemed to be in the 20-30 cent range. It has seen price pops up to 70 cents on news over the past but mostly hung around that 20-30 cent range. The company I am talking about is Golden Goliath GNG.

The reason why I am mentioning this company is because it goes to show just how crazy the market has gotten. Golden Goliath GNG isn't just a small junior with some land holdings or a few mineral claims looking for money like a lot of these players are today. GNG has been working in Mexico for many years now and aquired some impressive mineral claims. Over the years exploration and drilling and proven up this ground so much that a few large institutions have taken notice as well as major mining companies. Sprott Asset Management owns 12.2% and Agnico Eagle-Mines Ltd. owns 7.3%. Agnico-Eagle Senior VP even sits on GNG's Board. GNG's claims are owned 100% with no payments to make and already has two option agreements with other companies including Agnico-Eagle Mines Ltd.

One of GNG largest properties (Nopalera) lies directly adjacent to a new World Class gold discovery of 9.6 million ounces by industry giant Fresnillo PLC. GNG property has similar geology and alteration and has yet to be diamond drilled. The company has just around the 100 million shares outstanding at the moment. If you are looking for an undervalued mining stock, this could very well be one to take a closer look at. The stock today was 4.5 cents. What else can you buy for a nickel.

When I am looking for undervalued, I look at stocks just like I mentioned above. I also look at physical silver at under $25 an ounce and see value. J M Bullion has some great deals on silver rounds although there might be a wait time on delivery.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Grow Your Portfolio With Fertilizers. Pt. 2

May.27.13

WOW! Just a week ago I mentioned about getting into some potash plays and this week we see one of those players fly. Allana AAA received approval of its environmental, social and health impact assessment (ESHIA) from the Ethiopian Environmental Protection Authority (EPA) and Ministry of Mines and Energy. The approval of the ESHIA, prepared by Environmental Resources Management (ERM), is an important milestone to the granting of the mining licence for Allana's Danakil potash project.

With metal prices being what they are, potash is one of those commodities that can fill the void when trying to trade resource stocks. Most investors seem to shy away from metals these days do the fact that there is little momentum but for those who wish to buy and hold on speculation there are a few interesting plays taking place in BC. One play is the the Colorado Resources CXO. They have had some real interest seen in their stock from drilling s far. This enthusiasm is spilling over somewhat to other plays in the region such as Brixton Metals BBB. I just got an email today saying to keep an eye out on Victory Ventures VVN as they are in the same trend as Colorado. So here we are back to gold when we started out with potash.

Nothing beats physical metal as an investment. When thinking about buying silver bullion, the very best prices online today are with J M Bullion.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Grow Your Portfolio With Fertilizers

May.17.13

These take downs in the gold price are starting to get a bit annoying. It's that relentless pounding down of the price that is brought on by shorters and no doubt naked shorters that are the true culprits. Most junior stocks like I mentioned before are at 52 week lows. Even the large cap gold players are down. With the dow hitting new highs I am wondering which stocks it is that are seeing the new highs aside from google. Google hit $920 a share this week. Must be big money in click ads.

I was reading a article this week about Bill Gates, the Microsoft guy and why he is interested in fertilizers. That got me thinking as fertilizers have to be mined. You don't really create fertilizer out of thin air. When we think about fertilizer we usually think about Potash Corp. Of Saskatchewan POT or Sherrit S. But the are some smaller juniors that are exploring potash also. Three better known potash explorers are Passport Potash PPI, Encato Potash EPO and Allana AAA.

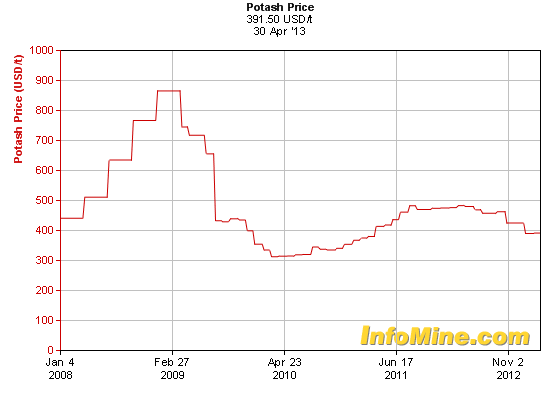

Looking at the chart of potash over the past 5 years you can get a glimpse of where it has traded. With little volatility in potash prices it makes budgeting a bit easier for potash explorers and there can be better stability in the share prices although the share prices can swing a lot just like the rest of the junior explorers. As long as people need to eat there will be a need for fertilizers and with population growing every year that need becomes that much greater. Fertilizer! That's food for thought.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

15,000 Dow

May.8.13

All the news these days seem to point to the the fact that the dow is 15,000. It was just a bit ago that it everyone was talking 14,000. The index seems to run up 100 points every few days now. That is not the case with the HUI or the GDX. As tough as it seems the miners are in the tank. For the past year it seemed that the only miners that were down were the ones that really had no properties of value or were runnng low on cash. But looking at a lot of the mid tier miners and explorers you see charts that are quite shocking. I think almost every miner of gold or silver is now sitting on 52 week lows. Large cap like Barrick ABX, Nova Gold NG, Tanzanian Royalty TNX, Silvercorp SVN and I could go on and on all day listing these miners, they are all at 52 week lows or boucing off. Some of these companies are seeing record insider buying of stock and why not! If the public can't seem to figure value out in some of these miners then the insiders might as well load up on cheap shares because sure as I am sitting here, things will turn around and the longer this downturn runs the more forceful the turnaround will be. I think that anyone who is selling out shares on a lot of these plays are really truly selling out at the bottom.

Not all miners are in the dump though. There still is surprises happening out there. Take for instance Colorado Resources CXO which saw it's stock pop from around 18 cents to around $1.20 in a matter of a week or so. Millions of shares trading hands also. Colorado has some ground in BC around the stewart area called North Rok that has seen some pretty impressive grades.

Of course with summer just around the corner here plays like Colorado will see some drilling happening as summer makes good times for doing field work. Hopefully over the summer more news will hit the wires and if news is good more plays in these areas will garner attention.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Buying Stocks

Apr.13.13

When is the best time to buy stocks? When is the best time to buy anything? It seems widely known that the best time to buy ANYTHING is when EVERYONE else is selling or not buying. It is like the supply and demand thing. No one interest?? Cheap price. Everyone interested?? Higher price. It's pretty simple. So when it comes to stocks, especially mining stock, would now be a good time to buy? Some would say yes while others would say wait and stil there are others that would say no.

The fact of the matter is there are a lot of good stocks out there that are way undervalued. Picking through the maze and finding the right ones will give the investor a chance to make a fortune. Contrary to what is popular belief, the mining sector and the gold bull run we are in still far from over. While there are lots of small companies on th verge of going bust, there are others who are well financed, have excellent ground and are continuing on their way to make mines. These small companies really don't care about a one day or one week drop in metal prices. Their deposits will still be years down the road before production and a lot of changes in world affairs will happen during that time.

The problem with metals like gold and silver is that there is two markets. There is a paper market and there is a physical market. When gold fell $80 on Friday and everyone was running to the exits, you would think that there would a bargain on the physical price. Well the prices do come down somewhat but for some reason the wait time for delivery is still 3-4 weeks? One would think that there would be glut of gold and silver on the market but .... no, there isn't. You place your order and wait. Why? Because the mints are running short on PHYSICAL still. There is tons of paper certificates out there but hardly any physical metal. Reading in a few well know articles from some respected writers will tell you that China and Russia are buying up the physical and for a bargain at that.

North American Nickel NAN is heading back into Greenland. They are working on what very well could be the largest nickel deposit anywhere. Here is an undervalued play. You only need to think back 10 or so years and think Diamond Fields and Voisey Bay. NAN stock is 13 cents right now. What would the largest nickel deposit in the world be worth to a major? A whole lot more than 13 cents for sure.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

April Fools? Part 2

Apr.6.13

Sure nice to see a good bump off bottom in the metals markets. Maybe the second quarter of the year will bring some spring time specials in the junior mining sector. There is quite a bit of chatter on different sites about a good continuation of the gold bull market especially since the news about Cyprus coming out. Lots of commentaries are wondering just who is next?

Junior miner Huldra Silver Inc. HDA

put out news stating that it has received US$2,228,043 in smelter payments since it began shipping concentrates in November 2012. The Company provided an update on the Merritt Mill and the Treasure Mountain Mine, British Columbia, Canada.

Since the modifications made to the crushing circuit and screening of mill feed announced on February 5, 2013, 55.1 dry metric tonnes of lead/silver concentrate and 53.9 dry metric tonnes of zinc concentrate were shipped to the smelter for the first lot period of the month, being February 1 to February 15, 2013.

Speaking of silver, Silvercorp SVM saw their share price touch a new 52 week low this past week. The stock touched $3.23 at one point but did manage to close out the week above that low at $3.43. Silvercorp is a silver miner in China and has seen their share price targetted by shorts over the past year along with some negative news about SEC investigations.

Wonder where silver prices are going? One good indicator is the ProShares Ultra Silver ETF AGQ. This ETF is sort of like the barometer for silver. It is very volatile but with the right attitiude and enough cash you can really swing trade this play. Anyhow, going by the chart it looks like a bottom has been reached and it could very well be turn around time for both silver and the ETF.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

April Fools?

Apr.1.13

After being away for the entire month of March, it's good to be back at the website doing some kinds of updating. Too bad there just wasn't a bunch of good news to tell everyone about the state of the junior mining industry. One quick look at a chart of the HUI, the Gold Bug Index and you can see that things are well on the downward slope and have been for the beter part of 2012 with little changes for the first quarter of 2013.

A one year chart of the GDXJ which is the Market Vectors junior mining index show about the same dismal picture of lower lows. One would almost think that with all the currency issues going on in the world today that gold would have broken out by now and carried some of these small plays upward also. That is just not happening though.

Reading different commentaries about the junior mining sector there is a few articles written about how upwards of 600 junior mining companies will not make it through the year due to money problems and the inability to raise funds. That senario is putting investors a difficult situation as to whether the company that may have invested in will be able to survive. If the compnay has funds put away and a good project, there is a fair chance that it will make it through. Companies with little money or marginal properties will either have to join up and merge with another company where resources can be combined or basicaly close their doors. If the company has a good property though there is always the chance that a major or mid tier company will look at buying the resource or take the company over. With stock prices in the pennies there can be some good upside for investors at this stage of the game though. You just have to do your due diligence and make sure your putting your money on the winners.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

Not Much Change In The General Market

Feb.10.13

Been a while since I last wrote here as I have been away on assignments. Not much has changed on the big picture of mining stocks as gold and the other metals seems to still be range bound. We were following Central Iron Ore CIO and if you were one of the lucky ones and bought in at the very lows of 4 cents you might have done very well if you sold out in the past few weeks as news was quite immpressive and the stock did pop 100% to an intra-day high of 9 cents.

Also in one of the other articles I mentioned Levon Resources LVN which is exploring its 100%-owned, 20,000-hectare (49,400-acre) Cordero Project in northwest Mexico. Cordero represents an outstanding and rapidly-growing target for porphyry silver, gold, zinc and lead. Cordero's first NI 43-101 resource was announced in June 2011 and included 310M oz silver, 900,000 oz gold, 5.3B lbs zinc and 2.9B lbs lead. At the time the stock price was 35 cents and has since rallied up to 52 cents. since that time the stock has fallen back into the low 40 cent range.

With spring time not to far off in the Yukon, plays in the White Gold district around Dawson will be something to keep an eye on. Lots of rumors of gold busting out of this trading range and ramping it's way up to the $2000 mark this year. Higher and firmer gold prices drives enthusiasm and stock prices.

Also with spring around the corner, drills will be turning over in Greenland. A few companies exploring there that are well worth checking into is North American Nickel NAN and Hudson Resources HUD. North American is working on a world class nickle deposit and Hudson is exploring rare earths.

As always, use Due Diligence and see our Disclaimer and be sure to visit one of our sponsors.

GAdams

To view older articles 2010 - 2011 - 2012

- 2013 - 2014

Investor Clicks Financial Advertising

The Financial Ad Trader - free advertising

Investor Clicks Financial Advertising

Investor Clicks Financial Advertising